Phillip Capital Morning Note - 22 Jan 2021

traderhub8

Publish date: Fri, 22 Jan 2021, 09:43 AM

We attended SPH’s update on its 1Q21 operations on Wednesday, 19 January 2021. Highlights were:

Media

Digital circulation increased 26.5% YoY, with the addition of 31k subscribers. Total circulation was up only 1.8% YoY due to a structural decline in print circulation. Quarterly media revenue was flat at S$29.6mn vs S$29.5mn in 1Q20 as higher circulation revenue offset lower digital-ad and print-ad revenue, which fell 36% YoY. Expect the decline in media to continue owing to rising competition from other advertising platforms and a softer economy.

Retail

SPH REIT’s 1Q21 revenue was up 10.8% YoY to S$66.6mn largely on the back of maiden contributions of S$12.8mn from its Westfield Marion acquisition in November 2019. Singapore gross revenue was down 11.3% YoY to S$49.7mn due to rental relief. However, footfall and tenant sales recovered during the end-year festive period. Key Singapore assets, Paragon and Clementi Mall, remained affected by border restrictions and work-from-home arrangements respectively. Paragon’s footfall as of November 2020 was -34% its level before COVID-19 while Clementi Mall’s was -51%.

Its two Australian assets’ tenant sales are steadily recovering, to near pre-COVID-19 levels. That said, high lease expiries of 32% of gross rental income in FY21 in a softer leasing environment may lead to muted rental reversions. Lease retention will be in focus.

Woodleigh Residences update

The group had sold 404 units or 60% of the total as at 8 January 2021. Of these, 190 had been sold since the lifting of the circuit breaker. Recent URA data show that the last 10 units were sold above S$2k/sq ft. Demand is still healthy, though construction costs are expected to increase due to COVID-19 delays and measures. Recent ministerial comments about potential property-cooling measures may have dampened Singapore’s hot property market slightly. The project has two years more to TOP and could get a possible 6-month extension from the regulators due to COVID-19 construction delays.

Purpose-built student accommodation (PBSA)

As at 8 January 2021, PBSA had achieved 88% of its revenue target for the academic year 20/21 and 17% of its target for the academic year 21/22. SPH will progressively take over as operator of its 28 PBSA assets by 1 October 2021, with an eye to list them as a REIT. No further write-downs in valuations were guided. Occupancies are expected to remain weak for the rest of 2021 due to flight restrictions for foreign students.

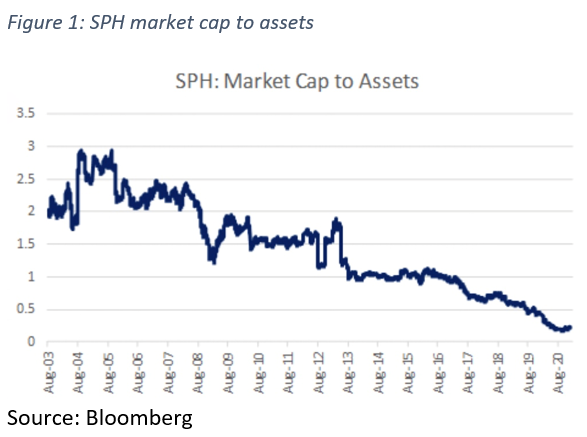

Stock looks cheap

Total cash, PBSA and retail assets amounted to S$4.3bn. This comprised: cash balance of S$898mn; PBSA assets of S$443mn; Paragon’s retail assets (66% stake) of S$1.7bn; Seletar Mall’s (70% stake) S$336mn; The Clementi Mall’s (100% stake) S$584mn; The Rail Mall’s (66% stake) S$41mn; Westfield Marion’s (33% stake) S$207mn; and Figtree Grove’s (56% stake) S$103mn. Further writedowns are not expected as heavy impairments were already taken in 2020. With a market cap of S$1.95bn as of 20 January 2021, SPH is trading at >70% discount to its total asset value against the 5-year average discount of 27%.

Bond and credit

Liquidity is strong, with cash of S$898mn able to cover debt maturing in the next two years. SPH also enjoys high recurring income from its 66% stake in SPH REIT. We like its SPHSP 4% perpetual bond with a yield to call of 3.8%. The bond has a cash price of 100.75 and is callable on 12 May 2025.

Source: Phillip Capital Research - 22 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024