Lendlease Global Commercial REIT – Weighed Down by Lower Rents

traderhub8

Publish date: Fri, 13 Aug 2021, 04:27 PM

- FY21 NPI missed, but DPU met expectations. Revenue and NPI at 92.4%/91.6% of our FY21e estimates, due to lower rental income during Phase 2HA.

- Lacklustre tenant sales and mall visitors may continue as safe-distancing measures and border closures remain in place. Rents weighed down by negative reversions.

- Downgrade to NEUTRAL from ACCUMULATE. Our DDM target price, however, climbs to S$0.87 from S$0.82 (COE 8%) as we roll over to FY22. Recent share-price appreciation has priced in most positives, in our view.

The Positives

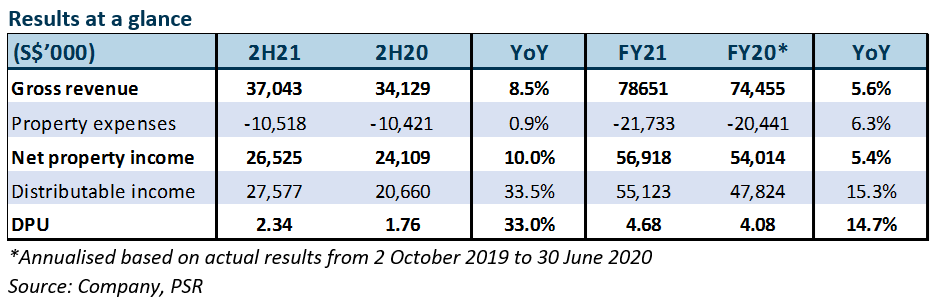

+ FY21 NPI missed, but DPU met expectations. Revenue and NPI were lower than expected at 92.4%/91.6% of FY21e estimates, attributable to a decline in rental income during Phase 2HA. That said, annualised FY21 gross revenue and NPI were still 5.6%/5.4% higher YoY. This was due to lesser rental waivers for 313@somerset. Expenses were higher in FY21 mainly because of provisions for doubtful debts of S$2.3mn. Distributable income and DPU were in line, at 99%/98.7% of our FY21e estimates. They were aided by higher net FX gains of S$5.4mn in 2H21.

The Negative

– Lower portfolio valuation. Both 313 and Sky Complex’s fair values fell 2.5%, attributable to higher discount rates of 6.15-6.75% vs. 6.00-6.75% in FY20. The valuers also project longer rent-free periods of 1-2 years and lower renewal rates. This was partially offset by a slightly higher 10-year average market rental growth rate of 2.85%, up 0.05% from the previous year. Overall, portfolio valuation dipped 1.2%, held up by the Grange Road carpark redevelopment. LREIT was appointed project manager for this site on 18 February 2021.

Outlook

2H21 tenant sales and mall visitors grew 33.7% and 6.2% YoY respectively, from their low bases in 2H20 during Singapore’s circuit breaker. 313’s occupancy inched up QoQ from 98.6% to 99.2%, after LREIT secured three new tenants in 4Q21. To replace Forever 21’s lease which expired in FY21, LREIT brought in Marks and Spencer on a short-term lease of less than a year. M&S is looking to extend its lease while LREIT has a few other prospects interested in the space.

Tenant sales and mall visitors may remain muted even as Singapore resumes economic and community activities in a calibrated way. Demand for retail space is likely to remain soft with continued safe distancing and border closures. Although rental reversions are improving QoQ, they remain negative, in the double digits. Weak demand may continue to weigh on 313’s rentals. Office vacancy in Milan was stable at 9.6% in 1Q21. With a long WALE of 10.9 years, income contributions from Sky Complex are expected to be resilient.

Source: Phillip Capital Research - 13 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024