BRC Asia – Resilient Quarter

traderhub8

Publish date: Wed, 12 May 2021, 09:08 AM

- 1HFY21 earnings of S$19.2mn, at 46.7% of our FY21e estimates. 1H is seasonally weaker.

- First interim DPS of 4 Singapore cents declared in five years. We raise FY21-22e DPS estimates to eight/10 cents from six.

- Credit situation improving. Guidance for receivables impairment unchanged at 3% of total receivables.

- Maintain BUY and target price of S$1.87. Based on 11x FY21e P/E, a 15% discount to its 10-year historical average P/E on account of the uncertain environment. Catalysts expected from an increase in foreign workers inflow into Singapore.

The Positives

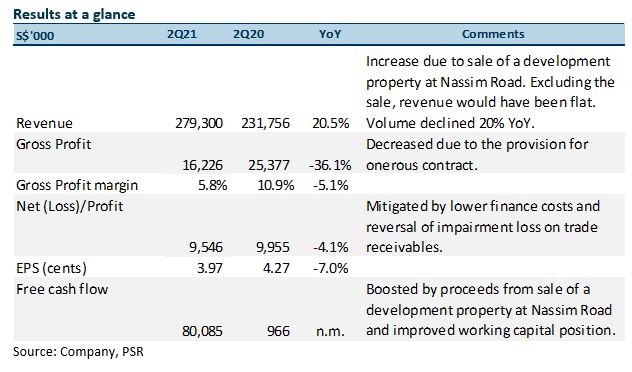

+ Earnings met, despite tough environment. 2QFY21 earnings of S$9.5mn formed 22.7% of our FY21e estimates, in-line. 1H is seasonally weaker than 2H. As global steel prices have spiked, the Group had to make an accounting provision for onerous contracts of S$21mn in 2QFY21. This brought the total provision to S$28.9mn for 1HFY21. Gross margins contracted to 5.8% mainly due to the provisions, which can be reversed when sales contracts are executed at lower steel spot prices. As BRC Asia hedges its steel contractual obligations for 15 months while most of its contracts are fulfilled within 18 to 24 months, price risks are mitigated. For more details on its provision for onerous contracts, refer to our Initiation report here).

+ First interim DPS in five years. An interim DPS of four Singapore cents has been declared, the first in five years. This reflects its relatively robust results in a tough environment and an improving construction sector. We raise our dividend forecasts for FY21e/FY22e to eight/10 Singapore cents from six cents for both years.

+ Credit situation improving. 1HFY21 provisions for impairment loss on trade receivables decreased 33% YoY to S$2.5mn from S$3.7mn. A reversal of impairment loss of S$0.1mn was booked in 2QFY21 compared with a provision of S$2.9mn in 2QFY20. The group has not observed any near-term customer stress. Full-year guidance for receivable impairments is unchanged at 3% of total receivables.

The Negative

– Tightening of border measures could slow construction activity further. The government’s move to ban long-term pass holders and short-term visitors from India from entering Singapore will affect operations in the construction sector. Construction activity, currently at 75 – 80% of pre-COVID-19 levels, could slow down again.

Outlook

Construction demand to improve to S$23bn-S$28bn in 2021. The Building and Construction Authority (BCA) has finalised 2020 construction demand at S$21bn. It expects construction demand to improve to S$23-28bn in 2021. The public sector is expected to contribute 65% of the new contracts or S$15-18bn, to meet stronger demand for public housing and infrastructure.

BCA also forecasts that average construction demand in 2022-2025 will be S$25-32bn per year, excluding the development of Changi Airport Terminal 5 and expansion of the two integrated resorts. The public sector is expected to contribute 56% to the demand.

As our forecasts have not included these projects, there is upside if they become live. In the near term, pipeline projects that will likely support the group’s growth are the Singapore Science Centre’s relocation, Toa Payoh integrated development, Alexandra Hospital redevelopment, Bedok’s new integrated hospital, Phases 2-3 of the Cross Island MRT Line and Downtown Line’s extension to Sungei Kadut.

Maintain BUY with TP of S$1.87

We maintain our BUY and target price of S$1.87. Our TP based on 11x FY21e, a 15% discount to its 10-year historical average P/E on account of the uncertain environment.

Source: Phillip Capital Research - 12 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024