Q & M Dental Group Ltd Major Turnaround Underway

traderhub8

Publish date: Thu, 04 Mar 2021, 10:59 AM

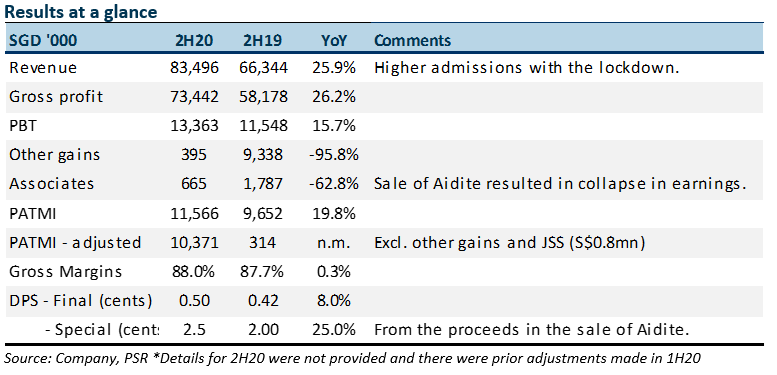

- Revenue was in line at 102% of our forecast. PATMI beat at 108% on higher-than-expected margins.

- Major turnaround in profitability in 2H20. PATMI jumped to S$10.3mn from S$0.3mn a year ago. Special DPS of 2.5 cents declared.

- Intends to open at least 30 clinics p.a. in the next 10 years. This represents 25% growth in FY21 from current 118 clinics: Singapore (83), Malaysia (34) and China (1). Also doubling lab capacity for COVID-19 PCR tests.

- Maintain BUY. Expect record operating earnings in FY21 from higher patient visits to clinics, aggressive clinic expansion and maiden contributions from the sale of kits and COVID-19 PCR lab tests. We raise FY21e PATMI by 6% to S$27.8mn. Accordingly, our FY21e target price rises to S$0.73 from S$0.70. This remains based on 20x FY21e PE, a 50% discount to historical normalised PE. We added S$0.03 from the market value of listed associate, Aoxin (S$0.186, Not Rated), at a 20% discount.

The Positive

+ Surge in revenue. 2H20 revenue leapt 26% YoY to S$83mn. Patient admissions rose as border closures and work from home gave households in Singapore more time to seek regular check-ups and opt for elective procedures. Border closures also raised the availability and capacity of dentists to undertake procedures.

+ Healthier balance sheet. Net debt declined from S$75mn in FY19 to S$20mn in FY20. FCF generated was S$19mn. Another S$47mn was collected from the disposal of Aidite in 1H20. Q & M announced a special DPS of 2.5 cents to return S$19mn to shareholders from the proceeds of its sale of Aidite. In January 2021, its final 12.2% stake in Aidite was sold for net proceeds of S$17mn and a net gain of S$5mn. Special dividends could thus be repeated in FY21. We have not incorporated its most recent disposal in our FY21e numbers.

+ Maiden revenue from PCR. Maiden revenue of S$2.2mn came from the sale of kits and laboratory tests of COVID-19 PCR. Gross margins were 63%. Approval of the laboratory, under 51% subsidiary Acumen Diagnostics, was only secured in September 2020. We model in revenue of S$33mn from PCR tests for FY21e.

The Negative

– Pandemic impact on Malaysia and new openings. Revenue in Malaysia was flat at around S$9.8mn. Lockdowns and movement restrictions hurt patient volumes. New clinics opened in FY20 also fell to six from 21 in FY19.

Outlook

We expect record core earnings in FY21e. Enablers would be:

- Increased patient admissions and higher availability of dentists for procedures.

- 25 new clinics modelled in for FY21e: 15 in Singapore and 10 in Malaysia. Q &M has boosted resources to recruit dentists.

- Maiden revenue contributions from the sale of kits and COVID-19 PCR lab tests.

The company will be providing quarterly updates from FY21 onwards.

Source: Phillip Capital Research - 4 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024