CapitaLand Limited Good Fight in a Tough Year

traderhub8

Publish date: Tue, 02 Mar 2021, 09:24 AM

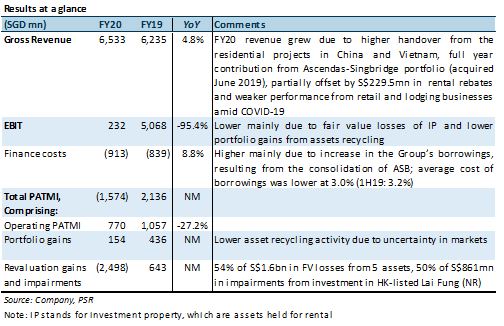

- FY20 net loss per share of 30.5 Scts was worse than our profit estimate of 30 Scts. DPS of 9 Scts, down 25% YoY, formed only 75% of our estimate

- Net loss was S$1.57mn. Operating PATMI of S$770mn was wiped out by S$1.6bn in revaluation losses and S$861mn in impairment losses. But in spite of the pandemic, FY20 residential and industrial portfolio beat FY19 performance.

- Maintain BUY. TP lower at S$3.75 from S$3.82, still based on a 20% discount to RNAV. Development and investment property book values are lower as we roll forward our estimates. CAPL remains our top pick in the sector as high recurring income and a pivot to New Economy assets are expected to keep earnings stable and future-proof its portfolio. FY21e EPS lowered by 15% from 40 Scts to 34 Scts.

The Positives

+ Strong residential sales. Strong demand in China and higher ASPs lifted sales to RMB14.8bn, 12.1% higher YoY. This was despite a 3.2% decline in units sold: 5,100 in FY20 vs 5,268 in FY19. About RMB10.5bn of sales will be recognised from 2021 onwards. Units sold in Singapore were up by 5.3x HoH in 2H20 on the back of strong demand. This is expected to continue, backed by consumer confidence for residential products. Full year, a 10-week closure of showflats and an absence of new launches in Singapore at the height of the pandemic brought units sold to 220, 56% lower than FY19’s 501.

+ Record 14,200 keys signed. Despite an arduous year for the hospitality sector, CAPL’s predominantly long-stay serviced-residence platform signed a record 14,200 keys. This brought its total signed to 122,607 keys. Of these, 52,884 or 43% have yet to commence operations. In FY20, 3,900 units in 25 new properties came online, adding to fee revenue. Another 17,000 keys will become operational in FY21.

+ Sustained retail recovery, high occupancy. Shopper traffic and tenant sales in China and Singapore have slowly inched back to pre-COVID levels. Committed occupancy for retail, office and industrial was resilient at above 88.2%/85.0%/87.6% (Figs 1-3).

+ Active capital-recycling. Although markets were frozen for the most part of FY20, the group managed to hit its S$3bn divestment target. CAPL and its listed REITs divested S$3.04bn of assets (FY19: S$5.9bn), realising portfolio gains of S$154mn (FY19: S$436mn).

The Negative

– Revaluation and impairment losses. A S$1.6bn downward fair-value adjustment represented 4.7% of the Group’s investment-property value. Five assets made up 55% of the revaluation losses. Newer assets such as CapitaMall Westgate, RCCQ and Jewel Changi Airport were opened between 2017 and 2019 and were still ramping up operations. As such, they were more affected by COVID-19 disruptions. Tianjin International Trade Centre and Ion Orchard suffered from a lack of MICE and tourist spending due to border closures. About 50% of the impairment losses were attributed to CAPL’s 20% stake in HK-listed Lai Fung (1125 HK, Not Rated). This investment was marked to market and written down as Lai Fung’s strategic direction has diverged from CAPL. CAPL is looking for buyers for its stake in this property company.

Source: Phillip Capital Research - 2 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024