FIRST SPONSOR GROUP LIMITED: Large Pipeline of Sales

traderhub8

Publish date: Thu, 18 Feb 2021, 05:26 PM

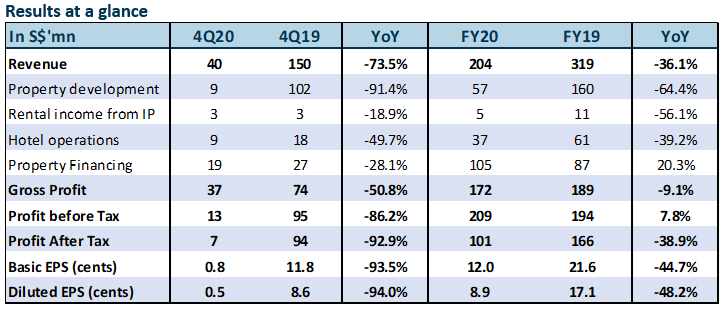

- FY20 net profit 28% below forecast due to lower share of after-tax profits from associates and JVs as well as lack of other gains.

- ASPs for Dongguan projects exceeded estimates by 10-30%. Unrecognised Dongguan sales rose from S$599mn to S$935mn. Gross development value (GDV) for unlocking surged from S$1.9bn to S$4.1bn, with the addition of new Fenggang and Panyu projects.

- Record FY21 pretax profit expected from revenue backlog.

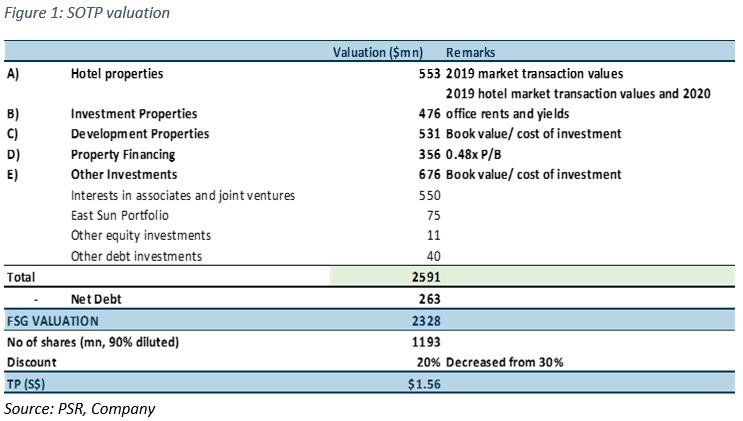

- Maintain BUY with unchanged SOTP target price of S$1.56.

The Positives

+ Record FY21 pretax profit expected. FSG only recognised profits from four commercial units and 3,997 carpark lots in FY20, which resulted in a 64% dip in revenue from property sales (FY19: 867 residential units, 122 commercial units and 199 carpark lots). This implies that the bulk of sales from the Star of East River and Emerald of the Orient would be recognised in FY21. We estimate a total GDV of S$363mn from these projects. In addition, unrecognised revenue from the Pinnacle and Plot F of Millennium Waterfront was S$372mn. This should be recognised progressively over the next two years.

The Negatives

– FY20 net profit 28% below expectations. Gross profit was in line at 95% of forecast despite a 36% YoY dip in revenue. This was thanks to better margins from the sale of carpark lots at Millennium Waterfront, which were carried at zero cost. However, net profit was down 39% YoY and 28% below expectations, due to a S$12.3mn loss from associates and JVs vs. a S$71.2mn gain in FY19. There was also a lack of other gains from the disposal of Oliphant a year ago. Adjusted for Oliphant office sale, FX gains and non-cash adjustments, net profit declined 14.8% YoY.

– RMB330mn loan in default. A borrower group with two cross-collateralised loans amounting to RMB330mn has been in arrears in a month’s worth of interest payments since March 2020. In November 2020, FSG commenced legal action to recover its outstanding loan principal and interest. The loans have been secured on a residential villa and a 5-floor retail mall in Shanghai with a combined LTV of 53.4%. In view of FSG’s ongoing discussions with the borrower and positive outcomes in two defaulted loans previously, FSG is optimistic about recovery. No provision was made for its outstanding loan principal in 4Q20.

Maintain BUY and TP of S$1.56. According to a 2020 JLL hotel investors’ sentiment survey, 1H20 global hotel transaction volume fell 51% YoY. Active investors shrank 40% as they moderated their appetite for hotel acquisitions. We have marked down our hotel valuations by 35% due to continued weakness in hotels. We also recategorised some investment properties as other investments. On the back of FSG’s upcoming property developments as well as its well-supported outlook, we decrease our SOTP discount from 30% to 20%.

FSG’s stock price has been hovering around its 5-year P/B average of 0.7x. Our target price of S$1.56 implies 0.75x FY21e P/B, not demanding.

|

Source: Phillip Capital Research - 18 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024