Frasers Centrepoint Trust Finding Footing in Shifting Sand

traderhub8

Publish date: Tue, 27 Apr 2021, 08:47 AM

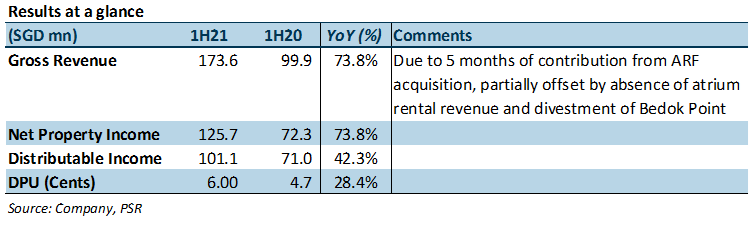

- 1H21 DPU of 5.996 Scts, up 28.4%, was in line, at 45.0% of our estimate. Earnings were lifted by five months of contribution from ARF portfolio, acquired on 28 October 2020.

- January/February tenant sales grew YoY, outpacing RSI. Retail portfolio occupancy of 96.1% near pre-pandemic levels. Retail rental reversions of -0.7% due to change in reversion methodology; otherwise +2.9%.

- Maintain BUY with DDM TP (COE 6.38%) lowered from S$2.93 to S$2.88. FY21e/22e DPUs dip 1.2%/1.4% after accounting for divestment of Yew Tee Point. Trading at attractive FY21e DPU yield of 5.5%. Catalysts expected from growth in mall catchments and synergies from ARF.

+ Positives

+ Tenant sales growth in January and February outpaced RSI. Tenant sales grew 0.4%/11.7% YoY in January/February, outpacing the RSI’s -8.1%/7.7%. This was in spite of an absence of atrium sales which are still prohibited due to safe distancing. That said, the recovery among the trade sectors remained uneven.

+ Divestment of Yew Tee Point at 15.8% above book. FCT announced the divestment of Yew Tee Point on 19 March 2021 for S$220mn. Consideration was 10% above the latest valuation of S$200mn on 31 January 2021 and 15.8% above book value of S$190mn. This was its third divestment in six months, as part of its pivot to larger malls with bigger catchments. The divestment is expected to be completed on 28 May 2021, with proceeds used to pare down debt and lower gearing.

– Negatives

– Retail occupancy dipped 0.3ppt from 96.4% to 96.1% (2Q20: 96.1%). Occupancy at Causeway Point gained 1.5ppts to 99.63%. That at Changi City Point improved 4.0ppts to 94.7%, Hougang Mall by 3.7ppts to 99.3% and Century Square by 2.3ppts to 96.4%. The gains were, however, erased by lower occupancy at Waterway Point, down 5.9ppts to 92.2%, and Tampines 1, down 2.3ppts to 91.9%. Occupancy at Waterway slipped after the pre-termination of H&M. FCT will be subdividing the returned 20,000 sq ft space, which will free up the escalator and improve vertical circulation at the mall. It has found a replacement tenant for the space vacated by Uniqlo at Tampines 1. Occupancy at FCT’s only office asset, Central Plaza, dropped from 95.3% to 92.1% QoQ.

– 1H21 rental reversions were -0.7%/-1.5% for retail/portfolio, based on new computation. FCT changed its method of computing rental reversions, from an average of new leases over the average of expiring leases to an average of change in rents from incoming over expiring rents. 1H21 retail reversions using the old method averaged +2.9%. The change in methodology will reflect changes in rents from the time the outgoing lease was first signed. The largest negative reversion of -10.5% was booked for Changi City Point. Leasing at this property remained challenging as not all employees in the surrounding business parks have returned to their offices. An absence of sales events at the Expo also cut footfall and vibrancy at the mall. Rentals were mostly reverted in the -1.2% to +1.9% range with a handful of smaller leases reverted at -5%. FCT continues to offer lower first-year rents with steeper second- or third-year rental step-ups for tenants still struggling. Final-year rents for such leases are expected to be in line with market rents.

Outlook

Impact of Code of Conduct

Singapore’s latest Code of Conduct for the leasing of retail premises will regulate how landlords charge items such as utilities and energy, legal fees and point-of-sale terminal costs. A low-single-digit impact on earnings is expected for FCT if the Code is applied to all of its leases concurrently. The Code will apply to leases signed after 1 June 2021 but not retrospectively. Hence, the financial impact will be more gradual and would be offset should atrium leasing return.

Source: Phillip Capital Research - 27 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024