Sheng Siong Group Ltd – Record Margins

traderhub8

Publish date: Mon, 02 Aug 2021, 09:51 AM

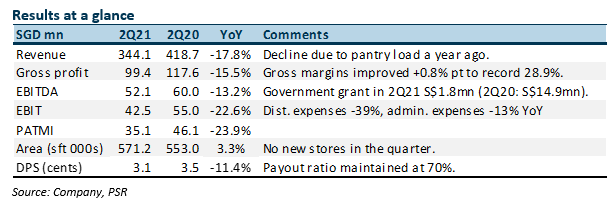

- 2Q21 revenue met but PATMI beat. 1H21 revenue and PATMI at 55%/64% of forecasts.

- Gross margin was a record 28.9%, higher than our 27% modelled for FY21e. Higher contributions from fresh products and house brands were behind this.

- No new stores contributing this year. Any new stores will likely be awarded only in 4Q21.

- We raise FY21e PATMI by 7% to S$109.9mn for better-than-expected margins. We also roll over our target price to FY22e, to better reflect normalised earnings. With borders shut and dining restrictions still effective, revenue should remain elevated in FY21e. Still using its 5-year historical average of 25x PE, our target price dips from S$1.71 to S$1.69. Maintain ACCUMULATE. Stock catalysts expected from new store openings and improving margins.

The Positive

+ Record gross margins. Gross margins of 28.9% were the highest by far, surpassing their previous high of 28.1% at the height of the pandemic in 2Q20 due to pantry loading. Margin expansion was driven by a higher mix of fresh-food sales and house brands. Fresh foods were evenly contributed by seafood, meats and fresh produce. House brands were predominantly rice, oil, washing and paper products. In-house product range also expanded into dry foods, snacks and processed and frozen ready-to-eat foods.

The Negative

– Still no store openings. SSG has submitted bids for two HDB stores recently. The outcome may be known in three months. Add another 1-2 months for store opening and any new stores will likely only materialise at year-end. The authorities may release six new supermarkets for bidding in 2022 and another eleven in 2023.

Outlook

Revenue remains elevated at S$2,387/sq ft, around 25% higher than pre-pandemic levels of S$1,916 in FY19. Dining restrictions and borders closures should lead to more frequent dining and time spent at home, fuelling grocery demand. Gross margins at 28% could be the new norm as fresh foods and house brands gain further traction. SSG has doubled stores in China to four but revenue remains low at only 3% of group revenue. It will continue to build up its e-commerce capacity as order fulfilment and delivery are the main bottlenecks to growth. Another challenge is higher resistance to higher-margin fresh-food purchases online. Low-margin bulkier, heavier and costlier-to-deliver items are still the most popular.

Maintain ACCUMULATE with lower TP of S$1.69, from S$1.71

ROEs remain commendable at 25%, dividend yields at 3.2% and net cash at S$228mn (as at Jun 2021), in our estimation. Stock catalysts are expected from new store openings and improving margins.

Source: Phillip Capital Research - 2 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024