DBS Group Holdings Ltd – Emerging Stronger

traderhub8

Publish date: Fri, 06 Aug 2021, 05:19 PM

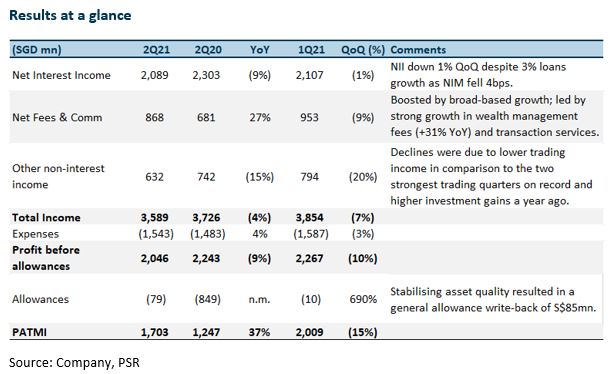

- 2Q21 earnings 10.7% above our 2Q21e forecast. The outperformance came from net fee income and S$85mn reversal in GPs.

- Asset quality stable, resulting in further GP write-backs of S$85mn. Management lowered full-year total allowances to under S$0.5bn (1H21 allowances at S$89mn). FY21 credit cost likely to be under 20bps.

- Broad based loan growth of 3% in 2Q21 and 6% in 1H21.

- NIMs retreated 4bps QoQ to 145bps. Full year guidance now at lower-end of guidance.

- Maintain ACCUMULATE with higher GGM TP of S$32.00, from S$31.40. We raise FY21e earnings by 6.7% as we lower our allowances. We now assume 1.39x FY21e P/BV in our GGM valuation, up from 1.36x, as we raise ROE modestly to 10.6%. Catalysts expected from declaration of special dividend.

The Positives

+ 2Q21 earnings exceeded forecast. All fees rose by double digits from a year ago. WM fees rose 31.5% as investment-product sales were boosted by an improving economy amid low interest rates.

+ Asset quality stable, resulting in further GP write-backs of S$85mn. Repayment by weaker exposures and credit upgrades allowed DBS to write back GPs during the quarter. The bank also made SPs of S$164mn, for the automotive and building and construction sectors. It lowered full-year allowances to under S$0.5bn (1H21: S$89mn) with credit cost likely to be under 20bps. We believe full-year allowances will come under this guidance because of the Group’s asset quality. In light of its recent GP write-back, we cut total provisions for FY21e to S$309mn from S$772mn.

+ Broad-based loan growth of 3% in 2Q21, 6% in 1H21. Loan growth was led by trade and non-trade corporate loans. Housing and WM loan growth was sustained at the previous quarter’s levels.

The Negative

– NIMs declined 4bps QoQ to 145bps; full-year guidance now at lower end of range. Increased deployment of surplus deposits at lower yields dragged NIMs down as deposits grew 1% QoQ. NII retreated 1% QoQ to S$2.1bn as lower NIMs offset higher loan and deposit volumes. Management now expects FY21 NIMs to fall at the lower end of its guided range of 145-150bps.

Outlook

Business momentum strong

Despite economic uncertainties from Singapore’s return to Phase 2 (Heightened Alert), loans and transaction pipelines are expected to be strong. We lower allowance estimates for FY21e. Consequently, our earnings for FY21e rise by 6.7%.

New initiatives expected to power growth

DBS is accelerating new initiatives as it faces interest-rate headwinds. New initiatives such as the DBS Digital Exchange, Partior, Climate Impact X and China Securities joint venture are expected to bring in revenue of S$350mn in FY22e, up from S$150mn in FY21e.

GP reserves sufficient

With its capital position and liquidity – CET-1 ratio of 17.5% in 2Q21 vs. 16.6% last year – well above regulatory requirements and high allowance reserves, we believe the bank has sufficient provisions to ride out current economic uncertainties. 2Q21 DPS is 33 cents, back to pre-pandemic levels. We do not rule out special dividends.

Investment Action

Maintain ACCUMULATE with higher target price of S$32.00, up from S$31.40

We raise FY21e earnings by 6.7% as we lower allowances estimates for FY21e. We now assume 1.39x FY21e P/BV in our GGM valuation, up from 1.36x, as we raise our ROE estimates modestly to 10.6%.

Source: Phillip Capital Research - 6 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024