Sembcorp Industries – Impaired Profitability

traderhub8

Publish date: Wed, 18 Aug 2021, 10:47 AM

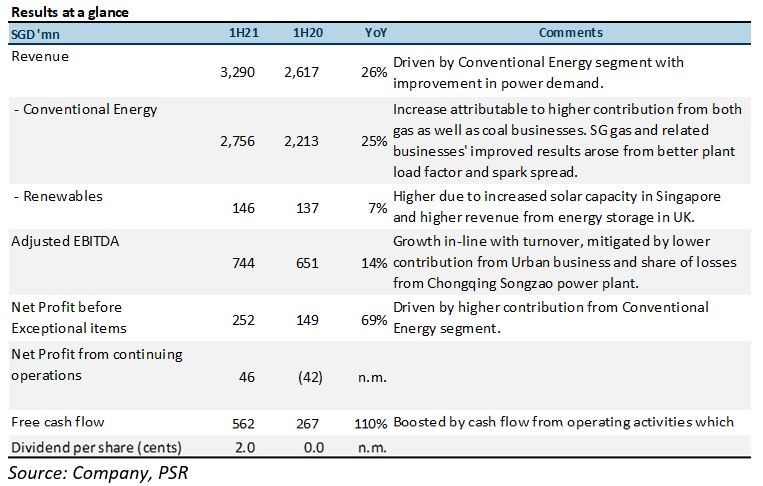

- Revenue was ahead of our expectations, at 57% of FY21e estimate. Net profit, however, missed at 14.7% of FY21e dragged by S$212mn impairment for its 49%-owned JV Chongqing Songzao.

- Underlying business resilient. Net profit before exceptional items was 69% higher YoY, driven by higher contributions from all key revenue segments.

- 2H21 to be affected by longer-than-expected planned maintenance shutdowns in Singapore, India and Myanmar as well as weaker demand due to a resurgence of COVID-19 Delta variant in key markets.

- We remain Neutral while reducing our target price to S$2.01 from S$2.07, still pegged at 1.0x FY21e P/B. We reduce FY21e earnings by 34% as we bake in impairments of S$212mn and lower Conventional Energy profits in 2H21.

The Positives

+ Underlying business resilient. Net profit before exceptional items was 69% higher YoY, lifted by higher contributions from all key revenue segments: Renewables, Integrated Urban Solutions and Conventional Energy. Revenue from Conventional Energy surpassed our expectations on the back of better-than-expected plant load factors, spark spreads as well as increased high-sulphur-fuel oil prices in Singapore. Its coal business in India – Thermal Power Project I (P1) and Thermal Power Project II (P2) – also performed better than expected with higher demand lifting turnover. This segment remained the key contributor to turnover, accounting for 84% of overall revenue.

+ Continued to make strides in the renewables segment. Turnover in this segment was up 7% YoY due to increased solar capacity in Singapore and higher revenue storage in the UK, with the commencement of plant availability fees. In 1H21, 78MW of renewable-energy capacity was installed. About 87MW of renewable-energy capacity is expected to come onstream by end-2021. The group maintains its target of deriving 70% of net profit from sustainable solutions by 2025. Net profit from sustainable solutions made up 31% of 1H21 profit.

The Negatives

– S$212mn impairment for 49%-owned JV. The entire carrying value of Chongqing Songzao was impaired following a periodic review. Chongqing Songzao operates a 1,320MW mine-mouth coal-fired power plant in Chongqing with coal procured from Chongqing Energy, its JV partner. Following Chongqing Energy’s closure of its coal mines, Chongqing Songzao turned to other provinces for coal supply. The import of coal translated into higher costs, depressing margins and affected the profit outlook of the plant.

– Planned maintenance shutdowns in 2H21 and weaker demand expected. Planned maintenance shutdowns for its Singapore energy-from-waste plant, Sembcorp Myingyan Power Plant in Myanmar and India SEIL Project 1 and Project 2 power plants will be longer than what we initially modelled. Management disclosed that the longer maintenance days are the result of a higher type of maintenance overhaul required in its gas-powered plants and COVID-19 disruptions last year which delayed required maintenance works.

We expect demand for Conventional Energy to taper off in 2H21 following a resurgence of the COVID-19 Delta variant in its key markets as well as higher fuel costs.

– Lower wind speeds in India. Despite higher installed capacity, contributions from India were lower due to lower wind resource. Wind speeds in India remained below their 20-year average of 5.51m/s, resulting in lower turnover.

Outlook

We expect the group to continue with its transition to sustainable solutions and sustainable development. Despite its ambitious growth plans, it will not require any equity fund-raising, relying entirely on internal sources.

Its longer-term outlook remains challenging due to persistent uncertainties surrounding the recovery from COVID-19, intense competition from other global utility companies and the expiry of long-term contracts. The expiry of long-term contracts is expected to affect PATMI by around S$100mn in the next five years. Impact on earnings is expected in Singapore and Vietnam as the natural gas contracts in Singapore approach expiry in 2028, and as Phu My 3 power plant in Vietnam faces reducing tariffs as its power purchase agreement approaches expiry in 2024.

Maintain NEUTRAL with lower target price of S$2.01

Our target price is still pegged to 1.0x FY21e P/B. FY21e earnings have been reduced by 34% as we bake in impairments of S$212mn and lower Conventional Energy profits. Consequently, our target price moves lower to S$2.01 from S$2.07.

Source: Phillip Capital Research - 18 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024