Keppel DC REIT – First Beachhead in China

traderhub8

Publish date: Wed, 28 Jul 2021, 09:52 AM

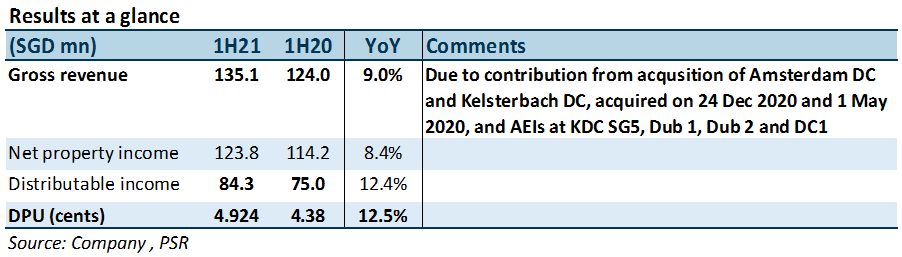

- 1H21 DPU of 4.924 Scts, up 12.5% YoY, was in line, at 50% of our estimate. Earnings improved following acquisition of Amsterdam DC and completed AEI at KDC SG5, DC1 and KDC Dub 2.

- Acquisition of Guangdong Data Centre at 9% NPI yields expected to add 1.9% and 1.7% to DPU and NAV.

- Upgrade to BUY from Accumulate on the resilient data centre demand and new data centre pipeline. DDM-based TP unchanged at S$3.20 (COE 5.75%). Includes S$500mn of acquisition assumptions for FY21e.

+ Positives

+ First beachhead in China, second-largest data-centre market globally

KDC has announced a sale and leaseback of Guangdong Data Centre from Guangdong Bluesea Data Development. This is a 46-year-leasehold, 7-storey, 221,689 sq ft facility in Jiangnan, Guangdong Province, which is part of the Greater Bay Area. Purchase consideration of RMB132.0mn or S$143.2mn represents a 7.8% discount to the property’s 1 July 2021 valuation. The asset carries an NPI yield of about 9% and will be leased to the vendor on a triple-net lease of 15 years, with an option to renew for another five. Guangdong Data Centre is the first of six data centres to be completed in the Bluesea Intelligence Valley Mega Data Centre Campus. KDC has an ROFR on the remaining five data centres, which are at varying stages of fitting out. The acquisition is expected to add 1.9% and 1.7% to its DPU and NAV on a 55% LTV pro-forma basis. KDC will issue equity to fund its acquisition, with completion expected in 3Q21. The acquisition will increase its WALE from 6.5 to 7.3 years.

+ Leases de-risked; potential divestment of iSeek Data Centre in Brisbane. KDC also signed leases for 5.3% of NLA during the quarter at positive reversions. This has reduced its FY21 expiries to 1.7% of NLA. Including leases signed in July, 0.8% remain for FY21. With the completion of Intellicentre 3 in Sydney, a 20-year lease with Macquarie Data Centres and the adjoining Intellicentre 2 has also commenced. Separately, KDC has granted its underlying tenant, iSeek Pty Ltd, the option to purchase iSeek Data Centre in Brisbane for A$34.5mn or S$35.3m. This is 21.5% above the property’s valuation during KDC’s IPO. The option is valid for five years and can be exercised from 1 August 2021. Final consideration will include the net book value of all capex required for the asset from January 2020.

– Negative

– Further compression of cap rates. Competition for assets remained stiff. Cap rates have been compressed by 50-75bps from a year ago to 4-6%. Thankfully, low cost of debt of 1.5% still leaves room for accretive acquisitions.

Outlook

There are market rumours that Singapore’s moratorium on data centres may be lifted this year. Should it happen, supply could increase over the next 2-4 years. However, stickiness of data-centre tenants and Keppel’s track record as a data-centre operator should help it retain tenants.

Soon after its investment mandate was expanded on 28 April 2021, KDC announced a non-binding MOU with M1 to invest S$87mn in the debt securities and preference shares of an M1-established SPV. This SPV, which will hold M1’s network assets, has a net book value of S$580mn. More details will be released when the MOU is inked.

Upgrade to BUY from Accumulate; DDM TP of S$3.20 unchanged

Our TP assumes S$500mn worth of acquisitions in 4Q21, for 6% NPI yields and at a 30% LTV. KDC’s acquisition of Guangdong Data Centre comes one quarter earlier than expected and is above our NPI yield forecast, though at a lower quantum. Still, we leave our estimates for the year unchanged.

Current share price implies FY21e/22e DPU yields of 3.8% and 4.4%. KDC is trading at 2.1x P/B. Dividend yield spread of 221bps is close to its 5-year average of 186bps. This is attractive against its 2019/20 average yield spread of 100bps.

Stock catalysts are expected from acquisitions and higher 5G, smartphone and cloud adoption. KDC will maintain at least 90% of its assets in data centres and will only consider assets that have been 50% leased at a minimum.

Source: Phillip Capital Research - 28 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024