Ascendas REIT- Industrials Turning the Corner

traderhub8

Publish date: Wed, 04 Aug 2021, 03:06 PM

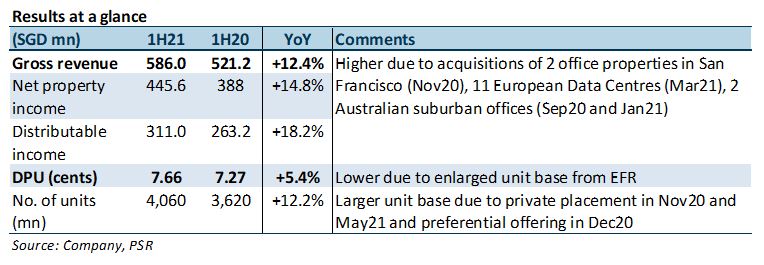

- 1H21 DPU of 7.66 Scts, up 5.4% YoY, in line at 48% of our FY21e forecast.

- Pick-up in portfolio occupancy to 91.3%, strong 1H21 reversions of +6.4% and better leasing sentiment in Singapore.

- Reiterate BUY. DDM TP (COE 6%) unchanged at S$3.65. Forecast FY21e DPU yield of 5.1% and DPU growth of 2% as acquisitions and redevelopment/AEI start contributing. AREIT remains our top pick in the sector for its scale and diversification.

+ Positives

+ Pick-up in occupancy. Portfolio occupancy improved QoQ from 90.6% to 91.3%, led by Singapore (+1.0ppt), Australia (+0.9ppt) and the US (+0.3ppt). There was a slight dip of 0.2ppt in the UK due to a non-renewal. Singapore occupancy rose to 87.9% following full occupancy at 31 Joo Koon Circle, a light industrial property which was vacant back on 31 Mar 2021. The property is now fully leased to a biomedical tenant on a 20-year lease. Australian occupancy improved to 95.8% after a lease was signed at a logistics asset in Sydney. This brought the asset’s occupancy to 54%, from zero in 1Q21. UK occupancy remained high at 98.2% despite the 0.2ppt dip.

+ 2Q21 reversions of +8.9% lifted 1H21 reversions to +6.4% (1Q21: +3.0%). Singapore reversions were +3.4%, better across the asset classes except integrated development, where reversions were down 3.1% for two small leases. Reversions for logistics, high-spec, business space and light industrials came in at 4.9%, 4.8%, 3.7% and 1.3% respectively. Reversions in the US were strong at 26.3%, towering above 1Q21’s 6.2%. In-place rents for its US portfolio, which comprises business space, are 10-30% below market, which should provide positive reversions in the coming years. New leases in 1H21 were primarily signed with the biomedical (34%), IT (19.5%) and lifestyle, retail & consumer-product (9.4%) sectors.

– Negative

– Policy-related vacancies in Singapore. Assets built on JTC land are subject to the JTC’s anchor-tenant and subleasing policies. They also have to adhere to URA zoning rules for the use of space. Some vacancies have been attributed to these policies, which may take longer lead times to replace anchor tenants.

Outlook

A higher plot ratio has been approved for the redevelopment of 1 Science Park Drive, formerly leased to TÜV SÜD. This will increase the land’s GFA by 3.5x from 30k sqm to 100k sqm. Preliminary plans are three vertical campuses, fitted with IT and life-science specifications. Given significant development costs of S$800mn-1bn, AREIT may redevelop this property via a JV with sponsor CapitaLand (CAPL SP, BUY, TP S$4.28). This will leave headroom for it to pursue other AEI, redevelopment and build-to-suit opportunities. More details will be released at a later date.

Source: Phillip Capital Research - 4 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024