United Overseas Bank Limited – Recovery on Track

traderhub8

Publish date: Thu, 05 Aug 2021, 03:05 PM

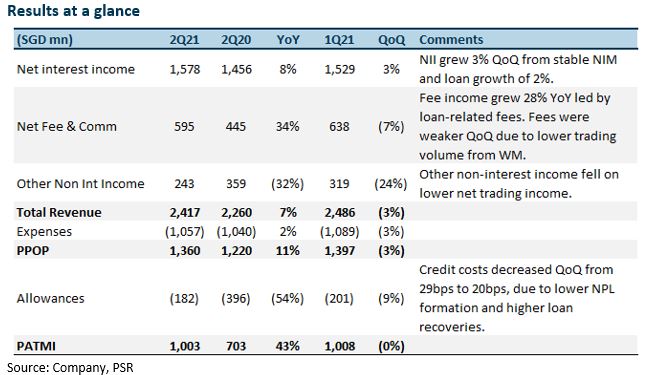

- 2Q21 earnings of S$1.0bn in line, at 25.5% of our FY21e forecast. Stronger-than-expected net fee and commission income offset by lower trading and investment income. 1H21 PATMI is 51% of our FY21e forecast.

- NIMs eased 1bp QoQ to 1.56%, though NII grew 3% in the same period led by steady loan growth mainly from term and trade loans in Singapore, North Asia and Rest of World. Guidance for FY21e unchanged.

- Impairment provisions of 20bps below our base case of 30bps in FY21e credit cost.

- Dividend payout returns to pre-pandemic levels. Interim DPS of 60 cents declared.

- Maintain ACCUMULATE with higher GGM TP (1.17x of FY21e P/BV) of S$29.00 from S$28.70 after earnings revision. We raise FY21e earnings by 7% as we crank up fees and commissions estimates on the back of strong growth in WM and income and loan-related fees. Catalysts expected from a stabilisation of outlook and the reversal of GP

The Positives

+ NII increased 3% QoQ, led by steady loan growth. Loans grew 2%, underpinned by term and trade loans in Singapore, North Asia and Rest of World. NIMs, however, eased 1bp this quarter to 1.56%. They are expected to be stable in FY21e as the bank targets loan growth to improve NII. Wholesale banking operating profits grew 6% YoY to a quarterly record backed by record investment banking revenue and strong growth in loans and trade volume.

+ Fee income exceeded our forecast by S$103mn. Fee and commission income grew 34% YoY, exceeding our forecast by S$103mn. The beat came from loan-related fees which benefited from more corporate drawdowns and opportunistic underwriting activities. Fees however, were 7% weaker QoQ due to lower trading activity from WM.

+ Impairment provisions below our base case of 30bps in FY21e credit cost. Allowances were S$182mn in 2Q21 or 20bp vs. S$201mn of provisions in 1Q21 or 29bp. The S$182mn provisions comprised 7bps in GPs and 17bps in SP. The QoQ drop reflected overall resilient asset quality and strong pre-emptive general allowances taken previously.

Total general allowance for loans, including RLARs, were prudently maintained at 1% of performing loans.

+ Dividend payouts resume to pre-pandemic levels. The bank has declared an interim DPS of 60 cents vs. 1H20 interim dividend of 39 cents. This translates to a payout of 50%.

The Negatives

– Loans under moratorium unchanged at 6%. We believe these belonged to weaker corporates which still require loan relief. As the moratoriums begin to expire, we could see an uptick in NPLs in the remainder of FY21e.

Outlook

Profit outlook should improve in 2021

UOB’s profit should recover in 2021 on the back of stabilising margins, stronger fees and lower provisions. We expect WM, loan-related and card fees to expand 22% YoY. We now expect credit costs to come in below guidance of 30bps from around 55bps last year. Management seems confident that GPs of about S$900mn already made can address any increase in non-performing loans as loan moratoriums expire.

We upgrade our FY21e earnings by 7% as we crank up fees and commissions estimates on the back of strong growth in WM income and loan-related fees. We expect loans growth at 2% and NIMs to remain stable for the rest of FY21e.

Investment Action

Maintain ACCUMULATE with higher GGM TP S$29.00, from S$28.70

We maintain our ACCUMULATE recommendation with a higher GGM target price of S$29.00 from S$28.70 following our earnings revision. Our target price remains based on GGM (1.17x FY21e P/BV) valuation.

Source: Phillip Capital Research - 5 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024