Hyphens Pharma International Ltd Not to be Written Off

traderhub8

Publish date: Fri, 05 Mar 2021, 12:17 PM

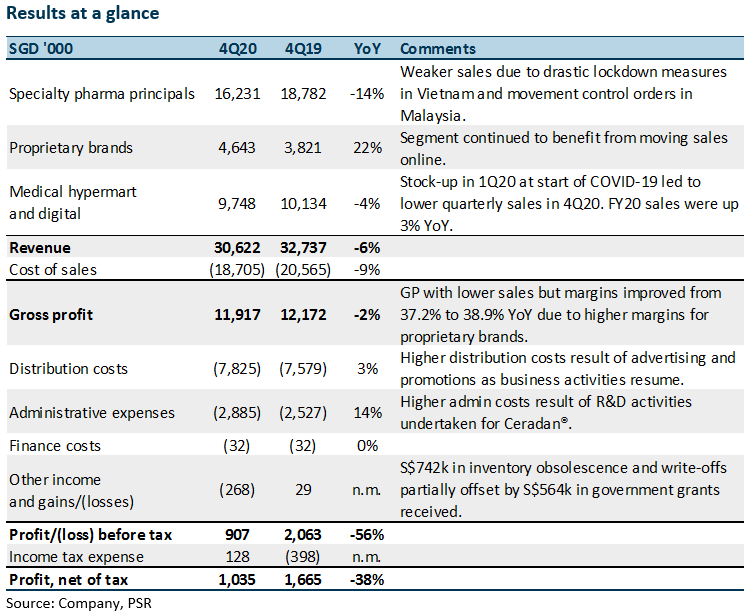

- FY20 earnings of S$6.2mn were 7% below our estimate due to higher distribution and administrative costs.

- Proprietary-brand revenue grew 22% to S$4.6mn in 4Q20 despite drag from specialty pharma as a result of COVID-19 disruptions in Vietnam and Malaysia.

- Prudent inventory write-offs in 4Q20 not expected to recur.

- Operating expenses higher due to promotions, advertising and R&D expenses.

- Continued to sow seeds of growth with signing of distribution agreement for Fairence® in South Korea and successful application of e-pharmacy licence in Singapore.

Maintain ACCUMULATE. DCF TP (WACC 7.2%) drops to S$0.345 from S$0.365 as we roll forward our valuation. Higher incremental CAPEX in FY21 will weigh down short-term cash flows, but business environment expected to normalise in FY21

The Positive

+ Strong proprietary-brand sales

Proprietary-brand revenue grew 22% YoY with growth squared on Ceradan® Ocean Health®. Proprietary brands commanded higher margins and helped to lift GP margins to 38.9% from 37.2% a year ago. As Hyphens continued to expand its proprietary-brand portfolio, we expect long-term margins to improve on a better revenue mix

The Negatives

– Weak specialty pharma sales

Sales of specialty pharma slid 14% YoY to S$16.2mn from S$18.8mn as movement controls restricted sales in Vietnam and Malaysia. While the weakness in Malaysia is expected to spill into the first two quarters of 2021, the rollout of vaccination programmes should help sales recover.

– Inventory obsolescence

Hyphens continued to provide for inventory obsolescence on PPE, diagnostic test kits and specialty pharma. Plans to offload inventory did not fully materialise, resulting in prudent write-offs which are not expected to recur in subsequent quarters.

– Higher operating expenses

Distribution costs increased 3% YoY in 4Q20 as the company ramped up advertising and promotions. Administrative expenses also increased 14% YoY to S$2.9mn with higher R&D spending on proprietary brands. Costs are expected to trend up in the near term, in keeping with Hyphen’s entry into new markets and new products.

Outlook

The company was awarded Singapore’s first e-pharmacy licence by the Health Sciences Authority in January. The licence will enable Hyphens to build its B2B network as telemedicine continues to take root in Singapore.

Hyphens has also appointed South Korea-based JS Pharma as the exclusive distributor of its pigment lightening cream Fairence® in Korea. Interest to distribute Fairence® in the competitive Korean skincare industry is recognition of the effectiveness of the product and could potentially lead to more product introduction to the Korean market.

Hyphens continues to plant seeds of growth with an expanded product portfolio in an expanded geography. This is expected to support its long-term profitability.

Source: Phillip Capital Research - 5 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024