Hyphens Pharma International Ltd-Repositioning for Growth

traderhub8

Publish date: Mon, 16 Nov 2020, 02:36 PM

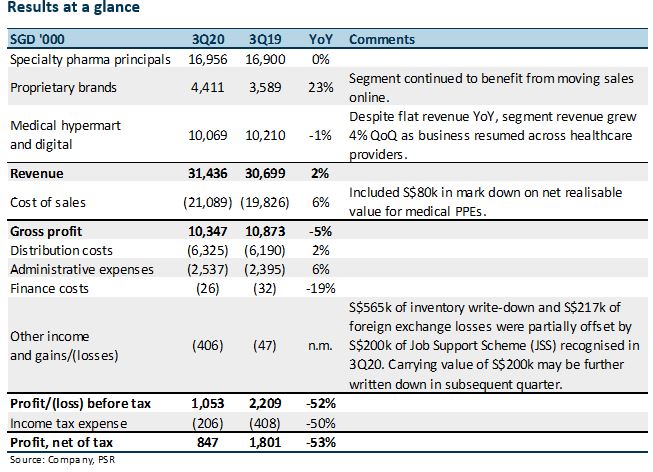

- 9M20 earnings of S$5.1mn were 17% below our estimate due to other losses arising from inventory obsolescence.

- 3Q revenue grew 2% YoY to S$31.4mn as strength in proprietary brands offset specialty pharma and medical hypermart weakness.

- COVID-19 led to S$565k in inventory obsolescence and S$217k FX losses.

- Short-term weakness expected as company reorganises operations to manage thinning margins and heightened inventories.

- Signed two distribution agreements in past month, to develop proprietary-brand business.

- Maintain ACCUMULATE with reduced DCF TP (WACC 7.2%) of S$0.365 from S$0.495. We cut FY20e and FY21e earnings by 20% to reflect a recovery only in FY22.

The Positive

+ Proprietary brands sustained growth

Proprietary-brand revenue grew 23% YoY as the company continued to move sales online. Revenue was down 2% QoQ due to S$1mn of exceptional corporate sales of Ocean Health® supplements in the previous quarter. Stripping that out, QoQ growth would have been 26%, underscoring the strong organic growth of proprietary-brand products.

Specialty pharma and medical hypermart revenue was flat YoY though up 6%/4% QoQ. This reflected their recovery as Singapore gradually reopened.

The Negatives

– Inventory obsolescence hurt earnings

Inventory in excess of S$600k was marked down as a result of disruptions from COVID-19 across products:

- Personal protective equipment like masks was marked down due to high supply resulting in lower selling prices and an influx of supply in the market, resulting in a net realisable value write-down of S$80k under cost of sales.

- COVID-19 test kits that were procured in anticipation of high demand from widespread testing in Singapore had to be written off after the Singapore authorities centralised supply of test kits. However, the company is exploring options to re-sell the kits to other markets. About S$300k in value was written off with S$200k on the books remaining. This may be written off subsequently if no buyers are found.

- S$100k of flu vaccines had to be written off due to lack of demand following travel restrictions. Flu vaccines have short shelf lives due to the different seasonal strains of flu viruses.

- A further S$200k was written down for an assortment of products due to lockdowns in different markets which affected demand.

FX exposure

About S$217k in FX losses was recognised from SGD weakness against the USD/EUR as well as depreciation of the rupiah and peso.

Outlook

Repositioning business to capture long-term growth

The company continued to expand its proprietary-brand business with the signing of two distribution agreements: one for the distribution of Ocean Health® in Sri Lanka with Healthguard Pharmacy Limited (non-listed) and another for Ceradan® in China with Shanghai Good Luck International Trading Co. Ltd. (non-listed). We expect the company to continue investing in this business on account of better margins.

Normalisation expected in FY22

Inventories, receivables and payables may only normalise in FY22 after the company’s reorganisation of its operations.

Investment Action

Maintain ACCUMULATE with reduced DCF TP of S$0.365 from S$0.435

FY20e and FY21e earnings have been shaved by 20% to reflect a total write-off of COVID-19 test kits in the fourth quarter and a pushout in recovery to FY22e. We have also reduced margin expectations from their high base in FY19 and incorporated higher expenses from possible reinvestments in its own-brand business.

Source: Phillip Capital Research - 16 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024