Singapore Banking Monthly – Biding Time

traderhub8

Publish date: Thu, 04 Feb 2021, 10:08 AM

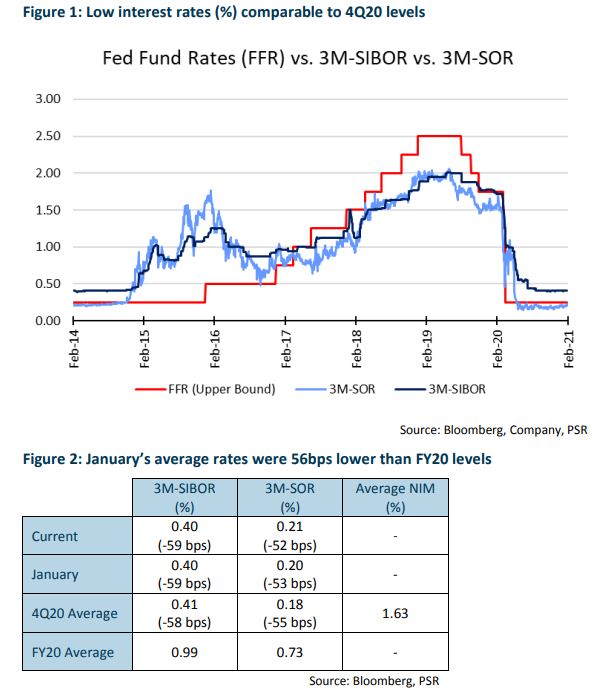

- January interest rates were similar to 4Q20 averages.

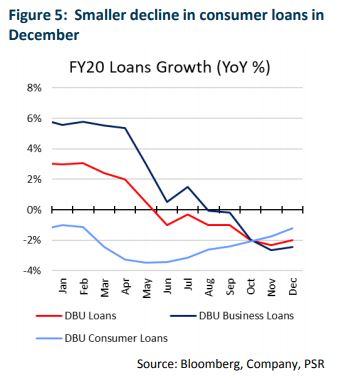

- Loans shrank 1.98% YoY in December, but improved 0.3% MoM in their second consecutive month of growth.

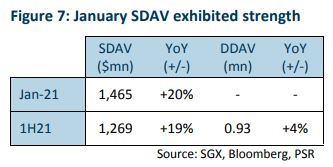

- SGX’s capital-market SDAV/DDAV grew 20%/4% YoY in January, sustaining their pace in 1H21.

- Remain NEUTRAL. Our pick for sector exposure is SGX (SGX SP, ACCUMULATE, TP: S$11.01) as we expect greater contributions from new businesses.

Interest rates unchanged in January

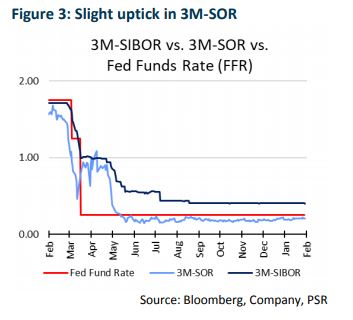

January’s 3M-SIBOR/3M-SOR of 0.40%/0.20% were 56bps lower than FY20 levels (Figure 2). Current 3M-SOR has edged up 1bp from January to 0.21% and rates are comparable to the past quarter.

Interest rates are expected to stay low for longer. In response, banks continue to adjust deposit rates to manage funding costs. OCBC is the latest to cut deposit rates, the fourth revision to its savings accounts in nine months.

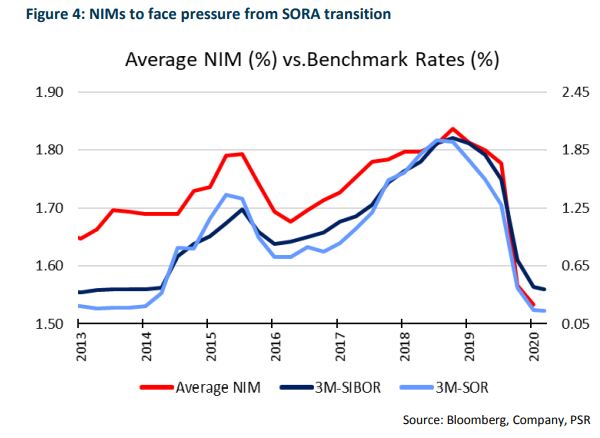

SOR to be phased out by end-2021

Singapore forges ahead with its plan to transition to a single-interest-rate benchmark, the Singapore Overnight Rate Average (SORA). SORA is a backward-looking overnight rate that is supposed to offer more stability than SIBOR/SOR, which are forward-looking and computed using US$ LIBOR. The latter had been found to have been manipulated by European and US banks.

SORA will replace SOR by 2021, beginning with the full transition of SOR-linked cash-market products by May this year. SORA is then expected to replace SIBOR by 2024.

NIMs could come under pressure, as the backward-looking SORA will remove the pricing premium for uncertainty for the forward-looking SIBOR/SOR. However, we expect savings from asset repricing to offset NIM compression in FY21.

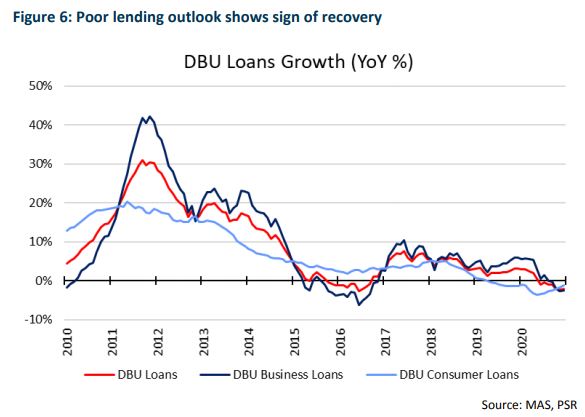

Lending gains in December

Loans fell 1.98% YoY in December, but this was an improvement from their decline of 2.32% a month ago. Business services and building and construction loans grew 5.7% and 5.3% YoY respectively. General commerce and credit-card loans fell 10.5% and 13.5% YoY respectively.

MoM, loans grew 0.3%, for the second consecutive month. Both business and consumer loans improved, up 0.18% and 0.51% respectively. Business loan growth was spearheaded by financial institutions’ loans, which grew 4.9% MoM. Credit cards led consumer loan growth, adding 1.7% MoM.

Housing loans grew 0.4% MoM and 0.3% YoY. They are expected to provide runway for system loan growth in the next 3-4 years, with housing project completions underway as the construction sector resumes operations.

Market activities normalised at heightened levels

Preliminary SDAV for January of S$1,465mn indicates a YoY increase of 20% from S$960mn in January 2019 (Figure 7). This matched its 19% YoY growth rate in 1H21. We believe SDAV will normalise at the heightened levels observed since the beginning of FY21.

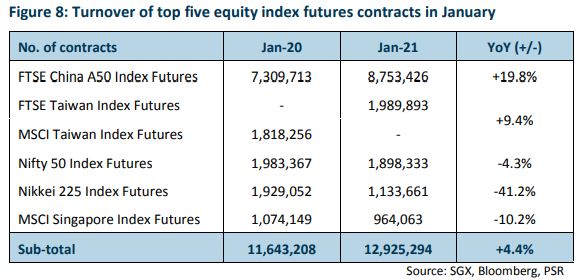

DDAV was 4% higher YoY in 1H21 at 0.93mn. Volume for the top five equity index futures grew 4.4% YoY to underpin the growth in turnover (Figure 8).

Average fees per contract shrank from S$1.34 to S$1.27 in 1H21 as a result of a fee holiday implemented during the transition from MSCI Taiwan Index Futures to its FTSE replacement. However, SGX should gain when the fee holiday expires and if market participation is sustained.

Investment actions

Remain Neutral. The outlook for the sector continue to brighten together with the Singapore economy. However, we believe the banks will follow through with their credit guidance for FY21, which implies continued muted earnings.

For sector exposure, we prefer SGX, whch has delivered a strong set of 1H21 results with positive contributions from newly-acquired businesses.

Source: Phillip Capital Research - 4 Feb 2021

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024