Koda Ltd – Furniture Boom in the US

traderhub8

Publish date: Fri, 23 Jul 2021, 10:01 AM

- FY21e PATMI expected to almost double with a boom in furniture demand as more work, study, entertain and spend time at home. Supported by increased exports to US. Year to May 2021, US furniture imports rose 44% YoY to US$24.9bn.

- Production capacity in Vietnam to expand following acquisition of land and factory building in March 2021. Vietnam is the world’s largest furniture exporter, exporting US$7.3bn of furniture to the US in 2020, up 31% YoY.

- Initiate coverage with BUY and TP of S$1.32, valued at 7.0x FY21e ex-cash PE. Stripping out net cash of US$13.7mn, Koda trades at ex-cash PEs of 3.3x/2.2x FY21e/22e PE. Catalysts expected from higher exports to US and increase in production capacity.

Company Background

Koda is a leading original design manufacturer or ODM of all types of home furniture. Founded in 1972 as a small workshop producing wooden cabinets, it has expanded to produce wood-based home furniture for the living, dining and bedroom. Koda now specialises in an entire range of affordable, ready-to-assemble, wood-based home décor.

Koda was listed on the-then Sesdaq board in January 2002 and migrated to the main board in May 2005.

Investment Merits

- 1HFY21 PATMI exceeded FY20; FY21e PATMI forecast to almost double. 1HFY21 PATMI increased 15.7% YoY and exceeded FY20 levels. Sales in 2HFY20, which was the January-June 2020 period, were largely hit by restrictions around the world to combat Covid-19. 1HFY21 revenue rose as export sales to North America recovered. We expect FY21e PATMI to almost double, supported by growth in export sales to North America. Year to May 2021, US furniture imports rose 44% YoY to US$24.9bn. Imports were even higher than pre-Covid levels by 18%. After the US-China trade war, Vietnam has overtaken China as the world’s largest furniture exporter. It exported US$7.4bn worth of furniture, up 31% YoY, to the US in 2020, a tad above China’s US$7.3bn.

- Expansion of production capacity in Vietnam. In anticipation of a bigger order book, Koda acquired a piece of land and a factory building in Vietnam in March 2021. This was to increase capacity for its mixed-material furniture production, storage and warehousing. Built-in area for the factory is approximately 8,473 sqm, while the land has an area of approximately 13,768 sqm. Koda has also expanded into sofa. Within furniture, sofa manufacturing is the most straightforward. Contributions from manufacturing sofas have not been factored in.

- Additional source of growth: target of 100 retail stores in China by end-2022. Koda started its Commune brand in 2011. Through aggressive expansion, Commune can now be found in 85 stores in four countries, 75 in China alone. Revenue from its retail and distribution segment grew at a CAGR of 13.2% from FY16 to FY20. Year to June 2021, furniture retail sales in China grew 18.8% to RMB78.1bn, driven by recovery in retail spending as life in China returns to normalcy.

REVENUE

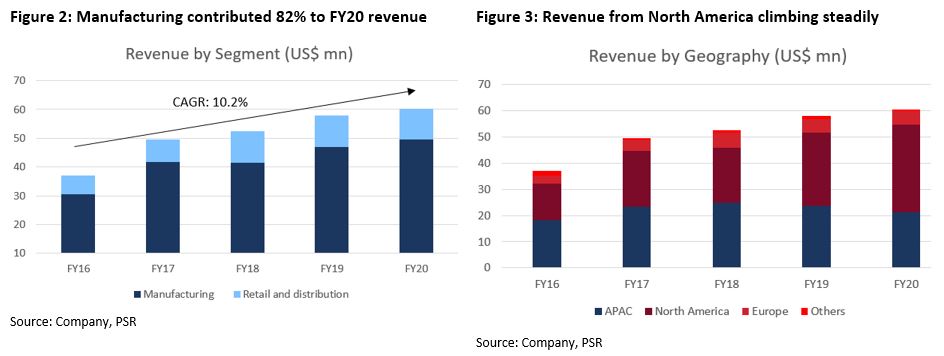

Koda has two main businesses: manufacturing, at 82% of its revenue, and retail and distribution, at 18%. Customers are located in about 30 countries, comprising wholesalers, distributors and major retailers.

Manufacturing. Koda exports furniture to 30 countries in North America, the Asia Pacific and Europe. North America is its biggest market, contributing 55.3% to FY20 revenue (Figure 1). Manufacturing is Koda’s bread-and-butter (Figure 2).

Retail and distribution. Koda established its Commune retail brand in 2011. Backed by Koda’s scalable distributor-retail business in China, Commune has grown at a CAGR of 13.2% since FY16. It is expected to be Koda’s near-term revenue driver. Over the past 10 years, Koda has opened 85 retail stores in Asia, 75 in China.

Alto by Commune is a higher-end sister brand launched in 2019. It currently operates more than 10 stores in Singapore and China.

Revenue CAGR was 10.2% from FY16 to FY20 as Koda expanded its customer base, and increased sales from existing customers. FY20 revenue rose 4.3% or US$2.5mn to US$60.4mn, led by higher export sales to markets such as North America despite Covid-19 control measures (Figure 3).

EXPENSES

Cost of sales include the costs of raw materials, labour, etc.

Operating expenses include selling and distribution expenses, at 8.7% of sales, administrative expenses at 15.1% and other expenses at 0.2%. Selling and distribution expenses rose US$0.3mn in FY20 due to higher marketing and staff costs for Commune’s new subsidiary in Chongqing. This was mitigated by lower trade-fair and travelling expenses due to Covid-19 restrictions.

MARGINS

Gross margins ranged from 27% to 36% in FY16-20 (Figure 5). Margins were affected in FY20 by higher selling and distribution expenses for Commune’s new subsidiary in Chongqing.

EBITDA margins were 9-15% over the period.

We expect gross margins to be in the same range over the next two years, as Koda expands its Commune presence in China. Higher economies of scale are expected from higher production.

OTHER INCOME

Other income rose by US$0.4mn to US$1.2mn, thanks to government grants and property tax and rental rebates of US$360k and higher interest income.

Source: Phillip Capital Research - 23 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024