BHG RETAIL REIT Occupancy Recovering

traderhub8

Publish date: Thu, 04 Mar 2021, 10:58 AM

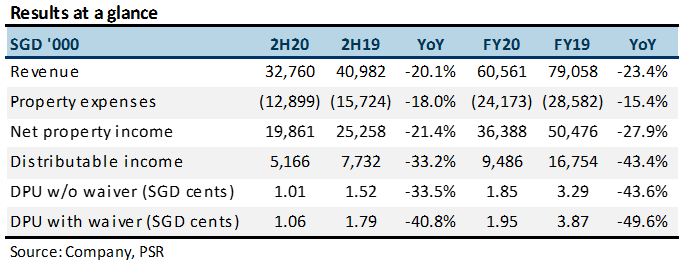

- FY20 DPU was down 50% YoY to 1.95 Singapore cents, in line with consensus expectations.

- Committed occupancy improved to 93.5% as three portfolio assets recovered.

- Portfolio valuation increased in tandem with the RMB’s strengthening against S$, partly offset by fair-value devaluation of some investment properties.

The Positives

+ Committed occupancy recovered to 93.5% from 91.5% in 3QFY20. Occupancy recovered in three malls: Chengdu Konggang, Hefei Mengchenglu and Hefei Changjiangxilu. Chengdu Konggang improved the most, from 90.8% in 3QFY20 to 96.4% in 4QFY20. Continued AEI at different assets, including the introduction of fresh brands and concepts and reinvention of retail and F&B offerings led to a recovery in leasing demand.

+ Portfolio valuation increased 3.8% YoY to S$943.2mn. YoY, the carrying value of investment properties increased, on the back of a stronger RMB. This was partially offset by fair-value devaluation for all investment properties except the Beijing Wanliu mall. Fair-value devaluations of 0-3% largely reflected potential occupancy changes and lower rents amid the pandemic.

+ Recovery from Covid-19. The REIT temporarily closed its two malls in Hefei in 1QFY20, from 7 February 2020 to 10 March 2020. Daily operating hours for its remaining malls were also reduced by about two hours. Financials have since been recovering. HoH, gross revenue, NPI and DPU increased 17.8%, 20.2% and 19.1% respectively in 2HFY20.

The Negative

– Reduction in DPU. NPI declined 27.9% YoY in FY20 because of lower gross revenue. The latter was caused by rental rebates and lease restructuring for eligible tenants to tide them through Covid-19. Partial compensation came from cost-cutting, which lowered property expenses. Apart from the lower NPI, an increase in units entitled to distribution as a result of a reduction in the sponsor’s distribution waiver and payment of property-management fees in units also pulled DPU down from 3.87 to 1.95 Singapore cents YoY.

Source: Phillip Capital Research - 4 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024