Singapore Banking Monthly – Sentiment Improved

traderhub8

Publish date: Mon, 07 Dec 2020, 09:26 AM

- November interest rates remained at their lowest since 2014.

- Loans shrank 2% YoY in October, reinforcing their weak outlook.

- Capital-market SDAV/DDAV grew 35%/11% YoY in November.

- Banks turned in soft 3Q20 results but reported greater asset-quality clarity. Improved credit outlook to pave the way for gradual earnings recovery.

- MAS announced four successful applicants for digital-banking licences. We do not expect any impact on banks’ earnings until FY22 when the digital banks start to operate.

- Maintain NEUTRAL. Downgrade OCBC and UOB to NEUTRAL from ACCUMULATE on the back of slow earnings recovery in a low-interest-rate environment while allowances normalise. Our pick for the sector is UOB (UOB SP, Neutral, TP: S$21.10), whose lower SPs and better credit outlook may provide a faster earnings recovery in FY21.

NIMs fell in 3Q20 on subdued interest rates

Banks’ NIMs dropped 4bps QoQ to 1.53% on low interest rates in 3Q20. Current 3M-SIBOR/3M-SOR of 0.40%/0.18% are at QTD averages (Figure 2). We expect NIMs to stay at this level in 4Q20, which would work out to a full-year average of 1.60%.

Turnover volume for SGX’s newly-launched FTSE Taiwan Index Futures was 1.9mn in November, just 3% shy of volumes for its MSCI substitute a year ago. Successful product replacements ahead of MSCI contract expiries in February 2021 give us reason to believe that SGX’s earnings will not be materially affected in FY21.

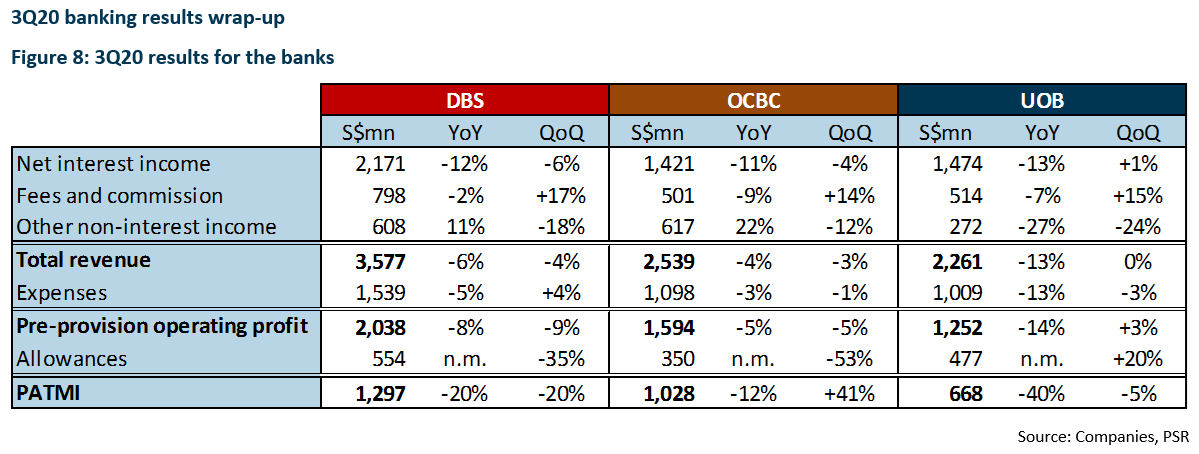

Earnings fell by varying degrees but a few trends could be observed.

NII: NII was down 11-13% YoY amid weak interest rates. We expect similar quarterly run rates in FY21 as loan growth remains weak.

Fee and commission income: While fees and commissions were down 2-9% YoY, they grew 14-17% QoQ. This tracked Singapore’s exit from its circuit breaker in the third quarter. Other non-interest income was higher for DBS and OCBC on the back of better trading income. A slower recovery in non-interest income is expected in FY21 as economic conditions remain challenging in the short term.

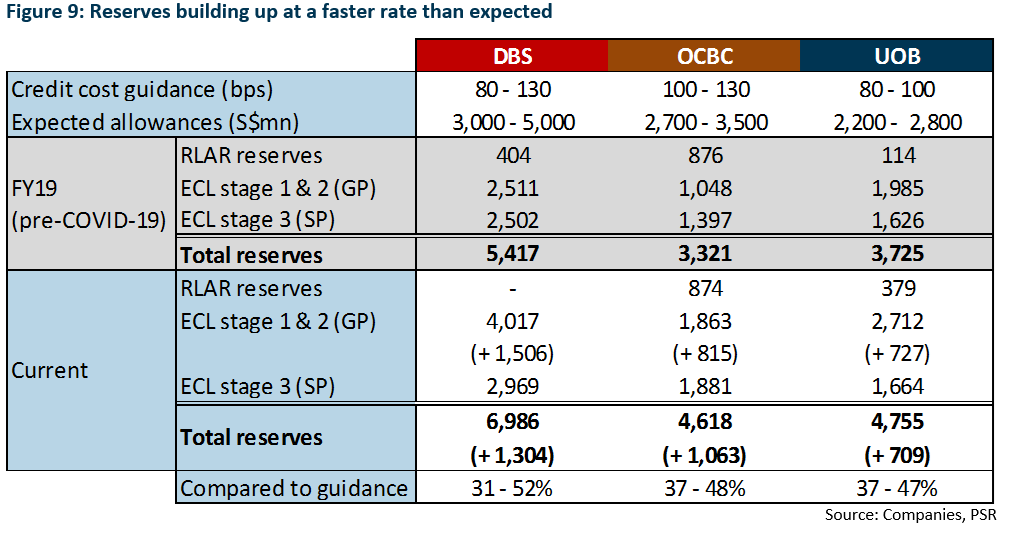

Allowances: Allowances stayed high as banks continued to build reserves for potential NPL formation in FY21. This was in preparation for the end of Singapore’s loan moratoriums next year. All three banks remained ahead of schedule in their reserve build-up, accumulating 31-52% of expected credit costs by 3Q20 (Figure 9).

Following Phase 1 expiry of loan moratoriums in Malaysia in October, interest payments for most of OCBC’s and UOB’s loans have resumed in Malaysia. Loans under moratorium fell to 5% from 9% of OCBC’s loan book and from 16% to 10% of UOB’s. Loans under moratorium for DBS remained at around 5% as it has no loan exposure to Malaysia.

Better clarity on asset quality allowed UOB to lower its credit-cost outlook to 30-40bps from 50-60bps for FY21. OCBC expects credit costs to come in at the lower end of its 100-130bp guidance for FY20 and FY21. DBS maintains its 80-130bp range for the two years.

Reserve Bank of India (RBI) approved merger of DBS and Lakshmi Vilas Bank (LVB)

On 25 November, the RBI approved the merger of DBS India and LVB (Non-Rated). DBS will inject Rs2,500 crore or about S$476mn into the merged entity. Alongside operating losses from LVB, we are expecting short-term merger expenses.

This could present a short-term drag to DBS’ earnings recovery in FY21.

Two digital full banking (DFB) and two digital wholesale banking (DWB) licences

On 4 December, the MAS announced the results of digital-banking licence bids. Four were awarded, two DFB and two DWB. This was one less than the total five – two DFB and three DWB – that MAS was willing to issue. The successful DWBs were deemed to be demonstrably stronger across the selection criteria. MAS may grant more DWB licences in the future.

Winners of the two DFB licences were the Grab-Singtel (ST SP, Neutral, TP: S$2.44) consortium and SEA Group. Winners of the two DWB licenses were a wholly-owned entity of Ant Group and a consortium comprising Greenland Financial Holdings, Linklogis Hong Kong, and Beijing Co-operative Equity Investment Fund Management.

All digital banks are expected to begin operations in 2022. Till then, we do not foresee any material impact on the three banks’ earnings. We believe the three have a head start in the digitalisation race. We also expect the digital entrants to face a challenging operating environment in a well-banked society.

Investment actions

Maintain Neutral. While the credit outlook has improved for banks, we believe that an earnings recovery to pre-COVID-19 levels will only be further down the road, in FY22.

We downgrade OCBC and UOB to NEUTRAL from ACCUMULATE as low interest rates, coupled with higher credit costs, continue to contribute to weak earnings. This is despite our higher revised TPs (Figure 10) to factor in normalising allowances in FY21. We remain NEUTRAL on DBS as a downgrade was made in August on an earlier rally.

For sector exposure, we prefer UOB (UOB SP, Neutral, S$21.10) as lower credit costs guided by the bank should lift pressure off its earnings faster than for its peers.

Source: Phillip Capital Research - 7 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024