Singapore Banking Monthly Extending Their Green Shoots

traderhub8

Publish date: Mon, 05 Apr 2021, 09:18 AM

- Current interest rates of 0.42% are 11bps higher than the start of the year.

- Loans fell 0.88% YoY in February but grew 0.46% MoM, the fourth consecutive month of growth.

- SGX’s SDAV was third-highest on record but down YoY alongside DDAV as there was an anomalous selloff during the COVID-19 outbreak last year.

- Maintain Overweight. Loans remain on path for recovery and interest rates are stable with a positive economic outlook. We continue to prefer OCBC (OCBC SP, BUY, TP: S$13.65) for its WM and insurance franchises.

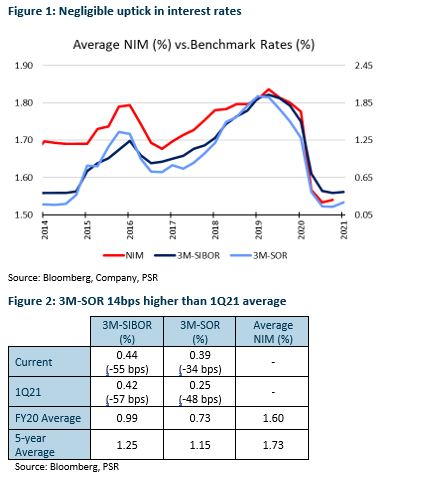

Interest rates ticked up in March

Interest rates edged higher for a second consecutive month to 0.42% in March. Year to March, they were up 11bps. Still, the rates were 53bps lower than their FY20 average. We continue to expect FY21e NIMs to come in at 1.45-1.55% for the three banks, lower than their 1.60% average in FY20.

Investment action

Maintain Overweight

Despite the run-up in their share prices in 1Q21, we continue to see upside for banks. They had traded above 1.4x P/B before in the past five years and are currently trading close to or below our P/B targets of 1.17-1.31x (Figure 10). Our targets are supported by improving ROEs as allowances ease off in FY21e.

The banks have also emerged from FY20 with stronger capital ratios of 13.9-15.2%. These are higher than their ideal operating range of 12.5-13.5%, which banks hope to achieve so as to not negatively impact ROEs from holding excess capital. This should support a resumption of pre-COVID dividend payouts once the MAS lifts restrictions.

For sector exposure, we continue to prefer OCBC. OCBC is expected to book faster earnings growth from its wealth-management and insurance franchises as market conditions improve.

Source: Phillip Capital Research - 5 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024