IX Biopharma Ltd. – Delayed Profitability

traderhub8

Publish date: Fri, 19 Feb 2021, 09:21 AM

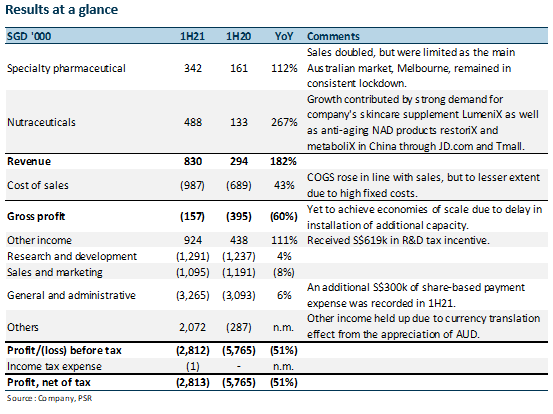

- Net loss narrowed 51% YoY to S$2.8mn in 1H21 to beat expectations by 63% on FX gains of S$2.2mn – without which results would have missed by 25%.

- Revenue almost tripled on strong demand for specialty pharmaceutical and nutraceutical products.

- Gross margins improved, though still negative as shipment of an integral component for a 5-6-fold increase in production capacity has been delayed till end-FY21.

- Wafermine out-licensing deal remains in sight, though progress has been impeded by border closures.

- Maintain BUY with a lower DCF target price (WACC 10%) of S$0.445 from S$0.455 as turnaround has been deferred to FY22e. We cut FY21e earnings by S$9.5mn, with loss of S$1.5mn from delayed capacity increase and S$8mn from deferred out-licensing deal.

The Positive

+ Strong demand for products

Revenue was up 182% YoY from S$294k to S$830k in 1H21. Excluding one-off out-licensing fees of S$150k in 4Q20, quarterly run rates of S$415k in 1H21 were comparable to the S$410k in 4Q20.

Specialty pharmaceutical revenue grew 112%. Growth could have been better if not for on-off lockdowns in Melbourne, which affected footfall in pharmacies and sales to clinics. The company was also unable to conduct training for its newly-launched medicinal cannabis wafer, Xativa.

Nutraceutical revenue skyrocketed 267% to S$488k YoY, supercharged by online sales on their JD.com and Tmall platforms. Demand for its skincare supplement, LumeniX and anti-ageing NAD (nicotinamide adenine dinucleotide) products, MetaboliX and RestoriX, continued to climb. Reception of its NAD products is encouraging as they are non-wafer products whose production is not affected by a shortage of freeze dryers.

The Negative

– Negative margins

Gross margin was -16% in 1H21, an improvement from the -57% a year ago. While demand for its wafer products remained robust, a shortage of production capacity did not help operating margins. Planned installation of additional freeze dryers that will increase wafer production by 5-6-fold has been delayed by COVID-19 supply-chain disruptions to April this year.

COVID-19 disruptions

Apart from the delayed installation of additional production capacity, the timeline for a Wafermine out-licensing deal continues to hinge on border restrictions in Australia. While iX has received interest from potential partners, in-person meetings remain non-viable. Due diligence, including visits to production plants in Australia, could not be completed.

The disruptions will slow down iX’s business turnaround that was previously expected by FY21. Nevertheless, with vaccine rollout in Australia soon, we are confident that deal-making and production expansion can resume by early FY22.

WaferiX’s intellectual property remains the jewel in the crown

R&D costs rose 4% YoY as the company continued to develop its medicinal cannabis range in preparation for more extensive commercialisation once the business environment improves.

With its extensive patents granted around the world, iX stands to unlock value from its WaferiX technology in the future. It can pursue out-licensing deals beyond existing products under its belt, including the technology itself for new product development.

Recommendation

Maintain BUY with a lower target price of S$0.445 from S$0.455. We cut FY21e earnings by S$9.5mn to reflect a sales loss of S$1.5mn as a result of delays in capacity installation. We also defer the S$8mn from the potential out-licensing deal to FY22. While many business plans have been put on hold by the COVID-19 pandemic, the company should be on the cusp of profitability once the disruptions are over.

Source: Phillip Capital Research - 19 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024