Manulife US REIT – Leasing, Lead the Way

traderhub8

Publish date: Wed, 18 Aug 2021, 10:47 AM

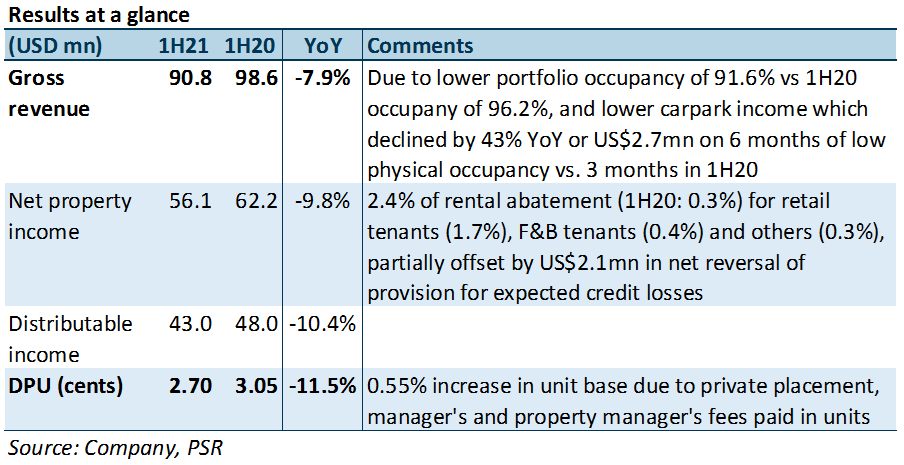

- 1H21 DPU of 2.70 US cts (-11.5% YoY) in line, at 47.5% of our FY21e estimate.

- 5% of NLA signed with 2.7% more expected in 3Q21. Headline reversions positive at 1.3%, though increase in tenant incentives and rent-free periods led to 10-15% declines in net effective rents.

- Stabilising of US office market and pick-up in leasing demand positive. Expect return-to-office in 3Q/4Q21 to lift carpark income and reduce rental-relief burden on MUST.

- Downgrade from Buy to ACCUMULATE on the back of limited near-term catalysts. FY21e DPU cut by 4.8% after taking in rental relief and slightly lower occupancies. No change to our DDM-based TP (COE 9.1%). FY21e/22e DPU yields 7.5%/8.02%. Prefer Prime US REIT (PRIME SP, Accumulate, TP US$0.94) in the sector for greater tenant exposure to STEM/TAMI sectors.

The Positives

+ Leasing momentum. MUST signed 0.8% of NLA in 2Q21, bringing NLA signed in 1H21 to 6.5% or 305,000 sq ft. Including leases signed after the quarter, FY21 and FY22 lease expiries declined from 5.7% to 2.3% and 18.1% to 13.1%. Leases were signed by tenants in the real-estate, insurance, tech, logistics and accounting sectors. Renewals, expansion and new leases accounted for 92.1%, 4.7% and 3.3% respectively. Leasing improved QoQ, with physical tours doubling and more tenants willing to sign longer 5- and 7-year leases. About 127,000sq ft or 2.7% of NLA is under advanced negotiations and could be signed in 3Q21.

+ Rental collections remained high at 99.0%. About 2.4% and 0.3% of rental income was given as rental abatement and deferrals to retail tenants in 1H21 to help them tide over reduced foot traffic.

The Negatives

– Positive reversions but still a tenants’ market. Reversions for 2Q21 and 1H21 were -3.7% and +1.3% respectively. The former was signed at Michelson, the only over-rented asset in MUST’s portfolio. Low occupancy during the pandemic has resulted in a tenants’ market. Rent-free periods and tenant incentives increased by 20-30% for renewals and doubled for new leases signed. As such, MUST’s effective net rents are 10-15% below pre-pandemic levels.

– Portfolio occupancy declined 0.3ppt/4.8ppts QoQ/YoY to 91.7% due to non-renewals and downsizing, mostly reflecting corporate relocations and consolidation. Occupancy at Michelson fell 9.7ppts YoY to 80.4% after the downsizing of LA Fitness and non-renewal by a legal tenant. Capitol’s occupancy fell from 91.4% to 85.4% after the non-renewal of a legal tenant who relocated to a suburban office. IDI Logistics’ departure from Peachtree was the main cause of a 9.7ppt YoY occupancy decline at this property to 90.4%. The only COVID-related non-renewal was at Centrepointe. The tenant decided to move to a purely work-from-home model, causing occupancy to fall from 98.7% to 91.6%. Still, portfolio occupancy of 91.7% punched above market occupancy of 87.8%.

– Gearing up 2.5ppts YoY to 41.6% on declining valuations. Portfolio valuation has fallen 5.9%/1.1% since FY19/20. The largest valuation declines were for Centrepointe, Penn and Figueroa, down 11.5%, 7.6% and 7.3% from Dec 2019 levels due to the valuer’s assumptions of higher leasing cost expectations, tenant incentives, rent-free periods and higher current vacancies.

Outlook

US office market stabilising

Leasing volume increased by 28.7% QoQ to 73% of 1Q21 levels. Average lease terms signed have increased QoQ from 7.1 years to 7.4 years. Tenant incentives and rent-free periods have slowed after increasing 21.1% and 41.3% since 1Q20. Net effective rents for Class A assets increased by 5.2% QoQ to 85.5% of 1Q20 levels. The pace of subleasing was down 80% YoY to 4.5% of existing stock. Twelve-month rental forecasts by CoStar Group were less negative for MUST’s submarkets, ranging from -2.4% to 0%. This compares with Mar 2020’s outlook of -5.8% to -1.7%.

Favourable supply outlook for MUST’s submarkets

Only three out of nine of MUST’s submarkets have incoming supply in 2021 and 2022. In Midtown Atlanta, 679,200 sq ft, representing 3.4% of existing stock, has already come online this year and is 100% pre-leased to Google and a legal tenant. About 469,000 sq ft, or 1.5% of existing stock, will come online in 2022 in Washington D.C. However, this new supply is in the Trophy class and not comparable to Penn which is a Class A asset. Another 340,000 sq ft representing 2.0% of existing office supply will come online in 2022 in Buckhead Atlanta. Only 28% of this has been pre-leased and will compete with MUST’s asset, Phipps.

Return-to-office to lift performance

Physical occupancy at MUST’s portfolio was 11% and 15% in 1Q21 and 2Q21. According to internal surveys by MUST in June 2021, physical occupancy is expected to reach 60% and 70% by 3Q21 and 4Q21 respectively, although the Delta variant remains a wild horse. Higher physical occupancy will help to lift carpark income and improve retail trading, in our view. As such, rent relief and credit loss provisions could ease in 2H21.

Shifting focus to New Economy sectors and secondary markets

According to CBRE, tenants in the tech, healthcare and life science sectors accounted for 31% of leasing demand in 2020. Research by JLL in April 2021 confirmed these sectors are among the top-paying tenant industries. However, these New Economy industries only account for 10% of MUST’s tenants, which limits its ability to increase rents. MUST’s future acquisitions are likely to focus on secondary markets where these industries are frequently located. These include Seattle, Salt Lake City, Austin, Boston and Raleigh where cap rates range from 6.5% to 7.5%. MUST aims to increase its exposure to New Economy tenants to 20%. It is open to divesting, M&As and JVs to reposition its portfolio.

Downgrade from BUY to ACCUMULATE, unchanged DDM TP of US$0.84

We lower FY21e DPU by 4.8% after taking in rental relief and slightly lower occupancy. No change to our DDM-based TP. FY21e/22e DPU yields are 7.5%/8.0%. Downgrade to ACCUMULATE in view of limited near-term catalysts.

Source: Phillip Capital Research - 18 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024