Micro-Mechanics (Holdings) Ltd – Tad Below Expectations

traderhub8

Publish date: Mon, 03 May 2021, 09:06 AM

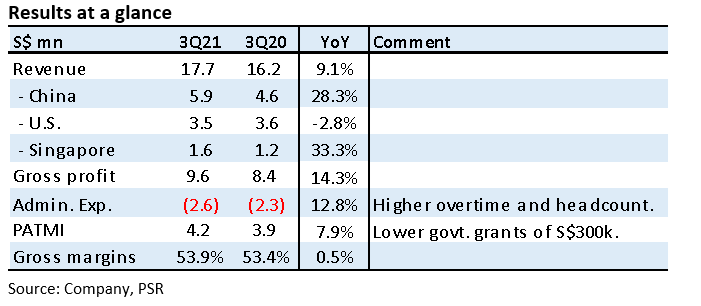

- 3Q21 revenue and net profit were below, with 9MFY21 revenue/PATMI at 77%/64% of our FY21 forecasts.

- Revenue was slower than expected, we believe due to semiconductor supply disruptions in several geographies and sectors.

- MMH is more reliant on volume than semiconductor price appreciation. Huge industry expansion to ease supply shortages at the front end will have a lagged impact on MMH.

- We lower FY21e earnings by 10% and gross margins from 56.5% to 55% for higher operating expenses. This lowers our target price to S$3.02 from S$3.35, still at 21x FY21e P/E ex-cash, in line with peers. NEUTRAL rating unchanged.

The Positive

+ Still a record March quarter. Revenue in Singapore grew 33% YoY and in China, 28% YoY. In contrast, there was weakness in Taiwan and the U.S. A contributor was difference in sector mix. Countries with more automobile exposure suffered from disruption in chip supply.

The Negative

– Gross margins lower than expected. We had expected record revenue and increased product complexity to lift margins, mirroring its FY17-18 upcycle when margins were 57% and capacity utilisation, 60%. Current utilisation is only 56%. Capex ramp in the past few years has yet to be fully utilised.

Outlook

Semiconductors’ multi-year upcycle continues. A tailwind for MMH, together with penetration of front-end semiconductor equipment, is its U.S. operations. Increased complexity of semiconductors from collapsing geometries and more advanced materials to handling wafer dies will further consolidate the supply chain and reduce current competition. MMH is embarking on its second-largest capex spending this year for further improvements in productivity and automation.

Maintain NEUTRAL with lower TP of S$3.02, from S$3.35

MMH pays attractive dividend yields of 4%, backed by net cash. Its strengths include consumable semiconductor products, high gross margins of 55% and ROEs of 32%.

Source: Phillip Capital Research - 3 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024