Keppel DC REIT Harvest Time

traderhub8

Publish date: Thu, 22 Apr 2021, 10:00 AM

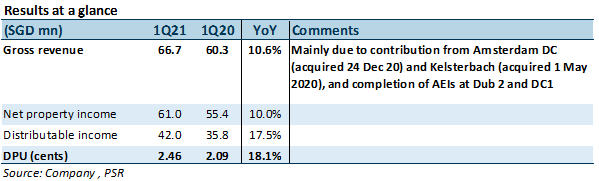

- 1Q21 DPU of 2.46 Scts, up 18.1% YoY, was in line, at 25.0% of our estimate.

- Earnings improved following acquisition of Amsterdam DC and completed AEIs at DC1 and KDC Dub 2.

- Maintain ACCUMULATE and DDM-based TP of S$3.20 (COE 5.75%). TP includes S$500mn of acquisition assumptions for FY21.

+ Positives

+ 1Q21 NPI and DPU grew 10.0% and 18.1% YoY respectively, led by Kelsterbach DC in Germany acquired on 1 May 2020 and Amsterdam DC acquired on 24 Dec 2020. There were also contributions from completed AEIs at DC1 and Dub 2. At DC1, KDC converted two floors from shell & core to fully-fitted space. At Dub 2, additional IT power was brought on upon full commitment by tenants.

+ Practical completion or Intellicentre 3; 20-year lease signed. Intellicentre 3 in Sydney Australia achieve practical completion in 1Q21. It is on track for completion in 1H21. KDC has signed a 20-year triple net master lease with Macquarie Data Centres for Intellicentre 2 and Intellicentre 3. This will commence upon completion of the development.

– Negative

– Gearing inched up QoQ from 36.2% to 37.2%. This followed debt drawn for AEI payments. As KDC values its properties on an annual basis, valuation uplift from its completed AEIs has not yet been reflected in its books. This implies gearing may be slightly overstated. Nonetheless, gearing still well under the 50% regulatory limit and is backed by KDC’s high interest coverage of 13.1x and high-quality tenants.

Outlook

Demand-supply gap to push up market rents. About 27.9% of its leases by GRI or 6.9% of NLA will expire in 2021. Most of the leases will be from Singapore and Malaysia colocation assets, which have shorter WALEs of 1.2-1.8 years. Singapore is KDC’s core market, accounting for 56% of its AUM. Given the moratorium on data centres in Singapore, there is a strong likelihood that market rents will be bid up in the coming two years, coinciding with its lease expiries. While KDC has not started engaging tenants in renewal negotiations, DCs’ tenant stickiness and limited alternatives imply potentially high retention rates for KDC.

Competition for assets compressing cap rates. KDC is still evaluating acquisitions. It was previously studying several piecemeal and portfolio acquisitions with cap rates of 5-7%. It now shares that cap rates have been compressed by 50-75bps YoY, with some deals coming in at sub-5% yields.

Source: Phillip Capital Research - 22 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024