United Overseas Bank Limited – Steady Quarter

traderhub8

Publish date: Fri, 07 May 2021, 02:45 PM

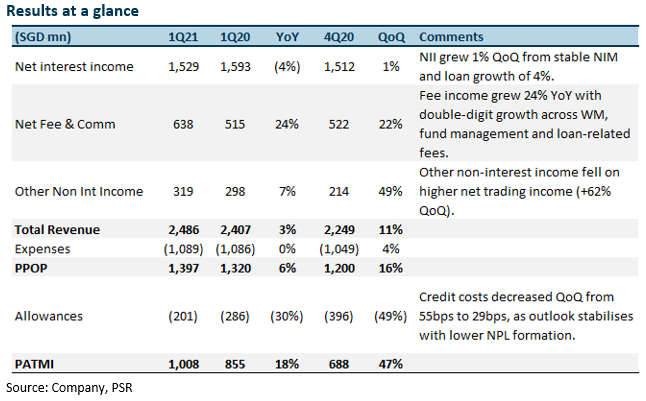

- 1Q21 earnings of S$1.0bn in-line, at 25.5% of our FY21e forecast boosted by stronger than expected other non-interest income but dragged by higher than expected allowances.

- NIM unchanged QoQ at 1.57%, helped by lower cost of deposits at 1Q21. Guidance for FY21e remain unchanged.

- 1Q21 credit cost declined 26bps on QoQ basis to 29bps. FY21e guidance is 30bps, down from 30-40bps previously.

- The bank is reviewing Citi’s for-sale assets in Asia Pacific. Information memorandum on sale expected later this month.

- Maintain ACCUMULATE and GGM TP (1.17x of FY21e P/BV) of S$28.70.

The Positives

+ NII increased 1% QoQ, NIM stable. NII increased 1% QoQ led by loan growth of 4%, led by term and trade loans in Singapore and North Asia. NIM was unchanged at 1.57% this quarter, helped by lower cost of deposits. NIM is expected to remain stable in FY21e as the bank targets loan growth to improve NII. Wholesale banking business grew 9% YoY, to a quarterly record backed by improving sentiment. Credit demand was strong from large corporate and institutional clients.

+ Robust growth in fees and commissions. Fee and commission income grew 24% YoY and 22% QoQ. This came from record wealth-management AUM and a pick-up in equity markets. Loan-related fees were also supported by large investment-banking and loan-related deals in Singapore, Hong Kong and U.S.

The Negatives

– No write-backs despite stabilising outlook. The bank recognised S$71mn of SPs in 1Q21 with GP unchanged at 1% of loans. Total allowance for this quarter is S$201mn. Despite the sizeable provisions it made in 2020, the bank has delayed the write-back of these allowances in favour of a stronger balance sheet.

Outlook

Profit outlook should improve in 2021. UOB’s profit should recover in 2021 on the back of stabilising margins, stronger fees and lower provisions. We expect wealth management, loan-related and card fees to expand by 22% YoY. We also expect credit costs to come in below guidance of 30bps from around 55bps last year. Management seems confident that GPs of about S$900mn already made can address any increase in non-performing loans as loan moratoriums expire. Some 6% of its loans remain under moratorium, unchanged from last year.

Keen to review Citi assets. UOB is looking at the assets that Citi has put up for sale in the Asia Pacific. It will share more details once the information memorandum, expected later this month, is released.

Dividends

The MAS has still not indicated when the dividend cap on banks will be lifted. In 2020, the central bank had called on local banks to cap their total DPS at 60% of the amounts in FY19. UOB expects to resume the 50% dividend payouts once the cap is lifted.

Source: Phillip Capital Research - 7 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024