PropNex Ltd – Bumper Quarter

traderhub8

Publish date: Mon, 16 Aug 2021, 06:25 PM

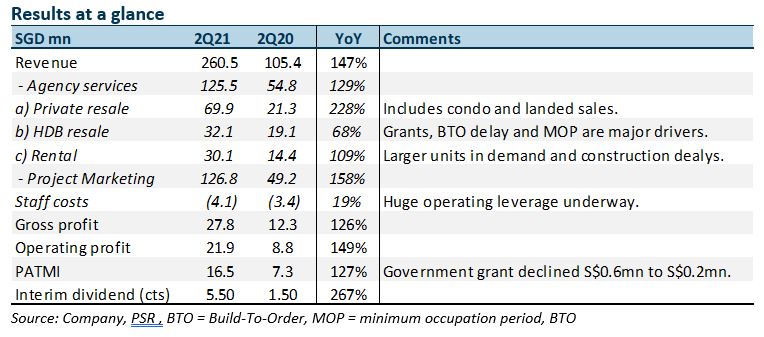

- 2Q21 PATMI surged 127% YoY to S$16.5mn. A major beat. 1H21 PATMI at 75% of our forecast. All four revenue streams grew.

- Private resales stood out with a more than 3-fold jump in revenue. Resale prices more attractive than new-unit prices. Interim DPS up almost 3-fold to 5.5 cents, a 65% payout for 1H21.

- 2H21 to remain buoyant, underpinned by a virtuous cycle underway. HDB upgraders are pushing up new home sales, driving demand for resale units due to their price differential. Rising affordability forms the foundation of this upcycle. After a decade, the property price index is only up around 13%. Rising income and TDSR should contain speculation.

- We raise FY21e PATMI by 53% to S$63.5mn as we lift revenue by 77%. DCF target price (WACC 9.8%) rises from S$1.36 to S$2.08. That said, recent rally has priced in most of the positives. Downgrade to ACCUMULATE from BUY.

The Positives

+ Resales led growth. Private resales grew the fastest. 2Q21 revenue spiked 228% YoY to S$70mn, supported by a four-fold rise in industry resales to 5,333 units. Last year’s circuit breaker had severely affected volumes. Private residential resales in Singapore are on track to touch their highest in a decade. Attractive prices compared to new-home prices are the main reason.

+ Interim DPS raised almost 3x. Interim DPS has been bumped up from 1.5 cents to 5.5 cents, representing a 65% payout. The S$20.3mn payout is well supported by S$33mn of operating cash flows in 1H21. Net cash as at June 2021 was S$120.6mn, up from S$99.7mn in June 2020.

+ Attractive operating leverage. PropNex’s operating leverage was in full display in 2Q21. Revenue jumped 147% while operating costs only rose 38% YoY. The bulk of the increase was for variable referral fees and marketing expenses.

The Negative

– Nil.

Source: Phillip Capital Research - 16 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024