YOMA Strategic Holdings Ltd - Collateral Damage

traderhub8

Publish date: Wed, 10 Mar 2021, 10:22 AM

- 2Q21 to be washed out by political instability and Covid-19. Spillover into 3Q21 likely.

- Myanmar’s political regression and ongoing violence to thwart Yoma’s growth prospects.

- Downgrade to NEUTRAL from BUY with a revised TP of S$0.156, down from S$0.34. We change from SOTP to 0.45x P/B valuation, slightly above its average historical low in 2007-2010. This reflects the stock’s negative outlook over the next one year amid violence, strikes and business disruptions.

2Q21 likely to be washed out by political instability and Covid-19

Since the coup on 1 February, peaceful protests have swiftly escalated into violent protests. The military has opened fire on demonstrators and conducted overnight raids to arrest residents. As of date, more than 50 people have been killed, which is more deadly than the Saffron Revolution in 2007. The 2007 protests were triggered by a decision of the military government to remove price subsidies for fuel. The number of casualties in that crisis was estimated at 13-31.

The situation is also not yet as bad as 1988 when over 3,000 people were killed across Burma, as Myanmar was then known. Before the crisis, Burma had been ruled by the repressive and isolated regime of General Ne Win since 1962. The 8888 uprising was triggered by the announcement of withdrawal of newly-replaced currency notes, which wiped out citizens’ savings instantly.

Over the past month, state telecommunication services have been disabled intermittently. All major construction work has ceased. On 8 March 2021, Myanmar’s biggest trade unions began widespread strikes in their latest attempt to force the country’s generals to step down. At least 18 labour organisations representing industries such as construction, agriculture and manufacturing called on workers to stop work to restore Aung San Suu Kyi’s elected government to power. The impact has been felt at every level of the national infrastructure, with hospitals, ministry offices and banks all unable to operate. Major shopping centres have also been closed and factories are not operating.

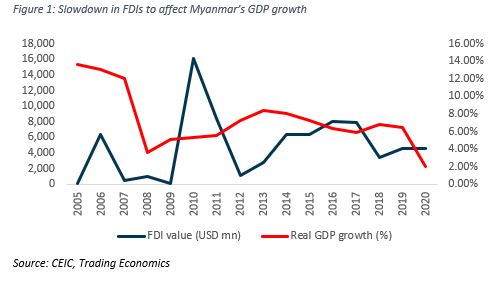

Apart from US sanctions against the top military brass, Britain has frozen the assets of a few military generals and imposed travel bans on them. Canada is imposing sanctions against nine military officials. The EU will press ahead with sanctions this month and withhold some development aid. Political instability is expected to damage investment sentiment and hurt economic growth in the country.

We are anticipating major business disruptions to affect at least a quarter of Yoma’s FY21 revenue. There could be fewer Wave Money transactions as consumers conserve cash. F&B and Motors sales are also likely to be lacklustre. Given the pause in construction work, Yoma may not be able to recognise revenue from the completion of its property-development projects in the next 3-6 months. Yoma Land has US$45mn worth of revenue yet to be recognised from City Loft @ Star City, The Peninsula Residences and Star Villas.

Downgrade to Neutral with a revised TP of S$0.156, from S$0.340. We change our valuation from SOTP to P/B, using its average historical price tanks during major conflicts, political upheavals and natural disasters. Before the 2010 general election, Myanmar was under military rule. Given that the current state of emergency in Myanmar is expected to last a year and violent protests are not likely to cease in the near term, we believe a P/B discount of the similar magnitude as in 2007-2010 is warranted. Excluding 2007 when Yoma traded at its low of 1.45x P/B, its historical 2007-2010 had averaged lows of 0.41x P/B.

Our 0.45x P/B TP is slightly above its 2007-2010 low of 0.41x, given that Yoma is now a bigger conglomerate with more resilient businesses such as Financial Services. Our FY21e book value is US$0.257. We believe Ayala will proceed with its second tranche US$46mn investment in Yoma. At US$/S$ rates of 1.35, our valuation translates to a TP of S$0.156.

Re-rating catalysts could come from significant improvements in the political situation, a sanctions uplift and a return to normalcy.

Source: Phillip Capital Research - 10 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024