DBS Group Holdings Ltd – Inflection Point

traderhub8

Publish date: Mon, 03 May 2021, 09:07 AM

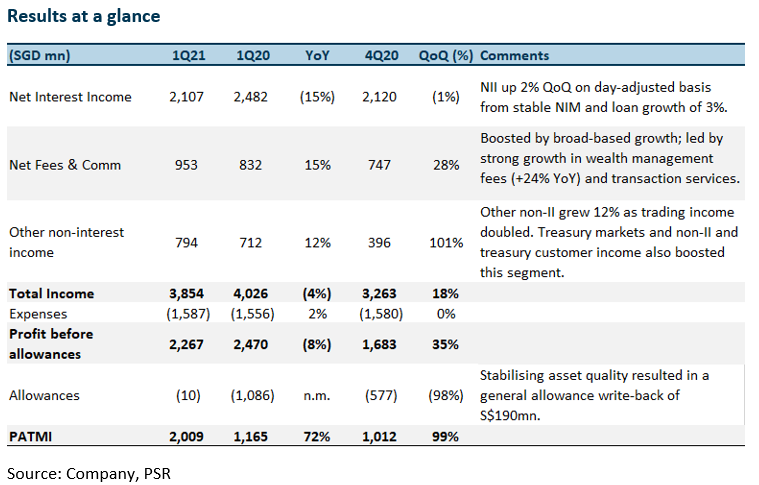

- 1Q21 earnings above, at 34.5% of our FY21e forecast. The strong beat came from net fee income and a S$190mn reversal in GPs.

- NIM fell 37bps to 1.49%, at the upper-end of guidance. Loan growth of 7% YoY cushioned NII. NIM was unchanged from last quarter.

- Fees and commissions surged 15% YoY, rising above pre-COVID levels.

- Credit cost stabilised, resulting in a general allowance write-back of S$190mn and SPs returning to pre-pandemic S$200mn or 21 basis points. Total allowances in FY21e likely to be below S$1bn.

- Maintain ACCUMULATE with higher GGM TP of S$31.40, from S$29.50. We raise FY21e earnings by 5.6% as we lower our allowance estimates and crank up our fee income estimates. We now assume 1.36x FY21e P/BV in our GGM valuation, up from 1.31x.

The Positives

+ Net Interest Income up 2% QoQ on day-adjusted basis

Net interest income grew 2% QoQ to S$2.11bn, adjusted for the number of days in the quarter. NIM was unchanged at 1.49% QoQ, and remained at the upper-end of its guidance.

Loans growth was broad-based, and grew 3% QoQ in constant-currency terms while deposits increased 2% from the previous quarter.

+ Net fee income increased 15% YoY rising above pre-COVID levels

Wealth-management fees increased 24% to a record S$519mn on the back of strong investor demand for a wide range of investment products in a low-interest-rate environment. Transaction services were up 10% to a new high of S$230mn as trade finance and cash management fees mitigated a fall in card-related fees.

Investment banking fees jumped 36% from higher fixed income and equity-market activities. Management guided that the pipeline for both debt and equity capitals remains healthy.

+ Credit cost stabilising, resulting in GP write-back of S$190mn

Stabilising asset quality allowed the bank to write-back S$190mn of GPs. SPs of S$200mn or 21 basis points back to pre-pandemic levels. Delinquencies for both corporate and consumer segments stayed low despite the tapering of loan moratoriums.

FY21 allowances likely to be below S$1bn vs. S$3bn in FY20. GP reserves at S$4.13bn, in excess of MAS’ requirement by 31%.

We believe FY21 provisions is sufficient to account for asset-quality deterioration in FY21 and expect credit costs to normalise to pre-COVID levels along with the economic recovery.

The Negative

– No indication when MAS will lift dividend cap

In 2020, MAS had called on local banks to cap their total DPS at 60% of the amount in FY19. As it has yet to lift the dividend cap, DBS declared dividends of 18 Singapore cents per share for 1Q21.

With its capital and liquidity – CET-1 ratio of 14.3% in 1Q21 vs. 13.9% last year – well above regulatory requirements and high allowance reserves, we believe the bank will revert to 33 cents per quarter or an annualised DPS of S$1.32 once the cap is lifted. We do not rule out special dividends.

Outlook

Business momentum strong

Singapore’s latest economic data confirm a strengthening of the global economic rebound. Business momentum, hence, is expected to be strong. We upgrade our estimates for FY21e and FY22e fee income by 2.6% and 2.7% respectively. We also lower allowance estimates for FY21e. Consequently, our earnings for FY21e/FY22e are raised by 5.6%/1.0%.

Acquisitions to drive future growth

DBS’ LVB consolidation will expand the bank’s footprint in India. Earlier operating concerns have waned after DBS took decisive action to provide for NPAs.

The bank’s recent acquisition of a 13% stake in Shenzhen Rural Commercial Bank for RMB 5.3bn or S$1.1bn – at 1.01x FY20 P/BV – should also allow it to tap growth opportunities in the Greater Bay Area. The acquisition – subject to approval from China Securities Regulatory Commission – should help it further penetrate the Chinese consumer market and is expected to be immediately earnings- and ROE- accretive. On a pro-forma basis assuming DBS had owned a 13% stake in Shenzhen Rural Commercial Bank since the start of 2020, the acquisition would translate to about S$113mn of associate income to DBS, assuming an exchange rate of RMB4.90/1.

Source: Phillip Capital Research - 3 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024