IREIT GLOBAL Another Year of Resilience

traderhub8

Publish date: Mon, 01 Mar 2021, 09:25 AM

- FY20 NPI and DPU at 102%/103% of our forecasts, in line. Rental collection exceeded 99%.

- FY21 lease breaks/expiries minimal at 3.7%/3.3%. Portfolio occupancy remained high at 95.8%. Portfolio valuation increased by 1.2% with high occupancies anchored by blue-chip tenants in German portfolio.

- Maintain ACCUMULATE with raised DDM TP (7.85% discount rate) of S$0.70, from S$0.68. Our TP implies yields of 7.3% and total prospective returns of 14.2%. FY21e DPU has been raised by 7% for better operational performance.

The Positives

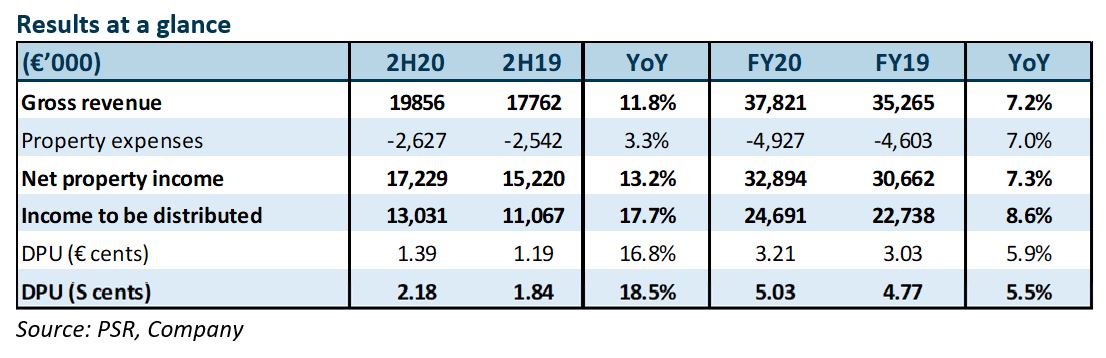

+ FY20 better than expected, rental collection high. Gross revenue and NPI in FY20 were up 7.2% and 7.3% YoY respectively, following consolidation of its Spanish properties after their acquisition on 22 October 2020. FY20 NPI, distributable income and DPU were slightly better than expected, at 102%/104%/103% of forecasts. Rental collection exceeded 99%. Outstanding were rental rebates and deferrals granted to a few tenants.

+ High portfolio occupancy, minimal FY21 expiries, stable portfolio valuation. Portfolio occupancy remained high at 95.8%, though down 0.5% from a quarter ago as two tenants exercised their break option at Delta Nova IV. FY21 lease breaks/expiries are minimal at 3.7%/3.3% by gross rental income (GRI). Despite Covid-19, portfolio valuation increased by 1.2%. High occupancy of 99.6% anchored by blue-chip tenants led to a 2.3% valuation increase for its German portfolio. This constituted 82% of its total portfolio valuation. Valuation of its Spanish portfolio, in contrast, was down 3.5% due to longer vacancy assumptions.

The Negative

– Chunky FY22 expiries, 5% likely de-risked. About 32.5%/24.6% of leases by GRI will be due for lease breaks/expiries in FY22. About 5% of the lease breaks are attributable to DRB* for its lease at Berlin Campus due in June 2022. DRB is likely to keep its lease as rental rates are attractive. It recently leased a new building adjacent to Berlin Campus for more than double Berlin Campus’ passing rents. Other properties up for lease breaks/expiries are IREIT’s Darmstadt and Munster Campus, leased by Deutsche Telekom (DT). IREIT has started to engage DT for early renewals.

*DRB – Deutsche Rentenversicherung Bund

Outlook

With lockdown extensions and strict social-distancing restrictions in several economies, a sustainable recovery in the European real estate remains largely uncertain. Though work-from-home is taking roots, it remains too early to predict the direction of office demand as work arrangements are still in a flux. To date, physical occupancies in its portfolio amount to 30%.

After its rights issue in 4Q20, aggregate leverage improved to 34.8% in FY20 from 39.3% a year ago. Weighted average debt to maturity was 5.3 years, with all borrowings due to mature only in 2026. This provides IREIT with the flexibility to pursue M&A growth opportunities. It is looking at office, retail and logistics assets in Europe, particularly in countries where Tikehau Capital has a foothold such as France, Italy and the Netherlands.

To provide more options to its unitholders, IREIT is exploring the possibility of implementing dual-currency (€/S$) trading. Although its S$ trading liquidity may be compromised, we believe dual-currency trading will help to attract European investors looking for exposure to a pure Western Europe office portfolio. IREIT is also considering changing its distribution currency from S$ to its functional currency, €. If implemented, it will not need to hedge future distributions. This is more efficient, in our view, as IREIT can focus purely on operational metrics.

Maintain ACCUMULATE with raised TP of S$0.70. FY21e DPU has been raised by 7% for better operational performances. Current price implies dividend yields of 7.3% and total prospective returns of 14.2%.

Source: Phillip Capital Research - 1 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024