United Overseas Bank Limited - Sun Is Coming Out Again

traderhub8

Publish date: Tue, 02 Mar 2021, 09:24 AM

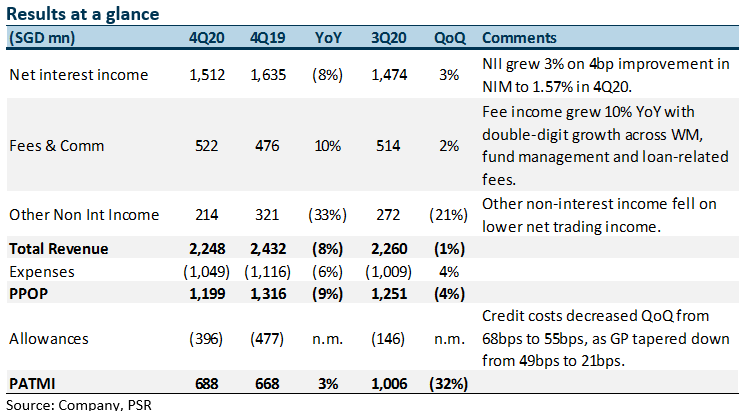

- FY20 earnings of S$2.94bn met, at 2% of our estimate.

- NIM recovered QoQ to 1.57% to boost NII by 3%.

- Fees and commissions grew QoQ and YoY, though trading income was lower.

- Commitment to 50% payouts implies FY21e DPS of S$1.20 on strong CET-1 of 14.7%.

- Upgrade to ACCUMULATE from NEUTRAL with higher GGM TP of S$28.70 from S$21.10. We raise FY21e earnings by 22% to reflect double-digit growth in fees and commissions as well as tapered credit costs. We continue to peg TP at 1.17x P/BV but lower COE from 8.9% to 8.5% on lower risks. We also forecast a higher 6% ROE from better profitability.

The Positives

+ Resilient interest margins

NIM improved 4bps QoQ from 1.53% to 1.57%, contributing to a 3% increase in NII. Better management of liquidity and funding costs lifted NIM. NIM is expected to be stable as the bank targets loan growth to improve NII. Room for further funding-costs adjustments and improving LDR can help manage NIM compression pressures.

+ Robust growth in fees and commissions

Fee and commission income grew 10% YoY and 2% QoQ. Fund-management and wealth-management fees improved, particularly as UOB’s wealth-management franchise gained traction. Credit-card fees also grew by double digits for a second consecutive quarter to S$109mn, mirroring a recovery in consumer spending.

The Negatives

– Weak trading income

Volatile market conditions caused its trading income to decline. This reduced its non-interest income by 33% YoY and 21% QoQ. The QoQ decline was also due to more investment gains booked during the previous quarter. As volatility subsides, we expect trading income to stabilise in FY21e.

Source: Phillip Capital Research - 2 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024