Singapore Telecommunications Ltd – Thanks Again, Airtel and A$

traderhub8

Publish date: Tue, 17 Aug 2021, 06:25 PM

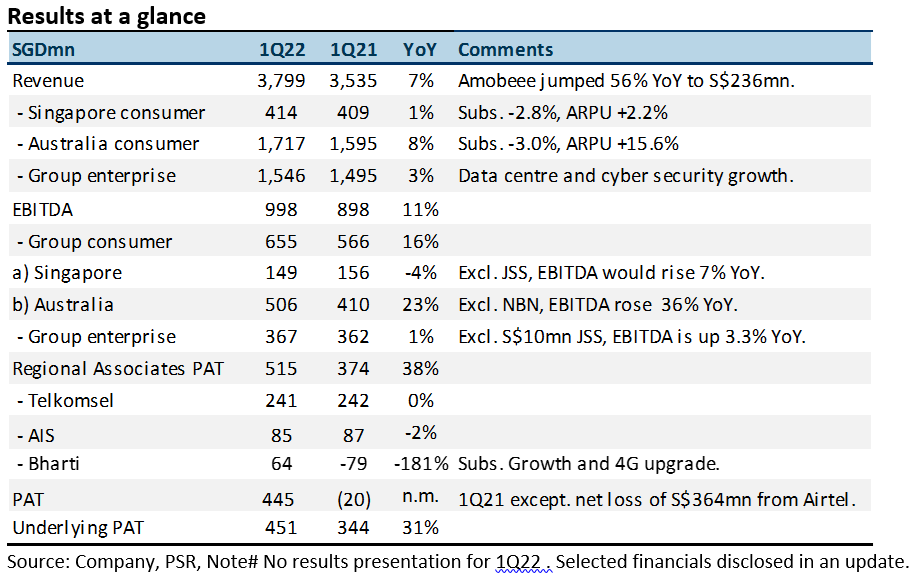

- 1Q22 revenue/EBITDA met our expectations at 25%/24% of FY22e estimates.

- Bharti Airtel’s (BHARTI IN, Not Rated) turnaround and an 11% YoY rise in A$ supported Optus earnings. We raise FY22e associate earnings by 6% to S$2bn.

- 1Q22 EBITDA for Australia consumer was better than expected on account of higher ARPUs. In comparison, EBITDA for enterprise was lower than modelled.

- Our FY22e EBITDA forecast is unchanged but PATMI raised by 4% with Airtel’s improvement. We upgrade Singtel to ACCUMULATE from NEUTRAL on the back of its recovery underway, led by Airtel, Bharti and later, border reopening, which should help to improve mobile revenue. SOTP TP raised to S$2.52 from S$2.32 with better associate valuations.

The Positive

+ Jump in Australia EBITDA. Mobile revenue was resilient, growing 5% YoY to A$1.26bn. EBITDA rose 23% YoY to S$506mn. Reasons mentioned were a cessation of fee waivers and rebates and lower bad-debt provisions. We believe the group’s S$305mn of impairments and payroll charges in 4Q21 also helped to lower its cost structure.

The Negative

– Enterprise growth was sub-par. Earnings growth in the enterprise segment has been below our expectations. Despite high demand from data centres and cyber security, legacy carriage business from voice and roaming remains a drag on earnings.

Outlook

The bright spots remain Airtel and Australia. We expect the corporate exercise at NCS and disposal of infrastructure assets to provide share-price catalysts in the short term.

Upgrade to ACCUMULATE with higher TP of S$2.52, from S$2.32

Our SOTP valuation is based on 6x EV/EBITDA for Singtel’s core Singapore and Australia businesses, at S$0.77/share. Associates are marked to market at S$1.75/share with a 20% discount to reflect volatility in their share prices.

Source: Phillip Capital Research - 17 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024