First Ship Lease Trust – Dividend Support

traderhub8

Publish date: Mon, 03 May 2021, 09:08 AM

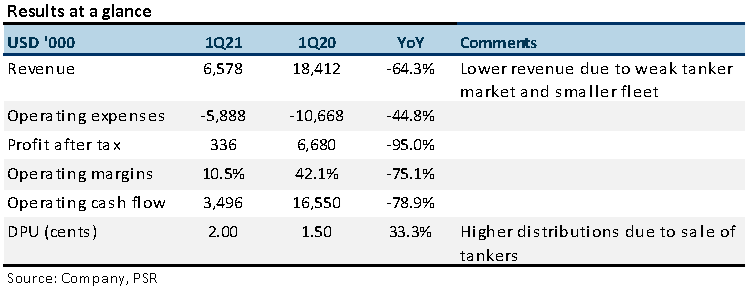

- Profit after tax declined 95% YoY, on lower revenue due to weak tanker market and smaller fleet. 1Q21 net profit roughly in line, at 28.4% of our FY21e forecast.

- 1Q21 DPU of 2.00 US cents forms 41.8% of our forecast. Operating cash flow was US$3.5mn (1Q20: US$16.6mn).

- Maintain ACCUMULATE with lower TP of S$0.03 from S$0.05. We halve FY21e net profits due to subdued tanker market. Our TP remains pegged to 0.9x FY21e P/BV, the industry average. Global tanker market is facing lower demand and higher supply. Dividend support, however, is expected from potential payout of all its FY21e operating cash flow of US$14.5mn together with net sales proceeds from recent disposal of three product tankers worth S$55mn.

The Positives

+ 1Q21 DPU grew 33.3% YoY. FSL Trust paid higher dividends with proceeds from the sale of tankers, including two Long Range 2 newbuilds.

+ Strong liquidity supported by healthy cash flows. The Trust has cleared all borrowings, both current and non-current bank loans, with proceeds from its tanker sales. Net cash was US$47.8mn. Operating cash flow was a positive US$3.5mn despite marginal earnings, due to a depreciation charge of US$1.7mn during the quarter (1Q20: US$16.6mn).

The Negatives

– Lower revenue and net profits. Revenue and profits after tax fell 64.3% and 95.0% respectively YoY, as a result of tanker-market weakness and a smaller fleet of 11 vessels (1Q20: 15 vessels) after the disposal of two new Long Range 2 product tankers in February 2021.

– Lower contracted revenue. Contracted revenue dipped from US$29.8mn as at 31 December 2020 to US$26mn as at 31 March 2021.

Outlook

Tanker rates are expected to remain tepid with most international borders still closed.

Tanker rates depend on oil demand and supply. According to the Organisation for Economic Cooperation and Development (OECD), oil demand in 2021 will grow from 91.3mn bpd in 2020 to 97.1mn bpd, the bulk of it in 2H21. This is still below pre-pandemic levels. Even though OPEC’s monthly oil production ticked up to 25mn bpd in March 2021, this was still far below average pre-pandemic monthly levels of 30mn bpd in 2019.

Meanwhile, floating crude oil storage has decreased over 2020, adding more tonnage back to the fleet. With tanker demand remaining low and higher supply, tanker rates may stay at current levels in the short term.

Source: Phillip Capital Research - 3 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024