CapitaLand Limited – Growth-focused Powerhouse

traderhub8

Publish date: Mon, 26 Jul 2021, 09:55 AM

- Proposed restructuring and demerger of investment-management business to allow unitholders to realise immediate upside from development business, at 0.95x BV offer compared to CAPL’s 20-30% historical discounts to NAV.

- Implied consideration of S$4.102 is 27% premium to 1-month pre-announcement VWAP and 8-18% discounts to IFA’s valuation range, suggesting upside for CLI.

- Maintain BUY and TP of S$4.38, based on 80% probability-weighted RNAV that the demerger will be approved and SOTP. Catalysts expected from faster asset recycling and a hospitality recovery.

Recap: demerger of CAPL’s development business from investment-management platform

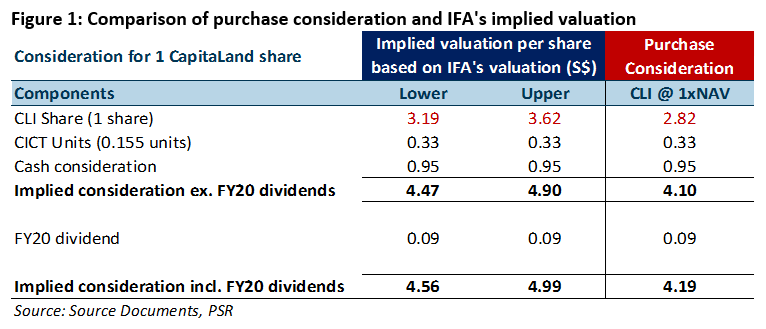

Recall that under CAPL’s proposed restructuring scheme in March 2021, shareholders of one CAPL share will receive one CLI share valued at S$2.823 (1x NAV), 0.155 unit of CapitaLand Integrated Commercial Trust (CICT SP, Accumulate, TP S$2.50) and S$0.951 in cash for a total consideration of S$4.102 (Figure 3). The S$0.328 for CICT was based on its last traded price of S$2.122. The implied consideration excludes CAPL’s proposed FY20 DPS of 9 cents.

An EGM for the restructuring will be held on 10 August 2021. If approved, the estimated date for the delisting of CAPL and listing of CLI is 17 September 2021.

Release of Independent Financial Advisers’ valuation and introductory document for CLI

The Independent Financial Advisers (IFA) has valued CLI using SOTP, breaking CLI down into five businesses: investment management (P/E), lodging management (EV/EBITDA), investment properties (RNAV), unlisted funds (carrying value) and listed funds (REITs/business trusts at market value). The IFA has given CLI a valuation range of S$3.19-3.62. This translates to S$4.47-4.90 for one CAPL share, or 8-18% discounts to the implied purchase consideration of S$4.102/share (Figures 1 and 2). The latter provides upside from CAPL’s pre-announcement WVAP while IFA’s valuation points to upside for CLI.

Outlook

CAPL’s focus to the development of its fund-management and lodging-management segments will be better appreciated under CLI’s asset-light, capital-efficient business model. Clear growth targets have been set for these two businesses. CLI aims to increase funds under management from S$78bn to S$100bn by 2024. Its growth targets apply to both its investment properties and future development projects, ensuring that its balance sheet can be monetised within 3-4 years for reinvestments. The lodging segment, which manages 123K room keys, of which 43% are under development and have not begun contributing, is aiming for 160k keys by 2023.

Maintain BUY and probability-weighted RNAV TP of S$4.38

No change to our earnings forecasts or target price, pending completion of the demerger. Potential catalysts include faster asset recycling and a recovery of the hospitality sector.

Source: Phillip Capital Research - 26 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024