Dasin Retail Trust Recovering But Leasing Caution

traderhub8

Publish date: Thu, 04 Mar 2021, 10:58 AM

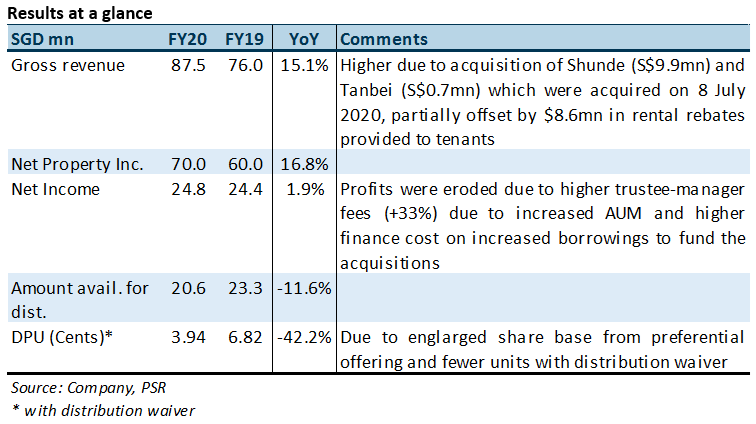

- FY20 DPU of 3.94 Sts (-42.2% YoY) missed, at 82% of our estimate. This was because S$8.6mn or 10% of revenue in rental waivers were given to tenants in FY20.

- Portfolio occupancy increased from 96.1% to 96.5% QoQ. 4Q20 cash rents recovered to 95.8% of 4Q19 levels.

- Downgrade from Buy to ACCUMULATE. We lower our rental-growth assumptions to factor in weaker leasing. FY21e-24e DPUs cut by 13-16%. This lowers our DDM-based TP (COE 8.12%) from S$0.90 to S$0.82

The Positives

+ 4Q20 cash rents recovered to 95.8% of 4Q19 levels. As 24% of leases by GRI are tied to tenants’ turnover, cash rents recovered QoQ (Figure 1) in tandem with retail sales. 4Q20 same-store cash revenue, based on straight-line income recognition, recovered to 95.8% of 4Q19 levels. We think variable-rate leases have largely been de-risked as retail sales returned to YoY growth in 4Q20.

+ Portfolio occupancy increased from 96.1% to 96.5% QoQ. This was still 3.3ppts below 4Q19 occupancy of 98.8%. Renewals formed the bulk of the leases signed. Rental reversions were 46% on 13% or 9,085 sqm of space at Ocean Metro Mall. The mall had been enhanced from January to December 2020. The space returned was previously occupied by a furnishing tenant and was carved up and leased to tenants purveying goods and services for children. Portfolio rental reversions were not disclosed. We believe they could have been negative, mirroring China’s single-digit retail contraction. Conducive terms were extended to some new leases signed during the year, such as waivers of rental step-up in the first year.

The Negative

– Portfolio valuation dipped 4% YoY. The most notable decline was Dasin E-Colour’s 8.1% fall, likely as occupancy slipped from 96.3% to 86.0% YoY. Dasin E-Colour was affected by the closure of nearby universities – the mall’s primary catchment – during lockdowns. The mall is the smallest in Dasin’s portfolio, accounting for 2.8% of its FY20 revenue. Valuations of two newly-acquired malls, Shunde and Tanbei Metro Malls, also dropped 1.2% and 0.9% respectively. Valuations for the rest of Dasin’s malls were down 4.2-5.1%.

Source: Phillip Capital Research - 4 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024