StarHub Limited – Final Quarter of Roaming Drag

traderhub8

Publish date: Thu, 06 May 2021, 09:36 AM

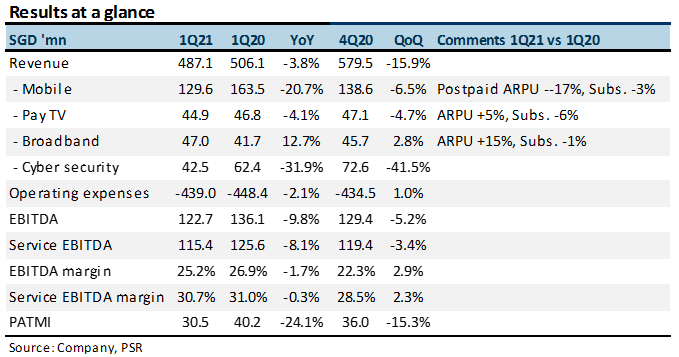

- 1Q21 revenue and EBITDA were within expectations, at 24%/26% of our FY21 forecasts.

- Revenue down 4% YoY, dragged down by a 21% YoY drop in mobile revenue to S$130mn. Broadband a bright spot with a 13% YoY rise to S$47mn.

- EBITDA was down 10% YoY, under lower high-margin roaming revenue and cost-savings.

- Our NEUTRAL recommendation and target price of S$1.24 are maintained, pegged to regional peers’ 6x EV/EBITDA. EBITDA forecasts unchanged. However, PATMI is raised by S$30mn to S$115mn. Depreciation is trending much lower than modelled. Without international travel and roaming revenue, 2021 could be a lacklustre year. Growth to be driven by enterprise segment, namely cyber security and broadband.

The Positives

+ Recovery in broadband revenue. Broadband revenue was stronger than expected. A 15% YoY rise in ARPU only resulted in minor churns. A vital need for broadband in homes for work and entertainment was likely responsible for the acceptance of higher prices.

+ Healthy cash flows. FCF in 1Q21 was a healthy S$97.4mn. StarHub earlier guided for DPS of at least 5 cents in FY21e.

The Negatives

– Collapse in cyber-security revenue. A 32% YoY collapse in cyber-security revenue reflected lumpy projects in prior quarters. Orderbook was healthy, said StarHub. Admittedly, there is little visibility on future revenue for this division apart from the industry’s healthy outlook and demand. We forecast 30% revenue growth for FY21e.

– Pay-TV subscribers at 310k, lowest since IPO in 2004. Churns accelerated to 8,000 in 1Q21, the highest since StarHub’s transition from cable to fibre in late 4Q19. It is unclear how much the introduction of Disney+ in February can stem the attritions.

Source: Phillip Capital Research - 6 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024