HRnetGroup Limited – Record Breaker

traderhub8

Publish date: Thu, 19 Aug 2021, 10:46 AM

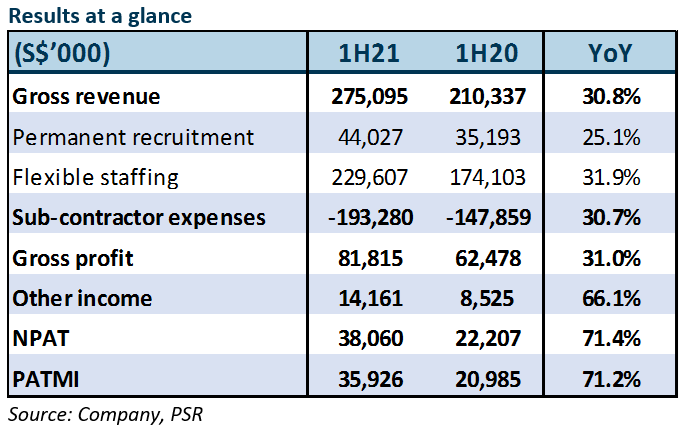

- Record gross profit and NPAT. Revenue increased 30.8% YoY on the back of higher permanent-recruitment rates and flexible-staffing volume. 1H21 gross profit in line at 51% of our FY21e forecast. NPAT surpassed at 75% with gains from disposal of financial assets and lower SG&A.

- Flexible-staffing growth likely to continue amid business uncertainties. Permanent-recruitment volume to pick up with countries’ reopening.

- Maintain BUY with a higher TP of S$1.05 from S$1.00. After adjusting for one-off items, our FY21e core PATMI increases by 8.8% as we lift flexible-staffing revenue and lower SG&A expenses. Our TP remains pegged to 14x FY21e ex-cash P/E, HRnet’s historical 5-year high as we anticipate labour market recovery and potential M&As.

The Positives

+ Record gross profit and NPAT. 1H21 revenue and gross profit were in line at 54%/51%, but NPAT and PATMI exceeded at 75% of our estimates. We attribute this to S$6.8mn of net fair value gains from its disposal of financial assets and lower-than-expected SG&A expenses. Permanent-staffing revenue grew 25.1%, underpinned by a 17.5% increase in revenue per placement YoY as HRnet filled more senior and niche positions that command higher remuneration packages. Flexible-staffing revenue rose by 31.9% on the back of a 47.1% YoY spike in the number of contractors hired to an all-time-high of 17,123 in June 2021. This was thanks to its Recruit First business expansion in 2019 and 2020 and clients’ preference for manpower flexibility amid business uncertainties.

+ Recovery in key markets. Singapore is HRnet’s largest revenue and gross-profit contributor. 1H21 gross profit in this market grew 31.1% YoY: flexible staffing +33.5% and permanent recruitment +25.0%. Gross profit in North Asia, comprising China, Hong Kong and Taiwan, was up 29.9% YoY: flexible staffing +57.6% and permanent recruitment +23.9%. Volume growth was notably strong for flexible staffing in Rest of Asia, particularly Malaysia and Indonesia, where gross profit surged 40.8%.

+ Strong hiring in healthcare sector. The healthcare and life-science sector which serves pharmaceutical firms, hospitals and vaccination centres contributed 26% to revenue in 1H21, up from 15% in 1H20. The hiring of vaccination nurses constituted about 2% of revenue. Although more than 70% of the Singapore population is now fully vaccinated, demand for medical staff is still expected to come through in various forms, such as more nurses in hospitals, social-distancing ambassadors and temperature scanners at the airport. As Singapore gradually reopens borders for vaccinated travellers and a third booster shot for better immunity is within sights, hiring in the healthcare sector is not expected to pull back in the near term.

The Negative

– Pandemic-related relief tapered off. Pandemic-related assistance dropped in 1H21, as government grants and subsidies declined S$1.7mn from S$7.9mn in 1H20. We expect pandemic-related assistance to diminish by end-FY21, leaving S$4-5mn of government grants from the Wage Credit Scheme. We believe that this scheme will continue to support HRnet’s bottom line, given that the scheme has been introduced and extended since 2013.

Outlook

As various Asian economies commence their recovery with the aid of vaccination programmes, pent-up demand from 2020’s hiring standstill is expected to unleash job openings and employment churns. Strong local employment is predicated on restricted border movements. Still a market leader in Singapore in revenue and profits, we remain optimistic that HRnet will be able to ride the rush for employment. While a continued recovery in the permanent recruitment of mid-level positions is contingent on a re-opening of the economies that HRnet operates in, flexible-staffing volume is expected to grow further as various sectors and organisations choose this option to avoid committing to permanent headcounts.

Maintain BUY with a higher TP of $1.05 from S$1.00.

We lift our FY21e revenue and gross profits by 1.8% and 1.1% on the back of higher-than-expected flexible-staffing contributions. FY21e NPAT and PATMI have been raised by 27.7%, after accounting for higher other income of S$10.4mn and lower SG&A expenses. The increase in other income comprises S$6.8mn of net fair value gains from its disposal of financial assets as well as an additional S$3.6mn of pandemic-related government grants.

After adjusting for the one-offs, our FY21e core PATMI increases by 8.8%. Accordingly, our TP climbs to S$1.05 from S$1.00. This is still set at 14x FY21e ex-cash P/E, HRnet’s historical 5-year high as we anticipate labour market recovery and potential M&As.

Source: Phillip Capital Research - 19 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024