KOUFU GROUP LIMITED Recovering, Though Slower Than Expected

traderhub8

Publish date: Mon, 01 Mar 2021, 09:26 AM

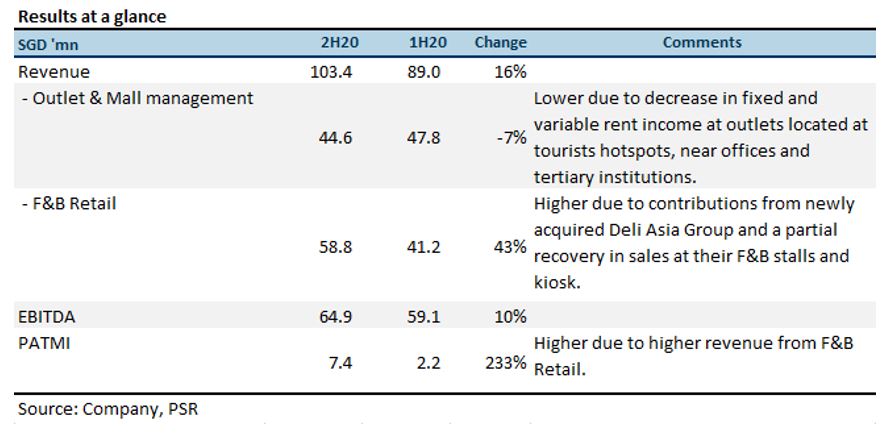

- FY20 revenue came in at 99% of our estimates as consumption recovers slower than expected.

- Expected TOP of Integrated Facility (IF) delayed again, to 1Q21.

- 30% improvement in footfall in Singapore and Macau in 2H20.

- We are downgrading our BUY rating to ACCUMULATE with a lower target price of S$0.68 (previously S$0.77) as we benchmark our valuation to 18.5x FY21e, the average of their peers. We lowered our revenue estimates for FY21e and FY22e by 6.5% and 6.2% respectively and consequently PATMI estimates for FY21e and FY22e is reduced by 11.5% and 10.4% respectively as the consumption recovery is taking longer to pan out.

Positives

+ Marked improvement in footfalls in Singapore and Macau. 2H20 footfalls at outlets and malls recovered slightly as the economy reopened. We estimate that food courts located near offices recovered by 30% HoH in 2H20 as restrictions eased. Footfalls and demand in food courts and coffee shops in the heartlands were stable. Footfalls in Macau recovered by 30% in 2H20 even though this was still about 60% below pre-COVID levels.

+ Marked recovery for F&B Retail in 2H20. F&B Retail was its biggest drag in 1H20 as this segment does not have fixed rental income from stall tenants, unlike Outlet & Mall Management. A resumption of operations after the circuit breaker in this segment led to an uptick in takings. Revenue in 2H20 was up 43% HoH. The uplift was also helped by contributions from Deli Asia Group, acquired on 30 July 2020.

+ New store openings resumed in 2H20; more to come in 2021. The Group opened one new food court, two R&B Tea kiosks and two Dough Culture kiosks in 2H20. The two new Dough Culture kiosks brought total outlets to nine since its acquisition of Deli Asia Group last year. The Group now expects to hit its target of 20 Dough Culture kiosks in three years instead of five under its previous plan.

For 2021, the Group has secured and will open three new food courts at Sun Plaza, Woodlands Height (Koufu’s new HQ) and NTU in the second quarter of 2021.

Koufu opened a third food court in Macau at Nova City in 3Q20. The current occupancy for food stalls remains at 100% even though business operations remain at reduced levels (~40% pre COVID-19) given lower number of visitors and travellers. Mainland China and Macau have slowly reopened its borders, along with the lifting of the 14-day quarantine policy on the Macau-Guangdong borders in July 2020.

Negatives

– Consumption recovery slower than expected. With work from home being the default arrangement, consumption recovery at food courts near offices, downtown and in tertiary institutions remains slow. Footfalls at Rasapura Masters and Elemen Restaurant at Marina Bay Sands remain low as travel restrictions are still in place. We estimate that footfalls and takings at both will remain at 45% of pre-COVID-We19 levels this year.

– Expected TOP of IF delayed again, to 1Q21. The progress of the construction of the IF has been delayed due to the COVID-19 measures introduced in both Singapore and Malaysia (where certain materials have been sourced from). The Group expects further delay in the TOP, to be in the first quarter of 2021, at the earliest, as the commencement of construction has been delayed. Management now expect to move into the IF in the second quarter of 2021 and to commence operation in the second quarter of 2021. The Group will be occupying 75% of the total gross floor area while the balance of 25% has been full tenanted out.

In light of the slower than expected consumption recovery, we lowered our revenue estimates for FY21e and FY22e by 6.5% and 6.2% respectively. Consequently, profit for FY21e and FY22e is reduced by 11.5% and 10.4% respectively from negative operating leverage and the delay in completion of the IF.

Update on Deli Asia acquisition

Koufu completed its acquisition of Deli Asia on 30 July 2020. The acquisition is expected to fast-track its revenue diversification and expansion to complementary dim-sum snacks, fried foods and dough products. Deli Asia will give it access to new markets such as the supply of frozen and partial fried food products to third-party businesses, including supermarkets and overseas markets.

Since its acquisition, two new kiosks have been opened, in 2H20. Another three are in the pipeline this year. Management now expects to hit its target of 20 Dough Culture kiosks in three years instead of five. We expect Deli Asia to contribute about S$2.7mn and S$3.2mn in profits in FY21e and FY22e respectively.

Cost-savings expected from move into integrated facility. The Group will move the manufacturing of Deli Asia’s food products to its new integrated facility when ready. This will save it rental costs from the two facilities that Deli Asia currently operates in.

Outlook

We continue to remain positive on the Group’s outlook post circuit breaker. We believe the recovery in consumption post circuit breaker will continue to improve footfalls and revenue of the food courts and coffee shops in 2021. We expect the completion of the Group’s new IF in 1Q21 to yield cost savings and provide an additional revenue source from the rental of the balance 25% space. Koufu has proposed a final dividend of 0.7 cents per share for 2H20, bringing FY20’s payout ratio to 67% of earnings. The Group is currently in the midst of sourcing for buyers for their two existing central kitchens, we see the announcement of a sale of their existing central kitchens as a catalyst for the Group.

Source: Phillip Capital Research - 1 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024