Mm2 Asia Ltd-Rights Issue to Deleverage

traderhub8

Publish date: Mon, 15 Feb 2021, 09:17 AM

- Announced 1-for-1 rights issue to raise gross proceeds S$54.65mn at 4.7 cents per rights.

- To pay off medium-term note due on 27 April 2021 and for general working capital and operations.

- This report has no stock rating, financial forecasts or target price.

Company background

mm2 Asia is a leading Asian media group with a core business in the production of content for films, TV and online entertainment. It has businesses in: 1) content production, distribution and sponsorship (33% of revenue); 2) post-production and content production (4%); 3) cinema operations (37%); and 4) event production and concert promotion (26%). It operates in Singapore, Malaysia, Taiwan, China and Hong Kong, with Singapore contributing 55% to FY20 revenue.

mm2’s core business is film, TV and online content production, distribution and sponsorship. It produces only content that is fully funded by film and content investors, which affords it a degree of defensiveness. With a fully funded pipeline of 20 titles for FY22 vs 14-18 titles in pre-Covid years, the group sees a steady recovery from Covid.

The news

mm2 has announced an underwritten and renounceable 1-for-1 rights issue to raise gross proceeds of S$54.65mn. Net proceeds would be about S$54.15mn, from 1,162,804,610 new rights issued.

- Estimated timeline. No timeline has been announced. An EGM for approval is likely to be held in early March. If approved, the new shares could be listed by mid-April 2021.

- Theoretical ex-rights price (TERP) is S$0.066, based on its closing price of S$0.085 on 11 February. The TERP is at a 22.4% discount to its closing price.

- Conditions. These include EGM approval. The underwriting agreement includes an extension of the maturity for its S$47.85mn convertible bond to 31 December 2021, as announced on 21 January 2021.

- Purpose. Proceeds will be used to repay a S$51.75mn medium-term note due on 27 April 2021 and for general working capital and operations.

Summary

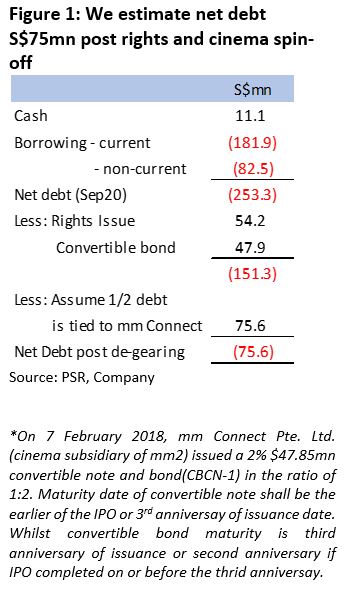

The rights issue will help mm2 de-gear its net debt of S$253.2mn as at September 2020. The next phase of de-gearing is a proposed listing of its cinema business under mm Connect Pte Ltd. Assuming an IPO or spin-off in-specie the S$47.85mn convertible bond would turn into equity. Another S$75mn of debt (or half total debt) in its cinema business could also be de-consolidated. After the rights issue and cinema listing, mm2’s net debt could shrink to around S$75mn.

At the current share price, the market cap of mm2 would be S$153mn after the rights issue. mm2’s 76.88% stake in UnUsUaL Ltd (UNU SP, Not Rated) alone is worth S$130mn. In addition, mm2 shareholders would have the opportunity to receive “free” cinema shares in a listing. On the existing film production operations, mm2 mentioned that it has a strong pipeline of over 20 titles for release in FY2022, compared to the typical 14-18 in previous years.

What does it mean?

Deleveraging and strengthening balance sheet. The rights issue is expected to raise gross proceeds S$54.65mn, of which S$51.75mn is intended for paying off the medium-term note due on 27 April 2021. Short-term borrowings and debt securities increased from S$131.7mn in 2HFY20 to S$181.9mn in 1HFY21. Based on 1HFY21 numbers, NAV/share would fall 38% from 0.21 cents to 0.13 cents with the rights issue. Gearing would drop from 50.6% to 46.2% and 39.8% if mm2 Connect is successfully listed.

The medium-term note was issued under a US$300mn Guaranteed Multicurrency Medium Term Note Programme on 27 April 2018. The medium-term note, MMASIA 7% 27Apr2021 Corp (SGD), is mm2’s only senior unsecured bond with a coupon rate of 7%. Its latest asking price on 10 February 2021 was S$95.92, which had recovered from about S$79 in January 2021.

Melvin Ang, Founder, Executive Chairman, has expressed his intention to vote for the rights and subscribe to his entitlement, flagging his support for and commitment to mm2.

Other updates

- IPO of cinema business, mm Connect. In December 2020, mm2 announced a possible listing of its cinema business, which is operated by its wholly-owned subsidiary, mm Connect, on the Catalist. The proposed spin-off and listing are in their preliminary stages. If successful, the listing could help to de-gear mm2’s balance sheet further, potentially converting its S$47.85mn convertible bond* into equity.

- Potential acquisition of Golden Village cinemas. mm2 has also proposed a merger of its Cathay cinemas with Golden Village cinemas. Golden Village is Singapore’s largest cinema chain, owned by Orange Sky Golden Harvest Entertainment. mm2 operates 64 screens at eight locations in Singapore under its “Cathay” brand. Another 14 cinemas are operated in Malaysia under three different brands. Golden Village operates 112 screens at 14 locations, commanding about 40% of the market. The combined entity would be the biggest cinema operator in town. Improved margins are expected from synergies and economies of scale. The merger is being pursued on the basis that both parties will bring in one or more new investors to inject capital into the merged business. The additional working capital is expected to fortify the balance sheet of the combined business.

- Extension of maturity date of convertible securities issued by cinema subsidiary, mm Connect. The maturity date of the convertible securities was originally 7 February 2021. This has been extended to the earlier of: 1) the date when the IPO of mm Connect is first open for acceptance; or 2) 31 December 2021. Conversion price is set at a 15% discount to the IPO price.

- Private-equity interest. On 7 February 2021, mm2 also announced that it had received a non-binding term sheet from a Singapore private-equity investor expressing interest in taking a minority stake in one of the group’s core businesses. This could potentially add another source of capital for mm2 to pare down its debt.

All developments are proceeding concurrently and independently.

Source: Phillip Capital Research - 15 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024