BHG RETAIL REIT – Harnessing the Mighty Chinese Consumer

traderhub8

Publish date: Mon, 08 Feb 2021, 11:33 AM

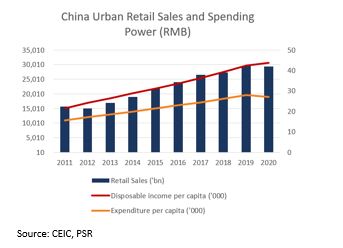

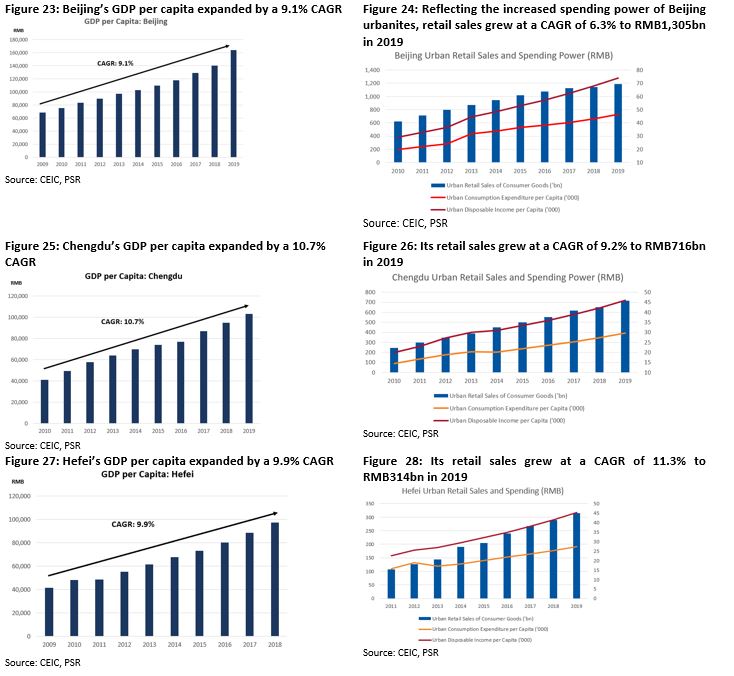

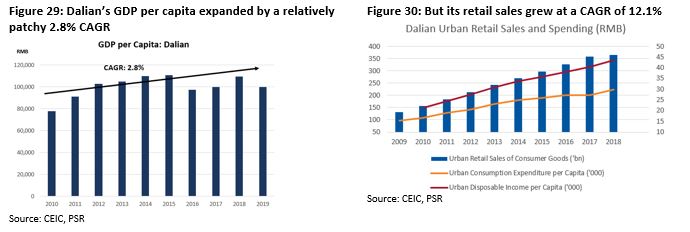

- Retail sales in the five cities where BHG REIT operates – Beijing, Chengdu, Hefei, Dalian, Xining – grew by a 8.3% CAGR in the past decade, reaching RMB3,080bn in 2020.

- Substantial M&A ROFR pipeline from sponsor that could expand its portfolio by 3.2x

Company Background

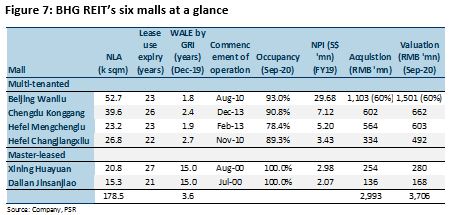

BHG Retail REIT was listed on the SGX on 11 December 2015. It has six retail properties strategically located in Beijing, Chengdu, Hefei, Xining and Dalian. Its six malls span 178,538 sqm of net lettable area. BHG distributed 100% of its distribution income in FY15, followed by at least 90% p.a. from FY16 onwards.

Highlights

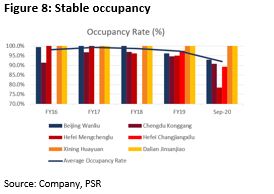

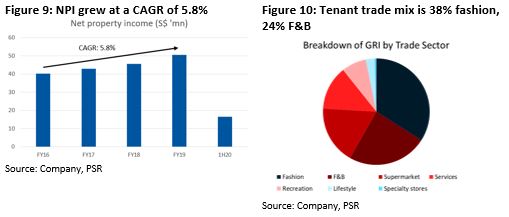

- Stable portfolio with quality assets and performance. Committed occupancy rate remained healthy at 91.5% as at 30 September 2020. Net property income (NPI) grew at a 5.8% CAGR from FY16 to FY19. Rental renewals in FY20 were about 80% of pre-Covid-19 levels. BHG REIT has a defensive lease structure. About 95% of its leases are structured on the higher of fixed rents or percentage of gross turnover, allowing BHG to benefit from upside while protected by fixed rents.

- Tapping China’s economic fundamentals. Over the past decade, disposable income and expenditure per capita of urban residents in China grew at CAGRs of 7.4% and 5.7% respectively. Urban retail sales grew at a CAGR of 6.5% to reach RMB29,424bn at end-2020. With the Covid-19 pandemic largely under control in China, YoY changes in monthly retail sales have turned positive again since September 2020. With China’s GDP forecast to expand 8.2% in 2021, retail sales are expected to sustain their strong growth.

- M&A growth opportunities. BHG REIT has a ready ROFR pipeline of 11 properties in 10 cities in nine provinces. Its most recent acquisition of Hefei Changjiangxilu mall for RMB334.0mn has added NLA of 26,828 sqm, and NPI yield of the acquisition is 0.7%. BHG REIT’s gearing was 35.7% as of 30 September 2020, providing comfortable debt headroom for growth via acquisitions before reaching its gearing limit of 45%.

About BHG Retail REIT

BHG Retail REIT was listed on SGX on 11 December 2015 at S$0.80 per unit. It has six retail properties spread out in five cities in China: Beijing, Chengdu, Dalian, Hefei and Xining, four of which are multi-tenanted and two are master-leased.

Sponsor Beijing Hualian Department Store Co. Ltd

Beijing Hualian Department Store Co. Ltd (000882.SZ, Not Rated) is part of the Beijing Hualian Group (Not Listed), which has interests in two publicly listed companies and several holding companies. An established Chinese home-grown retail-property operator, Beijing Hualian Department Store was one of the first companies to manage retail properties in China, with a focus on the ownership and management of community retail properties.

Assets

BHG REIT has six malls valued at RMB3,706mn or S$761mn:

- Beijing Wanliu. This is the largest mall in its portfolio, in which BHG holds 60.0%. Situated in Haidian, one of the largest urban districts in Beijing by population, residents have one of the highest per-capita disposable income in Beijing. The mall is surrounded by high-end residential communities.

- Chengdu Konggang. Located in Shuangliu County in Chengdu, Sichuan Province, the mall is served by the Shuangliu Railway Station and Shuangliu International Airport, capturing tourists. It serves as the heart of the community, providing quality shopping and experiential lifestyle services to the city’s growing middle and upper-middle families and young professionals living in high-density residential projects nearby.

- Hefei Mengchenglu. Located in Hefei’s North First Ring retail hub comprising several mature residential districts, high-quality office projects and commercial facilities, the mall is frequented by families and professionals for retail goods and services. The mall underwent supermarket resizing and asset enhancement initiative (AEI) in 2019.

- Hefei Changjiangxilu. A newly-acquired mall in April 2019, this is located in Shushan district in Hefei, one of the four central districts of Hefei. It is a new urban area where high-tech firms are based. Shushan is also developing into a new urban centre with high-end communities, cultural and sports centres, 5-star hotels and serviced apartments.

- Xining Huayuan. This property has been enjoying 100% occupancy since IPO. It is a 4-storey retail hub located in the Ximen-Dashizi area, a traditional core retail hub in Xining. Master lessee is the Beijing Hualian Hypermarket. The mall is well-connected by major roads and bus lines and is frequented by residents living and working in the area.

- Dalian Jinsanjiao. This is the smallest property by valuation. It is BHG’s other property with 100% occupancy since IPO. The mall is situated in the middle of several residential estates in Dalian. It is popular with middle-income families and professionals residing in the area.

Highlights

- Stable portfolio with quality assets and performance

Committed occupancy remained healthy at 96.7% in FY19. The latest reported figure is 91.5% on 30 September 2020, still healthy. Lower occupancy rate of 78.4% was recorded at Hefei Mengchenglu due to ongoing tenancy rejuvenation.

NPI grew at a CAGR of 5.8% from FY16 to FY19 (Figure 9). 1HFY20 NPI fell 34.5% YoY mainly due to Covid-19 measures at the start of the year. Its two malls in Hefei were temporarily closed from 7 February 2020 to 10 March 2020 while other malls remained open daily. Revenue from Hefei Changjiangxilu mall started in 1HFY19.

More than 65% of GRI and 80% of NLA are derived from the experiential segment, which typically requires consumers to visit the malls. Experiential offerings include pony and horse-riding training for children (Figure 11), an Amazing Art Space at Beijing Hualian mall and a flea market for children at Chengdu Konggang (Figure 12).

Rental renewals in FY20 were 80%, in line with pre-Covid figures. BHG had also provided rental rebates to certain tenants and all instalments were paid by end-FY20.

Defensive lease structure. About 95% of its leases are structured on the higher of fixed rents or percentage of gross turnover. This allows BHG REIT to benefit from upside while downside is capped by fixed rents. In FY19, more than 90% of its GRI was derived from base rents. Less than 10% was from variable rental income. Furthermore, more than 90% of its leases come with built-in rental escalation, allowing for organic growth.

BHG has been enhancing its assets continuously. It is on the constant lookout for opportunities to enhance its malls. It completed AEI at Hefei Mengchenglu in 2QFY19. Other new introductions included a container-style food lane outside its Chengdu Konggang mall, which has enhanced the mall’s attractiveness and visibility to nearby communities (Figure 14).

2. Tapping China’s economic fundamentals

Disposable income and the expenditure of urban residents in China have been steadily increasing in the past decade, at CAGRs of 7.4% and 5.7% respectively (Figure 15). Urban retail sales grew at a CAGR of 6.5% to reach RMB29,424bn by end-2020.

Figure 15: Steadily growing disposable income and expenditure per capita of urban residents

3.M&A growth opportunities

Sponsor, Beijing Hualian Department Store Co. Ltd, has a pipeline of ROFR properties. Of these, BHG completed its acquisition of the Hefei Changjiangxilu mall in April 2019 for RMB334.0mn. The mall added NLA of 26,826 sqm and accounts for 13.3% of its portfolio valuation.

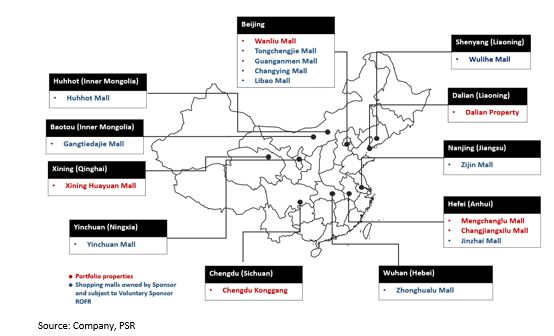

Under its ROFR agreement, BHG could potentially acquire 11 properties in various cities (Figure 18).

Figure 18: ROFR assets located in various cities

The REIT also continues to explore opportunities among third-party quality income-producing retail properties.

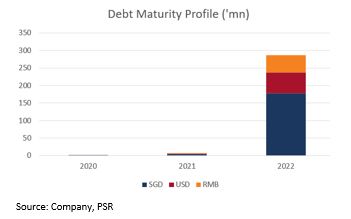

Gearing was 35.7% as of 30 September 2020. Borrowings of S$284.2mn were drawn down in FY19. Debt headroom for acquisitions remains comfortable, with a gearing limit of 45%. More than 80% of borrowings are offshore loans denominated in S$ and US$. About 60% of these offshore loans have been hedged using interest-rate swaps.

Figure 20: No major refinancing until 2022

Risks

Income support coming to an end. Its sponsor had waived its entitlement to dividends since IPO in December 2015. The amount of distributions waived, attributable to strategic investor units, in FY18 and FY19 amounted to S$5.3mn and S$3.6mn respectively or 25% and 15% of the REIT’s total units. The final distribution waiver was in FY20. From FY21 onwards, unitholders may face a drop in their DPUs and distribution yields.

Comparables

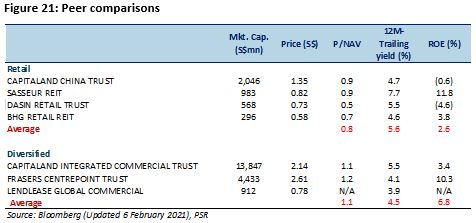

BHG REIT’s FY19 DPU yields with and without distribution waiver were 6.8% and 5.8% respectively.

It is trading at a 4.6% yield vs 5.5-7.7% for comparables like Dasin Retail Trust (DASIN SP, Buy, TP S$0.90), Sasseur REIT (SASSR SP, Not Rated) and CapitaLand China Trust (CLCT SP, Not Rated) (Figure 21)

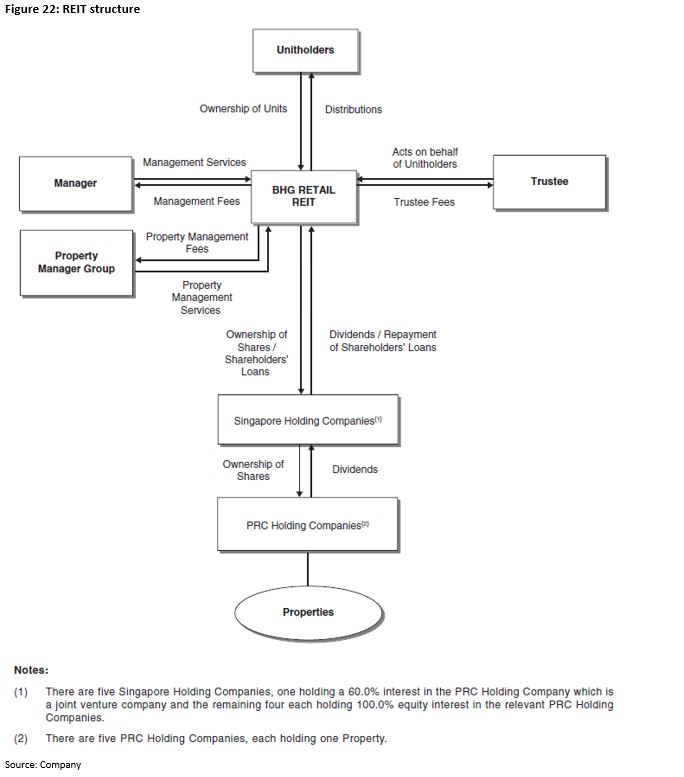

Appendix 1: REIT structure

Appendix 2: Overview of cities

Source: Phillip Capital Research - 8 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024