StarHub Limited Cost-control Saves the Day

traderhub8

Publish date: Mon, 22 Feb 2021, 09:21 AM

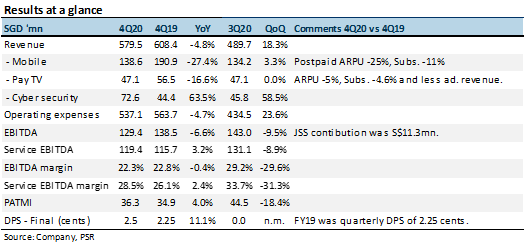

- 4Q20 revenue and EBITDA were within expectations, at 101%/97% of our FY20 forecasts.

- Revenue contracted 4.8% YoY to S$579mn, dragged down by a 27% fall in mobile revenue to S$138mn. Cybersecurity revenue was up 63% YoY to S$73mn.

- FY20 FCF jumped 77% to S$387mn, led by a S$130mn improvement in operating cash flow to S$576mn.

- Service revenue declined a massive S$176mn in FY20. To overcome this, StarHub cut staff costs (-S$39mn), marketing and acquisition expenses (-S$39mn) and cost of services (-S$42mn). Outlook remains muted with a loss of roaming revenue as international borders stay closed. Another pain point is renewed churns in pay-TV subscribers. Earnings resilience will depend on the telco’s ability to cut more costs. Revenue growth to come from cybersecurity, now its second-largest contributor. Maintain NEUTRAL and TP of S$1.24, the average of regional peers at 6x EV/EBITDA.

The Positives

+ Managing costs well. 4Q20 operating costs declined 4.7% YoY, in tandem with the dip in revenue. Cost of services such as pay-TV content, traffic and market/customer acquisitions were lower. EBITDA included JSS which was recognised as other income.

+ Healthy cash-flows. StarHub generated S$37mn of FCF in 4Q20 (4Q19: S$35.8mn). Operating cash flow was S$118mn. FY20 balance sheet was stronger with net debt of S$757mn vs. S$930mn in FY19.

The Negatives

– Roaming pain on ARPUs. Dragging down mobile revenue was a 25% YoY collapse in postpaid ARPU to S$30. This was due to a loss of roaming revenue from international travel restrictions. Another negative for mobile was a loss of 40,000 subscribers in 4Q20. In contrast, M1 and Singtel added 23,000 and 24,000 postpaid subscribers respectively in 4Q20.

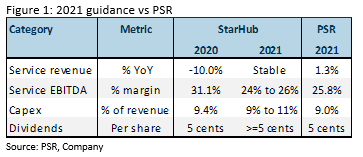

– Dividends slashed. Final FY20 DPS was 2.5 cents. This brought total FY20 DPS to five cents, a 44% drop from the nine cents in FY19 which was paid in quarterly DPS of 2.25 cents. Guidance for FY21 is DPS of at least five cents (Figure 1).

– Pay-TV subscribers resumed churns. After three quarters of stability, there was an exodus of 7,000 subscribers in 4Q20. This was more than double its 3,000 losses in the prior quarter. ARPU was stable QoQ at S$40 per month.

Outlook

Another quarter of roaming revenue loss* is expected in FY21. So are a decline in JSS support from the S$34mn in FY20 and sluggish pay-TV revenue. Cybersecurity will be its silver lining but profitability is low, with EBITDA margins of 12.4% and net margins of 1.5%. Cost management will be crucial for sustaining margins. However, major rationalisation of staff costs and variable pay TV content expenses are at their tail end. So are operating efficiencies. According to the company, 83% of its expected savings have been realised.

Source: Phillip Capital Research - 22 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024