Sheng Siong Group Ltd – Demand Still Above Trend

traderhub8

Publish date: Fri, 26 Feb 2021, 08:52 AM

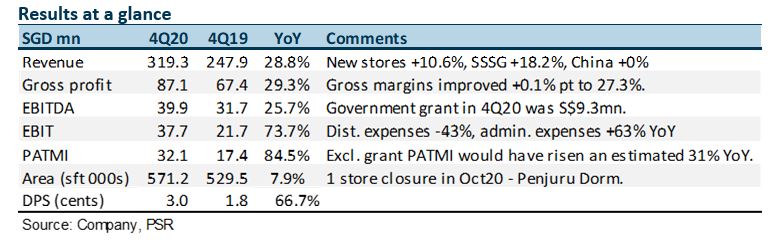

- 4Q20 revenue and earnings were within expectations, with full-year at 102%/101% of forecasts, excluding government grant. Final dividend jumped 67% to 3 cents per share.

- Revenue grew 28% YoY to S$319mn despite a gradual return of social and outdoor activities. Same-store sales growth in 4Q20 was 18%, 10-fold higher than 1.8% in

- FY21 earnings could be weaker following last year’s record sales triggered by pantry-loading and dine-home demand. We have modelled a 13% drop in revenue per sq ft for FY21e. Still, revenue should be 10% higher than pre-COVID levels. Expect grocery demand to be supported by dining at home and more households present in the country with international borders largely shut.

- FY21e PATMI and target price of S$1.71 Remains based on 25x PE, its 5-year historical average. Nevertheless, we raise the stock to ACCUMULATE from NEUTRAL as demand is still above trend.

The Positives

+ Healthy revenue despite re-opening. Revenue in 4Q20 was supported by same-store sales, which grew 10-fold vs. 4Q19’s 1.8% rise. New stores added another 10.6% points to growth.

+ Record cash flows and dividend hike. Net cash as at end-December ballooned to S$224mn from S$76mn in 4Q19. In FY20, SSG generated S$257mn of FCF, up from S$64mn in FY19. Final DPS was raised by 67% to 3 cents. Full-year dividend rose 83% to 6.5 cents for a payout of 70.5%.

The Negative

– Fewer store openings in 2021. Tendering of new stores by HDB has been temporarily suspended. There was only one tender for two HDB shops in 2020. There remains a pipeline of 20 stores to be awarded over the next 2-3 years but the timeline is unclear. The store in the Penjuru dorm stopped operations in March 2020 due to the pandemic. It was permanently closed in October 2020.

– Spike in administrative expenses. Administrative expenses jumped 63% YoY to S$57mn due to a S$12.8mn rise in staff costs for staff bonuses and additional headcount.

Outlook

FY20 revenue per sq ft was S$2,423. We are estimating S$2,100 for FY21e. This would still be 10% higher than pre-COVID’s S$1,916 in 2019. The higher revenue reflects the current trend of consumption and cooking at home. In addition, with international borders largely closed, the number of households in Singapore should remain higher than prior years. There is little clarity on whether home dining will sustain beyond FY22, after COVID. We have conservatively modelled weaker sales for FY22e. Our FY21e earnings are unchanged.

Upgrade to ACCUMULATE with unchanged TP of S$1.71

SSG’s investment merits remain its impressive 26% ROEs, dividend yields of 3.2% and net cash of S$224mn.

Source: Phillip Capital Research - 26 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024