United Overseas Bank Limited – Steady Quarter

traderhub8

Publish date: Mon, 10 May 2021, 09:35 AM

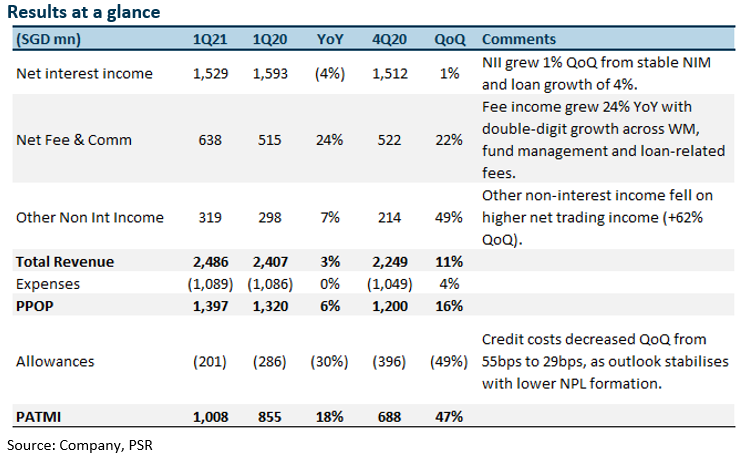

- 1Q21 earnings of S$1.0bn in-line, at 25.5% of our FY21e forecast boosted by stronger than expected other non-interest income but dragged by higher than expected allowances.

- NIM unchanged QoQ at 1.57%, helped by lower cost of deposits at 1Q21. Guidance for FY21e remain unchanged.

- 1Q21 credit cost declined 26bps on QoQ basis to 29bps. FY21e guidance is 30bps, down from 30-40bps previously.

- The bank is reviewing Citi’s for-sale assets in Asia Pacific. Information memorandum on sale expected later this month.

- Maintain ACCUMULATE and GGM TP (1.17x of FY21e P/BV) of S$28.70.

The Positives

+ NII increased 1% QoQ, NIM stable. NII increased 1% QoQ led by loan growth of 4%, led by term and trade loans in Singapore and North Asia. NIM was unchanged at 1.57% this quarter, helped by lower cost of deposits. NIM is expected to remain stable in FY21e as the bank targets loan growth to improve NII. Wholesale banking business grew 9% YoY, to a quarterly record backed by improving sentiment. Credit demand was strong from large corporate and institutional clients.

+ Robust growth in fees and commissions. Fee and commission income grew 24% YoY and 22% QoQ. This came from record wealth-management AUM and a pick-up in equity markets. Loan-related fees were also supported by large investment-banking and loan-related deals in Singapore, Hong Kong and U.S.

The Negatives

– No write-backs despite stabilising outlook. The bank recognised S$71mn of SPs in 1Q21 with GP unchanged at 1% of loans. Total allowance for this quarter is S$201mn. Despite the sizeable provisions it made in 2020, the bank has delayed the write-back of these allowances in favour of a stronger balance sheet.

Source: Phillip Capital Research - 10 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024