Raffles Medical Group Ltd – Navigating Pandemic Well

traderhub8

Publish date: Thu, 29 Jul 2021, 03:35 PM

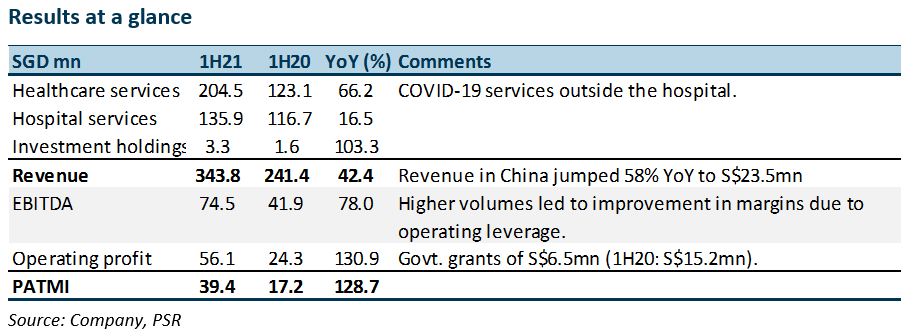

- 1H21 PATMI jumped 128% YoY to S$39.4mn. Earnings a large beat at 73% of our FY21 estimate.

- COVID-19 services such as vaccination and PCR swab testing fuelled growth.

- 400-bed RafflesHospitalShanghai started operations this month. EBITDA losses for both China hospitals, including RafflesHospitalChongqing, estimated at S$10mn this year.

- The group navigated the pandemic with a huge recuperation in earnings. Despite a loss of foreign patients, Raffles Medical managed to pivot to pandemic-related healthcare services. Our DCF target price (WACC 6.8%) is raised from S$18 to S$1.35 as we lift FY21e earnings by 41%. Nevertheless, downgrade from ACCUMULATE to NEUTRAL as the move into the endemic stage of COVID-19 lacks visibility. The transition from pandemic-related services to foreign patients is unclear as borders may remain shut longer than expected.

The Positives

+ Pandemic-related revenue. Revenue jumped 42% YoY in 1H21. Two sources of growth were COVID-19 vaccinations and PCR swab tests. Raffles operates 17 of Singapore’s 40 vaccination centres. Revenue from foreign patients was limited except for emergency cases. Still, Raffles has maintained contact with its foreign patients via telemedicine and may provide their opinions on patient condition.

+ Surge in operating cash flows. Operating cash flows catapulted from S$35mn in 1H20 to S$83mn in 1H21. However, capex also increased by S$13mn to S$40mn and dividends, to S$37mn in the absence of scrip dividends.

The Negatives

– No interim dividend. No interim dividend will be paid this financial year. But it has guided an annual dividend of half its average sustainable PATMI. Dividend for FY21e is expected to be not less than 2.5 cents. Our estimate is 3 cents.

Source: Phillip Capital Research - 29 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024