Singapore Banking Monthly – Waiting Game

traderhub8

Publish date: Tue, 05 Jan 2021, 06:43 PM

- December interest rates were at 4Q20 averages.

- Loans shrank 2.32% YoY in November, extending their weak outlook as business loans contracted more than consumer loans for the first time since 2018.

- Capital-market SDAV/DDAV grew 14%/11% YoY in December, auguring well for SGX.

- Maintain NEUTRAL. Our picks for sector exposure are SGX (SGX SP, ACCUMULATE, TP: S$9.45), given sustained market participation, and UOB (UOB SP, Neutral, TP: S$21.10) for its lower SPs and better credit outlook.

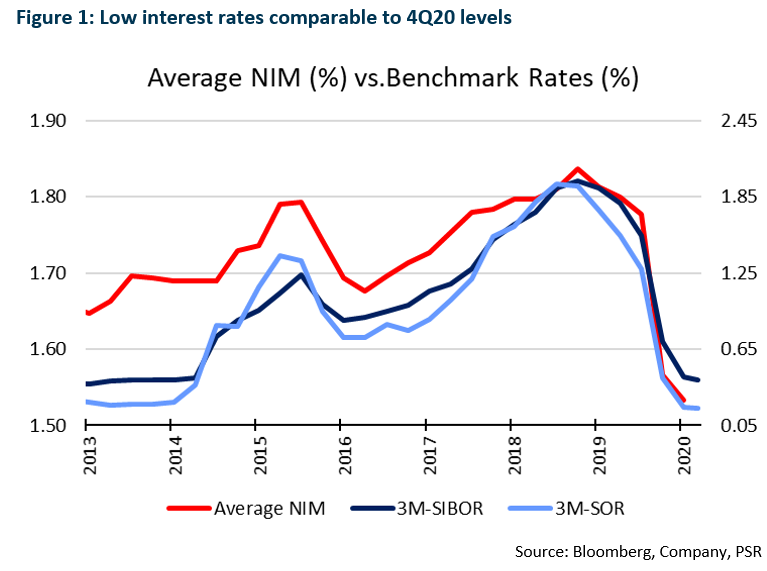

NIMs fell in 3Q20 on subdued interest rates

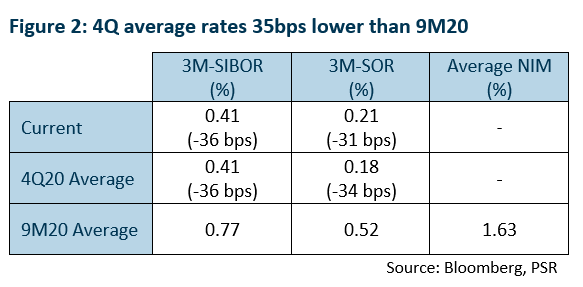

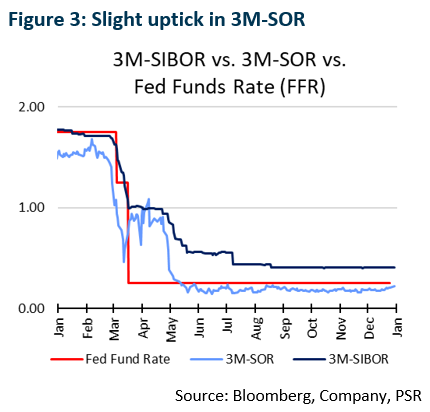

4Q20 3M-SIBOR/3M-SOR of 0.41%/0.18% were 35bps lower than 9M20 levels (Figure 2). As a result, banks’ NIMs in 4Q20 are expected to come in at 3Q20 levels, for a full-year average of 1.60%.

Current 3M-SOR is up 3bps from the average observed in 4Q20. 3M-SIBOR is at its 4Q20 average. Despite low interest rates, rate stability should provide opportunities for banks to better price asset yields to boost margins in FY21.

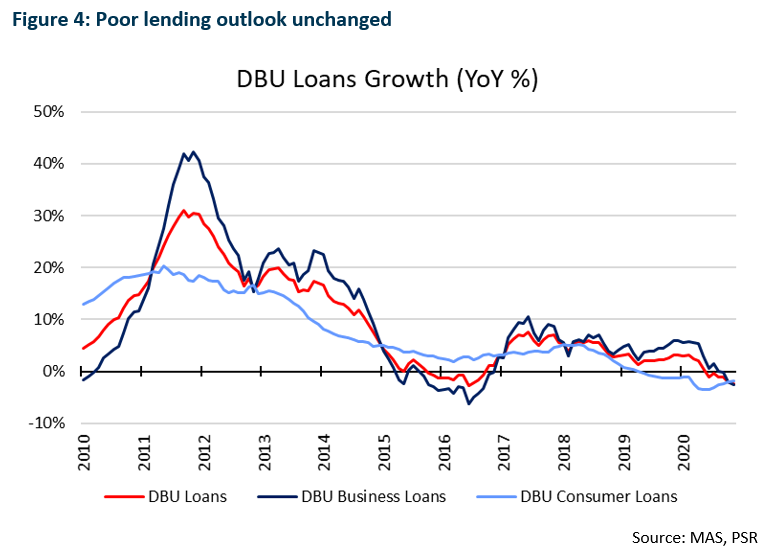

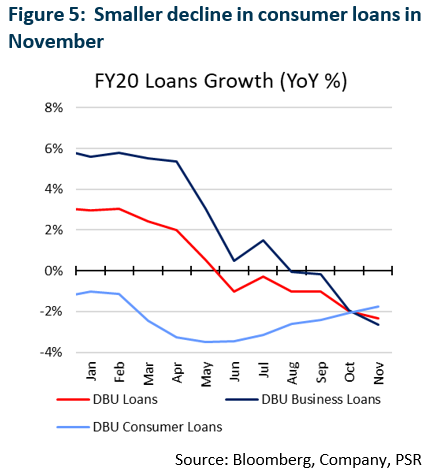

Lending worsened in November

Loans contracted 2.32% YoY in November, worse than their decline of 2% in October. Business loans performed poorer than consumer loans for the first time since February 2018, shrinking 2.66% YoY. Consumer loans slipped 1.76%, though they grew 0.42% MoM in their fifth consecutive month of growth. Growth was largely attributed to credit-card loan growth of 3.0% MoM.

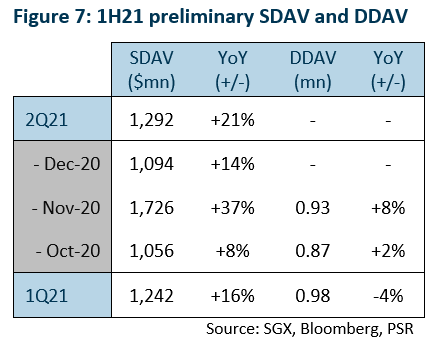

Commendable market activities despite holiday season

Preliminary SDAV for December of S$1,094mn indicates a YoY increase of 14% from S$960mn in December 2019 (Figure 7). This puts SDAV for 1H21 at S$1,267mn, up 19% YoY.

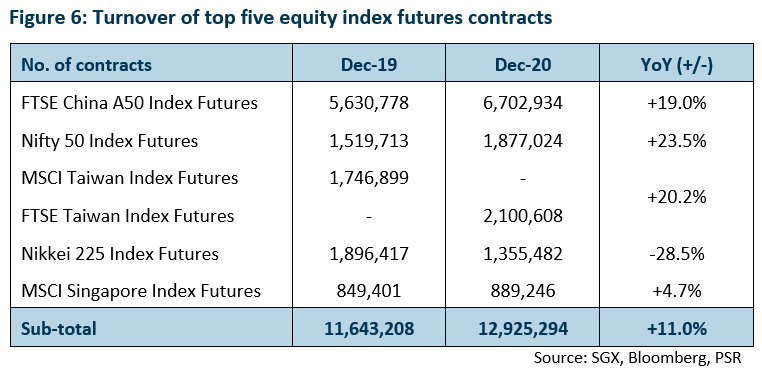

DDAV was 8% higher YoY in November at 0.93mn. Volume for the top five equity index futures grew 11.0% YoY, showing promising data for December.

Turnover volume for SGX’s newly-launched FTSE Taiwan Index Futures was 2.1mn in December, overtaking the performance of its MSCI predecessor a year ago by 20.2%.

With sustained levels of market participation, we expect SGX’s revenue to increase 10-15% YoY in 1H21.

Investment actions

Remain Neutral. The banking environment remains challenging as investors look for clarity on loan quality with the expiry of loan moratoriums in Singapore.

For sector exposure, we prefer SGX, given strong market participation observed for 1H21 and a potential lift in earnings from newly acquired businesses in the past year.

Among the banks , we continue to prefer UOB as lower credit costs guided should lift pressure off its earnings faster than peers.

Source: Phillip Capital Research - 5 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024