PropNex Ltd 33% ROE, 6.8% Dividend Yield

traderhub8

Publish date: Mon, 01 Mar 2021, 09:25 AM

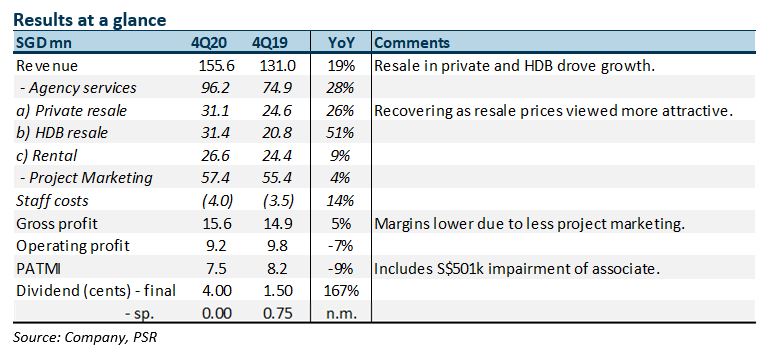

- 4Q20 results beat, with FY20 revenue and PATMI at 108%/108% of our forecasts. Recovery in resale transactions was stronger than expected.

- Revenue grew 19% YoY to S$155mn on a 51% jump in HDB resales and 26% increase in private resales. PATMI declined 9% YoY to S$7.5mn due to associate impairment and lower margins.

- Net cash of S$105.8mn (FY19: S$81.6m) from S$42mn of operating cash flows in FY20. Final DPS was up more than 1.5x to 4 cents.

- Maintain BUY with a higher DCF TP (WACC 9.8%) of S$1.00, from S$0.85. We raised our FY21e PATMI by 11% to S$30.8mn. Revenue estimates increased as we expect a healthier property market in 2021, led by resales. Yields of 6.8% backed by S$105mn net cash, 33% ROEs and an estimated 53% share of residential property transactions.

The Positives

+ Resale revenue recovered sharply. HDB and private residential resales rose a combined 37% YoY to S$62.5mn. HDB volumes were helped by government grants, delays in BTO units and a surge in units reaching their minimum occupation period. HDB resale revenue touched a record high. Private residential resales were bouyed by their large price discounts to newly launched units.

+ Even more cash. FY20 operating cash flows were S$42mn vs. meagre capex of S$0.5mn. Large cash inflows bulked up its net cash from S$81mn to S$105mn. Full-year dividend jumped 57% to 5.5 cents. A S$20.3mn payout is comfortably supported by operating cash flows and cash hoard on its balance sheet.

The Negative

– Impairment of associate. There was an impairment of S$0.5mn for associate Soreal Prop and S$0.16mn for trade receivables in 4Q20.

Outlook

We expect another year of growth led by the resale market.

HDB resales. HDB resales have been stoked by enhanced CPF government grants for HDB purchases in late 2019 and a rise in the number of HDB units eligible for resale on the expiry of their minimum occupation period. An estimated 25,230 HDB flats will cross the minimum occupation period in 2021, higher than the 24,163 in 2020.

Private resales. Industry resale transactions advanced almost 20% in 2020 to 10,729, recovering from the dismal 8,949 transactions in 2019. During the peak years in 2017/18, transactions averaged 13,500. Improving sentiment and resale flats’ widening price differential with new launches supported their demand.

Private new homes. Volumes are expected to dwindle with a slowdown in new launches. But prices are expected to creep up on the back of improving demand and depleting unsold inventories. Inventories are tight especially in the Rest of Core and Outside Core regions.

Cooling measures. Investors were lately spooked by the prospect of new cooling measures from the authorities. The steepness of any rise in the property price index will be the obvious trigger. Before the last cooling measures in July 2018, the index had scaled 9.1% in a span of 12 months, over 2Q17-2Q18. In comparison, it is only up 2.2% in the past 12 months or 4Q19-4Q20. It is also only up 5.0% since the last cooling measures in 3Q18. To climb 9% over 12 months, the index would need to add 6% in the coming six months to 166 points.

Maintain BUY with higher TP of S$1.00, up from S$0.85

Our FY21e PATMI has been raised by 11% to S$30.8mn. Our FY21e revenue estimates was raised by 9%. We also lowered our WACC from 11% to 9.8% on account of a lower beta observed. An even stronger balance sheet, higher cash flows and reduced earnings volatility are reasons for the lower beta.

Source: Phillip Capital Research - 1 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024