Singapore Exchange Limited – High Noon

traderhub8

Publish date: Mon, 25 Jan 2021, 09:30 AM

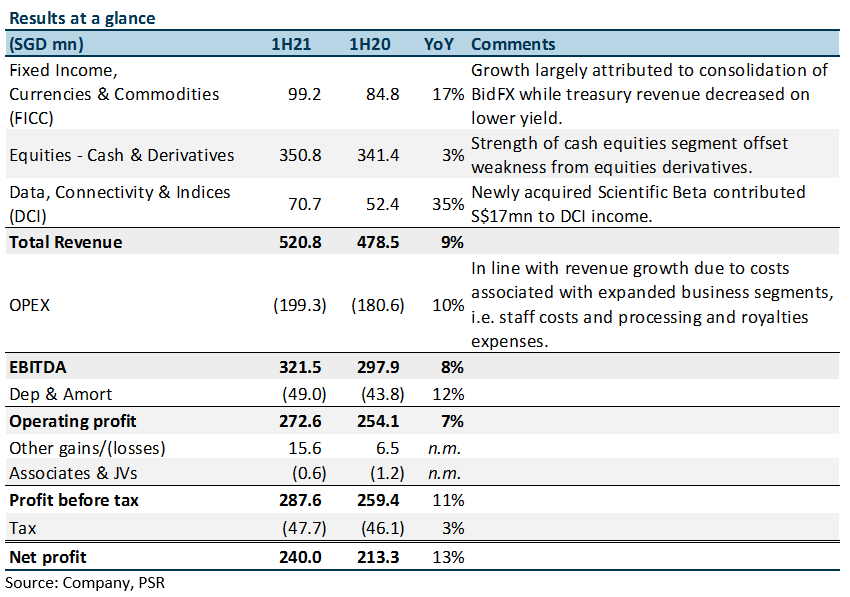

- 1H21 revenue in line but earnings beat our estimate by 12% on lower operating expenses.

- FICC and DCI grew 17% and 35% YoY, led by newly-acquired businesses, BidFX and Scientific Beta, respectively.

- Average fee per contract for equity derivatives fell from S$1.34 to S$1.27 due to fee holiday during transition from expiring MSCI products to FTSE replacements.

- Laid out pipeline for growth, which includes expanding suite of products with FTSE Russell and developing indices under Scientific Beta to capture new investment trends.

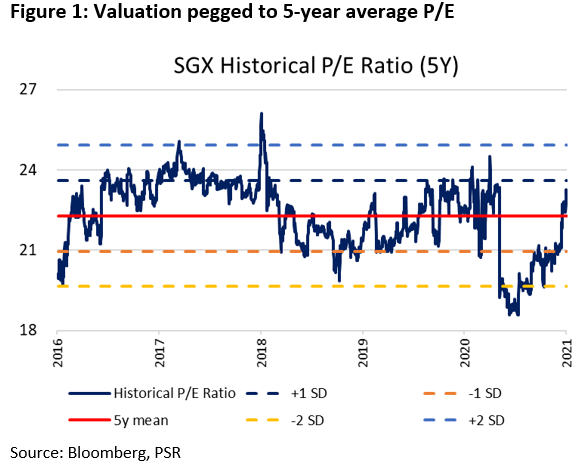

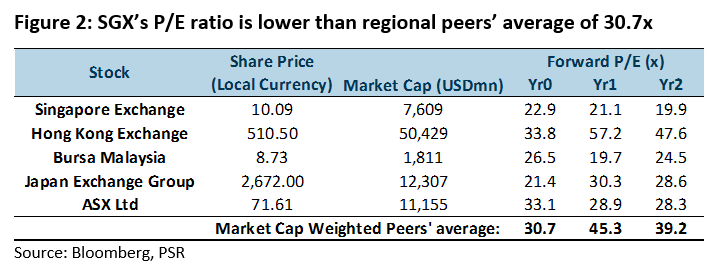

- Maintain ACCUMULATE with higher TP of S$11.01, from S$9.45. FY21e earnings raised by 8% to incorporate full-year expense guidance of S$535-545mn. Now peg our TP at 5-year historical average of 22.3x P/E vs. -1SD previously in view of its stronger growth prospects.

The Positives

+ Contributions from new businesses. BidFX and Scientific Beta contributed S$34mn in revenue, accounting for 80% of 1H21 revenue growth. Consequently, FICC and DCI grew 17% and 35% YoY respectively to lift total revenue by 9% YoY. Without which, revenue would have grown 2% YoY.

Both businesses will remain growth engines for SGX, with opportunities from cross-selling and new client acquisitions on the back of customer access to an enlarged trading network.

+ Sustained growth of cash equities trading and clearing revenue. This segment’s revenue grew 23% YoY to S$111.5mn, with SDAV increasing 19% YoY to S$1.3bn. Retail market participation increased, contributing positively to trading volumes and clearing margins.

The Negatives

– Equity derivatives. Despite volume growth of 4%, revenue here declined 9% YoY as SGX had introduced a fee holiday for the liquidity transition from expiring MSCI products to new FTSE replacements. Fee per contract fell from S$1.32 to S$1.27 but is expected to normalise as introductory fees taper off in the subsequent two quarters.

– Listings remained sluggish. Fixed-income listing revenue was up 4% YoY to S$5.1mn but equity-listing revenue fell 5% YoY to S$17.0mn as macroeconomic conditions remained weak for capital-raising. We expect listing revenue to improve as the economic outlook brightens.

Outlook

Continued development of multi-assets to anchor long-term growth. SGX remains committed to expanding its suite of products through strategic partnerships and new product development for newly-acquired businesses.

It has signed an MOU with the China Central Depository and Clearing to promote Singapore’s and China’s bond markets. It has also teamed up with NASDAQ to be its exclusive partner for its sustainable bond network initiative. On top of that, SGX is leveraging Scientific Beta’s research pedagogy to launch smart investing products centered on new investment trends in ESG.

Robust business ecosystem. The success of its transition from MSCI Taiwan equity derivative contracts to its FTSE replacement exhibits SGX’s positive relationships with partners and customers that can facilitate future product launches.

Investment Actions

Maintain ACCUMULATE with a higher TP of S$11.01, up from S$9.45, after we raise FY21 earnings by 8% to incorporate full-year expense guidance of S$535-545mn. Our TP is now pegged to its historical 5-year mean of 23x P/E. We adjusted our P/E from 1SD below its 5-year historical average to capture its longer-term prospects. SGX is trading at 22.9x P/E, which remains below the average of 30.7x for regional peers (Figure 2).

Source: Phillip Capital Research - 25 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024