Singapore REITs Monthly – Recovering With the Economy

traderhub8

Publish date: Mon, 18 Jan 2021, 11:14 AM

- STI outperformed FTSE S-REIT Index in January, as investors rotated to cyclical sectors to tap recovery prospects. Biggest gainers were Industrial REITs, climbing 3.0% MoM. Healthcare was the biggest loser, pulled down by First REIT (FIRT SP, Not Rated) which shed 40.2% MoM due to its impending rights issue.

- Sector yield spread over benchmark 10-year SGS (10YSGS) was 303bps, at -0.7SD. More acquisitions expected in low-interest-rate environment.

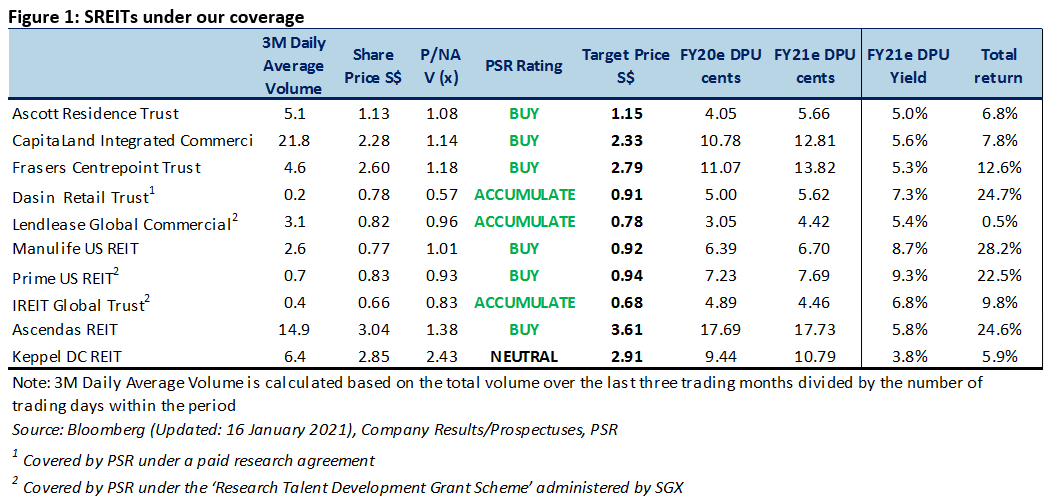

- Remain OVERWEIGHT with sector catalysts expected from pick-up in economy activity, interest savings and acquisitions. Prefer Retail and Hospitality. Top picks are and Manulife US REIT (MUST SP, BUY, TP US$0.92) and Ascendas REIT (AREIT SP, BUY, TP S$3.61). These counters look attractive at current valuations and will remain resilient despite the weaker sector outlook, in our view.

SECTOR ROUND-UP

Four inter-conditional resolutions to approve Eagle Hospitality Trust’s (EHT SP, Not Rated) rescue and recapitalisation plan failed to pass an EGM on 30 December 2020. The EGM was convened for voting on: i) the appointment of SCCPRE HRM as its new REIT Manager; ii) approval of the new Manager’s fee structure; iii) the appointment of SCCRPRE HTM as the new Trustee-Manager; and iv) the issuance of 140mn new units as payment of base fees to the new REIT Manager. The appointment of SCCPRE as the new REIT Manager was crucial as EHT’s working capital was to have run out by December 2020. Ongoing negotiations with lenders were contingent on the appointment of SCCPRE as the new Manager. As SCCPRE HRM was not appointed, EHT would not have sufficient resources to operate as a going concern beyond December 2020. Additionally, its incumbent REIT Manager had been removed after the EGM, in compliance with an MAS directive issued on 30 November. EHT appears to be headed towards a Chapter 11 bankruptcy filing and sale of assets.

Keppel REIT (KREIT SP, Not Rated) will acquire Keppel Bay Tower for S$657.2mn, at 1.2%/1.5% discounts to JLL’s/Cushman & Wakefield’s valuations and an LTV of 60%. The property comprises an 18-storey office tower and a six-storey podium block, with a combined net lettable area of 386,600 sq ft. Target completion of the acquisition is 2Q21. The acquisition is expected to provide a 2.7% pro-forma DPU accretion bases on an LTV ratio of 60%.

Frasers Centrepoint Trust (FCT SP, BUY, TP S$2.79) announced its divestment of Anchorpoint mall on 23 December 2020. The 71,213 sq ft mall comprising two retail levels has been sold to unrelated third parties for S$110mn. The sale is expected to be completed on 21 March 2021.

Retail

November 2020’s seasonally-adjusted Retail Sales Index ex-motor vehicles eased to -3.1% YoY, boosted by mega-sales events such as the 11.11 Singles’ Day and Black Friday on 26 November. This was an improvement over October’s -11.4%. Online sales accounted for 16.7% of total sales, slightly higher than the 13% average under Phase 2 reopening.

F&B sales are expected to be lifted by a relaxation of group size and capacity restrictions under Phase 3 reopening. The recovery for central malls is expected to be more pronounced than suburban malls due to returning office crowds. Still, suburban malls should be resilient, as more firms announce permanent hybrid work arrangements.

Although a recovery in sales could return confidence to tenants, weaker demand and lower rents may persist for some time as tenants rationalise costs. Dominant central and suburban malls which are located near transport nodes are likely to be prioritised when retailers consolidate stores.

Office

With more firms rolling out permanent hybrid work arrangements, more right-sizing is expected over the next 2-3 years when leases come due. We think that office rents will remain under pressure in 2021, even though oversupply can be mitigated by office stock taken offline for redevelopment in 2021/22.

Demand is expected to come from displaced office tenants, flexible-space operators, Chinese tech companies and non-bank financial services. Flexible space should feature more prominently as firms adopt flexible, low-capex, interim solutions while hashing out their space needs.

Industrial

The outlook for data centres, hi-spec and business parks remains favourable. These asset classes are supported by a growing technology sector and low supply under construction. In the near term, rents may still be under pressure as businesses remain cautious.

Warehouses have been benefitting from higher demand from logistics players, given a higher percentage of online sales. With increased e-commerce penetration, we expect demand for warehouse space to heighten further.

The leasing of light industrial factory space could be muted, as global demand is still on the mend. The outlook for factory assets remains challenging given considerable new supply. Key performance indicators have been a mixed bag. Manufacturing output rose by 17.9% YoY in November, up from -0.8% YoY in October. The PMI posted its sixth consecutive month of expansion in December but NODX landed in the red at -4.9%.

Hospitality

RevPAR dipped 2.3% MoM in November, as higher average daily rates (ADRs) were wiped out by lower occupancy. Industry occupancy of 53.8% was 35.1ppts lower YoY. The sector was weighed down by the mid-tier and economy segments.

The outlook for December through February looks more optimistic, as S$320mn of SingapoRediscover vouchers are eligible for redemption at selected hotels, attractions and tours from 1 December 2020 to 30 June 2021. An online poll conducted by The Sunday Times in December found that 60% of the respondents were willing to top up their vouchers when using them. About 51.3% of the respondents indicated that they would spend their vouchers on staycations and/or local attractions and tours.

Tourist receipts amounted to S$27.7bn in 2019, of which S$5.5bn was attributed to accommodation. In comparison, Singapore residents spent S$36.5bn on overseas travel in that year. As international borders remain closed, some residents may spend part of their travel budgets on staycations. While it is unlikely that the domestic market can make up for the shortfall in tourist spending, the SingapoRediscover Vouchers should provide a much-needed reprieve for occupancy and ADRs.

INVESTMENT RECOMMENDATIONS

Maintain OVERWEIGHT on SREITs

REITs have resumed their quest for acquisitions, spurred by low interest rates and share-price recoveries. The establishment of travel channels with more countries is expected to pave the way for more overseas asset acquisition negotiations. With interest rates expected to remain low, share prices recovering and confidence returning to capital markets, there could be more M&A opportunities for the REITs.

Sub-sector preferences: Retail and Hospitality

We believe that the Retail and Hospitality sub-sectors will be the first to benefit from further economic reopening. The rollout of vaccines has provided a clearer recovery timeline and is expected to lift the price overhang for Hospitality REITs.

Retail (OVERWEIGHT). While weaker demand and lower rents are expected as tenants rationalise costs in the near term, F&B sales could be lifted by a relaxation of group size and capacity restrictions under Phase 3 reopening. Central malls are expected to enjoy a more pronounced recovery due to returning office crowds. Suburban malls should, nevertheless, stay resilient, as more firms announce permanent hybrid work arrangements. Dominant central and suburban malls which are located near transport nodes are likely to be prioritised when retailers consolidate stores. Prefer Frasers Centrepoint Trust (FCT SP, BUY, TP S$2.79) due to resilient, necessity-driven spending at suburban malls and growth in suburban catchments.

Office (NEUTRAL). Lacklustre demand and downsizing from the adoption of permanent hybrid work arrangements will likely result in oversupply in the office market in the near term, despite mitigation from office stock taken offline for redevelopment. Rents could remain under pressure. Still, the long-term outlook of the office market is optimistic as Singapore remains one of the top cities for the location of regional headquarters. This is largely attributed to its political and operational stability, business-friendly policies and educated workforce. Prefer Manulife US REIT (MUST SP, BUY, TP US$0.92) for its defensive portfolio with a long WALE of 5.7 years and lower downsizing risks in the mature, remote-working-adjusted US office market.

Industrial (NEUTRAL). The outlook for data centres, hi-spec and business parks remains favourable. These asset classes are supported by a growing technology sector and low supply under construction. Warehouses have been benefitting from higher demand from logistics players, given a higher percentage of online sales. The leasing of light industrial factory space may be muted as global demand is still on the mend. The outlook for factory assets remains challenging given considerable new supply. Top pick is Ascendas REIT (AREIT SP, ACCUMULATE, TP S$3.61) for its diversified portfolio. AREIT is also positioned to capture new economy sectors. Some 93% of its assets are hi-spec, logistics and business park assets catering to the biomedical, hi-tech, e-commerce and knowledge-driven industries.

Hospitality (OVERWEIGHT). We believe the hospitality sector faces a long road to recovery. We estimate that the industry may only return to pre-COVID levels in 2023/24, in line with the Singapore Tourism Board’s expectation of a 3-5-year recovery timeline. We think that international borders will remain largely closed in 1H21. Economies with sizeable domestic demand such as China, the UK, France, Australia and the US will be the first to recover, in our view. Business travel is likely to be less frequent, as companies may elect to hold business meetings virtually to save costs.

On the other hand, some MICE demand is expected to return, as certain aspects of business engagement and networking cannot be replicated by virtual meetings. Also, digital adoption has resulted in leaner cost and operating structures for hoteliers, resulting in higher profit margins. COVID-19 has, moreover, set new historical lows for the sector. This may result in lower minimum rents in future master lease negotiations. Hospitality counters are still trading at depressed levels and should be positioned for a recovery. High efficacy rates of approved Moderna and Pfizer-BioNTech vaccines and high participation in the COVAX* programme have lifted the cloud of uncertainty and provided a more visible timeline to recovery. This should lift the price overhang for Hospitality REITs. Prefer Ascott Residence Trust (ART SP, BUY, TP S$1.15) as we expect it to make a faster recovery from its 74% exposure to countries with large domestic markets.

Source: Phillip Capital Research - 18 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024