Keppel Corporation – Firing on All Cylinders

traderhub8

Publish date: Mon, 02 Aug 2021, 09:52 AM

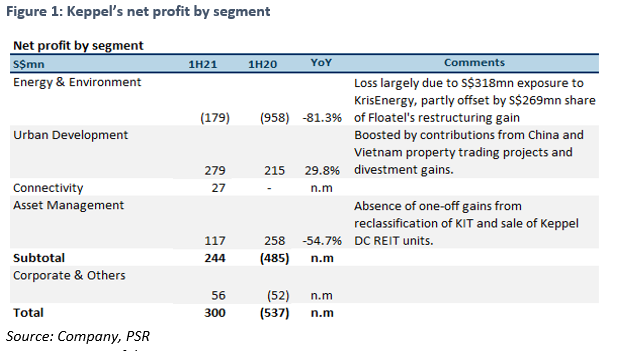

- Net profit of S$300mn in 1H21 ahead, at8% of our FY21e earnings, boosted by recognition of S$269mn from its share of Floatel’s restructuring gains.

- Keppel Offshore & Marine (O&M) turned EBITDA-positive in 1H21. Net orderbook grew over 70% YoY.

- Vision 2030 asset monetisation program ahead of schedule. Updated guidance now at higher end of S$3 – 5bn guidance range by 2023.

- We raise our earnings forecast for FY21e by 46% for higher estimates for its O&M, Urban Development and Asset Management businesses on promising tailwinds.

- Maintain BUY with higher SOTP TP of S$6.28 from S$6.20. We ascribe a higher 0.8x P/BV to its O&M division from an improving outlook in the sector, still with a 10% holding-company discount. Our TP translate to about 1.0x FY21e book value, a slight discount to its 5-year average of 1.05x. Catalysts expected from contract wins and a successful resolution to its O&M unit.

Positives

+ Net profit ahead, boosted by S$269mn from Floatel’s restructuring gains. Net profit was a significant improvement over the net loss of S$537mn for 1H20, which was hit by a S$930mn impairments of its O&M business. The improvement was led by better showings across the segments except asset management, further boosted by gains from a reclassification of Keppel Infrastructure Trust (KIT) and sale of Keppel DC REIT units.

1H21 interim dividend of 12 Singapore cents, up four times from last year, reflects management’s confidence in the Group’s prospects.

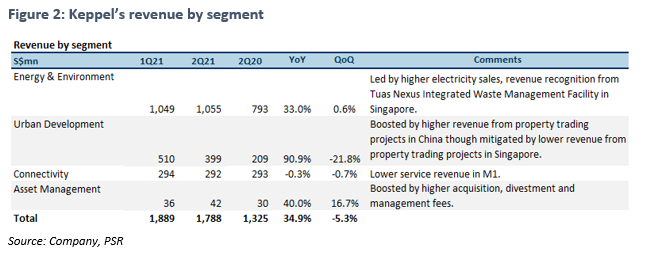

+ Keppel O&M turned EBITDA-positive in 1H21; net orderbook grew over 70% YoY. Keppel O&M generated a net profit of S$107mn {What is difference with table above?} in 1H21, from a loss of S$959mn a year ago. This year’s profit included the recognition of S$269mn from its share of Floatel’s restructuring gains. Despite increased manpower costs and Covid-19 manpower disruptions at its Singapore yards, Keppel O&M was EBITDA-positive. In 1H21, Keppel O&M secured S$3.1bn of new orders, including a floating production, storage and offloading (FPSO) P-78 contract and an FPSO topside fabrication project more recently in July. Net orderbook grew over 70% to S$5.7bn as at end-June 2021, from S$3.3bn in the same period last year.

+ Vision 2030 asset monetisation program ahead of schedule; updated guidance now at higher end of S$3 – 5bn guidance by 2023. Keppel has announced the monetisation of over S$2.3bn in assets since the asset monetisation program was announced in September 2020. It now expects to surpass the S$3bn milestone well ahead of its original 3-year schedule. It aims to achieve the higher end of its S$3 – 5bn target by the end of 2023.

Through proactive asset monetisation, free cash flow and net gearing improved. Free cash inflow was S$499mn compared to an outflow of S$664mn last year. Net gearing was lowered to 0.85x as at 30 June 2021, from 0.91x as at 31 December 2020.

Negatives

– M1’s net profit 47.5% lower YoY from lower roaming and prepaid revenue. M1’s net profit of S$21mn was lower than its S$40mn in 1H20. This was mitigated by a divestment gain from its interest in Keppel Logistics (Foshan), following an agreement reached with the local authorities on Lanshi’s port-closure compensation and lower net interest expense.

Outlook

Keppel O&M and Sembmarine (SMM SP, Non-rated) are in preliminary discussions on a potential combination. We expect some form of agreement in the fourth quarter of 2021. While nothing has been firmed up, we view the discussions positively as it provides better clarity on the fate of its O&M unit. With the overhang removed, along with the planned divestment of its logistics unit, we believe Keppel will be re-rated.

The proposed transactions are expected to be earnings-accretive for Keppel in the current financial year on a pro-forma basis, although there is no guarantee of completion by this year. The group’s net debt should fall as a result of the deconsolidation of Keppel O&M and receipt of part of the consideration from the merged entity. Distribution in specie of the merged entity will, however, reduce Keppel’s shareholders’ funds. Overall, net gearing is not expected to be much affected by the transactions.

Source: Phillip Capital Research - 2 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024