Fortress Minerals Ltd Continued Outperformance

traderhub8

Publish date: Mon, 26 Apr 2021, 09:48 AM

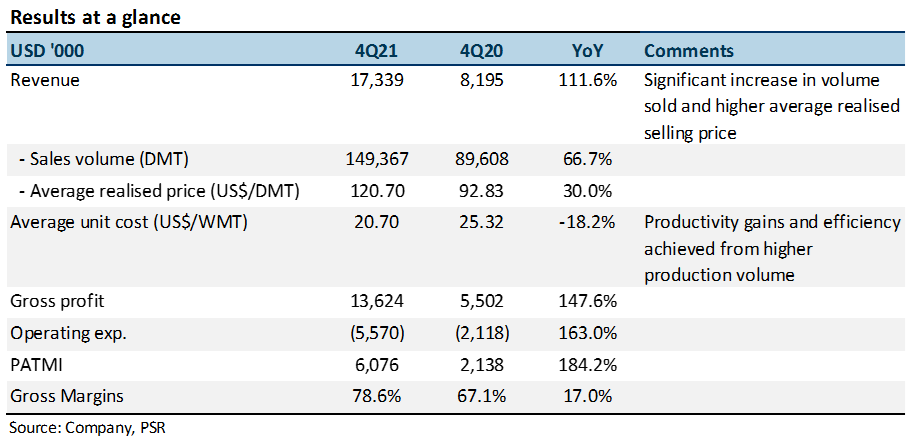

- 4QFY21 results beat, with FY21 revenue and PATMI at 122%/116% of our forecasts. Volume sales growth of 66.7% YoY in 4QFY21 exceeded our +12.8%. Gross margin of 78.6% and ASP of US$120.70/DMT also beat our forecasts of 74.3% and US$96.00/DMT.

- 4QFY21 PATMI tripled YoY to US$6mn from higher selling prices and an 18% decline in unit production costs.

- Maintain BUY with higher TP of S$0.64 from S$0.47 as we roll over our 11x P/E target to FY22e, still in line with industry average. Our FY22e PATMI has been raised by 27% to US$21.8mn as we increase our production forecast by 12% to 498,032 DMT. Iron ore prices are expected to remain elevated with a rebound in steel production and supply disruptions.

The Positives

+ Steady increase in volume. Iron ore concentrates sold increased 66.7% YoY by volume in 4QFY21 and 67.9% in FY21. This lifted revenue by 111.6% in 4QFY21 and 84.1% in FY21. QoQ, volume sold and revenue were higher by 60.2% and 68.3% respectively.

+ Spike in margins. Gross profits more than doubled from US$5.5mn in 4QFY20 to US$13.6mn in 4QFY21. Gross profit margins rose from 67.1% to 78.6%. This was achieved with higher realised ASPs of iron ore concentrates, which went from US$92.83/DMT in 4QFY20 to US$120.70/DMT in 4QFY21. Unit costs also decreased from US$25.32/WMT to US$20.70/WMT with the help of efficiency gains.

+ Operating cash flow turned positive. Operating cash flow turned from a negative US$11k in 4QFY20 to a positive US$2.7mn in 4QFY21. 4QFY21 FCF remained a negative US$4.2mn vs. -US$478k in 4QFY20 from a spike in capex. Full year, FCF increased to US$7.1mn from US$4.8mn in FY20.

The Negative

– Spike in capex. Capex jumped from US$390k in 4QFY20 to US$3.6mn in 4QFY21, as FML expanded its truck fleet and reinvested in its Bukit Besi mine for further exploration works.

Source: Phillip Capital Research - 26 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024