Singapore Banking Monthly Daybreak

traderhub8

Publish date: Mon, 08 Mar 2021, 12:18 PM

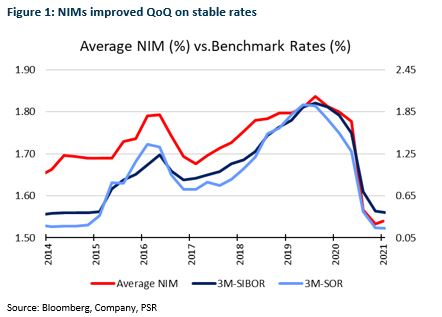

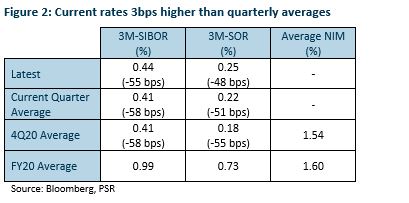

- February interest rates ticked up from January

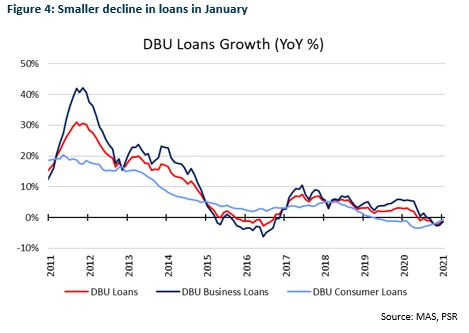

- Loans grew 0.72% MoM in January for their third consecutive month of growth.

- Credit outlook improved as loans under moratorium fell.

- SGX’s capital-market SDAV/DDAV dropped in February due to Lunar New Year holidays.

- Upgrade sector to OVERWEIGHT from NEUTRAL. Banks to benefit from economic recovery via higher fees and commissions and lower credit costs. Top pick is OCBC (OCBC SP, BUY, TP S$13.65) as we expect greater improvements from its wealth-management and insurance franchises.

While tough pricing competition may weigh on margins, loans are expected to grow healthily in FY21 as we gradually exit the pandemic. Improved consumer and business confidence should support loan growth of mid-to-high single digit of 5-8%, in our estimation.

Improved credit outlook

GPs averaged 15bps in 4Q20, down from 31bps in FY20 (Figure 6). The drop signalled banks’ confidence that credit costs could normalise in FY21.

A better credit outlook is supported by a fall in loans under government relief programmes to 1-2% of loan books from 5% previously. GP reserves, which grew by 45-55% in FY20, should provide sufficient buffer for any asset-quality deterioration in FY21e.

Source: Phillip Capital Research - 8 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024